Weekly: Hartnett Says "A.I. is Inflationary"

The Lessons of LTCM Revisited

AI is inflationary…no way politicians in 2020s would allow AI to cause widespread unemployment even if transitory- Michael Hartnett

SECTIONS

Market Summary— Debt Ceiling, TD’s Gold trade, AI Bubble

Week’s Analysis/Podcasts— TD, Tom Luongo, debt ceiling, Moor

Research— Hartnett, GSTrader, Grants and more

Charts— Stocks, Bonds, Commodities, FX

Calendar— GDP revision, FOMC minutes, PCE

Technicals— GC, CL, BTC, S&P

Zen Moment— Watering Hole

Full Analysis—Hartnett, GSTrader, Grants and more

1. Market Summary

Quick heads up. The Grants article we wanted to write on was more a history lesson than a report to be translated. We saw no need to rewrite such good prose. Enjoy it as is. Moving on..

DEBT CEILING UPDATE

With the June 1 X-date rapidly approaching, markets will look for signs of actually executing a deal now. Friday notwithstanding, there have been positive overtures from both sides. Markets appear to be assuming negotiations are a done deal, suggesting that any souring in tone as things play out could upset risk sentiment. Take for example the fact that stocks did not react too harshly on Friday to the GOP walkout even while Gold spiked, the dollar dropped, and bonds sold off. Gold is now rallying on debt ceiling stress again and dodged a big bullet last week. These were bond guys buying as well ,which tend to distort late day moves.

TD IS LONG GOLD, BOA IS CLOSING LONGS

TD updated their Gold opinion post Thursday’s selloff. They stick to their guns about: CTA longs being less weak than usual and underinvestment by Macro funds while acknowledging the partial liquidation the previous day

Money managers liquidated some gold length and added shorts as debt ceiling optimism and resilient data aided the apparent formation of a triple top. Still, our positioning analytics argue that selling exhaustion is imminent.

They included something new. Shanghai traders have started adding to their positions again.

After all, we estimate a high bar for subsequent CTA trend follower liquidations, whereas discretionary traders remain underinvested and Shanghai traders have begun adding to their positions once more.

This is surprising given we know Shanghai bought the highs last week. We also noticed that BOA is telling clients to take profits in Gold even as their private client group is adding to longs.

The best summer trade pure and simple is contrarian “long US dollar” (take profits on gold)

We are not short Gold, but please note: TD is long, Hartnett is closing longs and while Gold has a tendency to be strong in the summer historically, it is nothing like the November Buy Season we know and love.

BOUNCING BABY BUBBLE BORN

Finally, Stocks reacted positively and violently in what is definitely a reaction to nascent AI insanity. As the GS equity trader notes today: Big cap tech had been rallying due to them being the biggest beneficiaries of AI. The market showed its hand when Steve Cohen made his “We’re Going Up” comment.. BOA updated their famous bubble chart to include AI.

Next week Nvidia reports earnings, so that could be a wild one. Good Luck.

Full TD note at bottom along with BOA, GS, and Grant’s excerpt

Sectors/Technicals

Semiconductor CHiPS had a good year this week

Tech lead, utilities and defensives lagged in a reversal of the week before

Gold miners took a hit as did real estate

Commodities:

Political ineptitude rescued Gold and Silver

Crude did ok, purely on Gasoline buying

Bonds:

Weaker all week

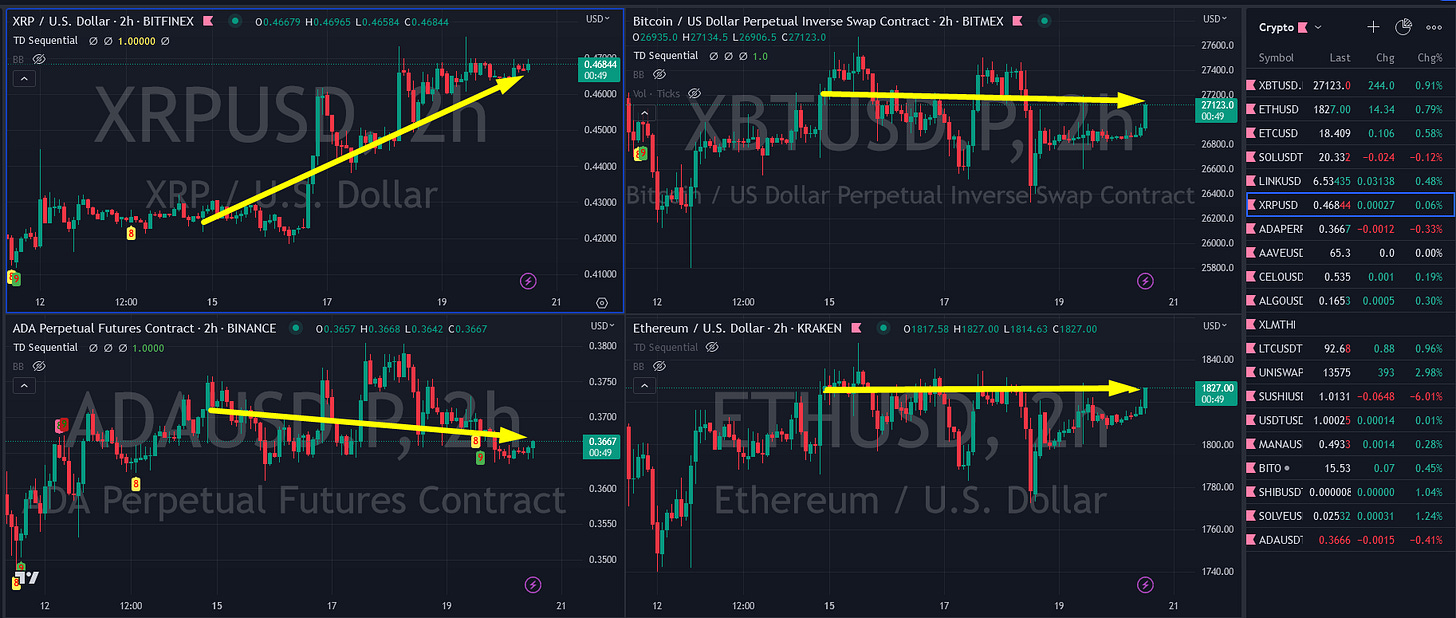

Crypto:

Flat is where its at, but Ripple keeps rallying

Note BTC and ETH did not run with Tech last week

2. Week’s Analysis/Podcasts:

GoldFix posted over 20 original and curated stories this week for readers which can all be found HERE

Key Stories This Week:

3. Research Excerpts:

Hartnett: New Bubble Alert

There is so much in here. Here are several topics covered in his tightly worded yet cryptic trader-speaking style.

On SVB: It may indeed be like LTCM

On LTCM: The Feds reaction to it ultimately caused the crash in 2000

On LTCM: The recession delayed will end up with a new bubble and crash

On SVB as LTCM 2.0: if this is true, then you have to own the coming AI bubble early in what he calls the H-squared trade

On AI: it is actually inflationary due to politics, AI leads to UBI which leads to YCC

He lays out the similarities to the 1998 LTCM rescue and its aftermath, the likely path forward, reasons for possible delays on that path, good criteria in defining a bubble and a lot more.

Note to subscribers on reading Hartnett1

Grants on Gold and Default risk:

The gold standard, says economist John Cochrane, can be viewed as a fiscal commitment that the state would repay its debts plus interest in un-depreciated coin.

BOA on CTAs: BOA says small funds and CTAs are very short Oil and Copper and very long Gold. They believe Gold stop loss selling will begin to accelerate if $1933.10 is touched.

Our CTA model’s short commodity positions continued to increase in size for Oil, Aluminum, and HG and LP Copper futures.

Next week the selling looks to be less except in a bearish price path. The Gold long in our model remains elevated in size and a stop loss would come at 1933 on the front future.

GSTrader: Very nice insightful take on stocks by drivers, sectors, and policy concerns in their Markets Macro Thinking Out Loud

Why did the market rally to YTD highs this week? Three principal components:

1. positioning.-hedge fund net exposure was in the bottom decile…

2. the debt ceiling.-there was a generally positive bias to the headline roulette this week (Friday notwithstanding) ... given that tease, I think folks have high expectations….

3. the AI buzz.-the fever around AI has been very detectable in the past month... think MSFT, GOOG…

ANALYSIS AT BOTTOM…