Housekeeping: Many will be receiving GoldFix Weekly for the first time. It is different than the dailies. It is more like a magazine. Content touches many areas of markets. The index may help.

Founder’s Class : No Founders today as out of town. Previous Founders recordings (30 of them) located here

SECTIONS

Market Summary

Technicals

Podcasts

Calendar

Charts

Premium divider

Analysis

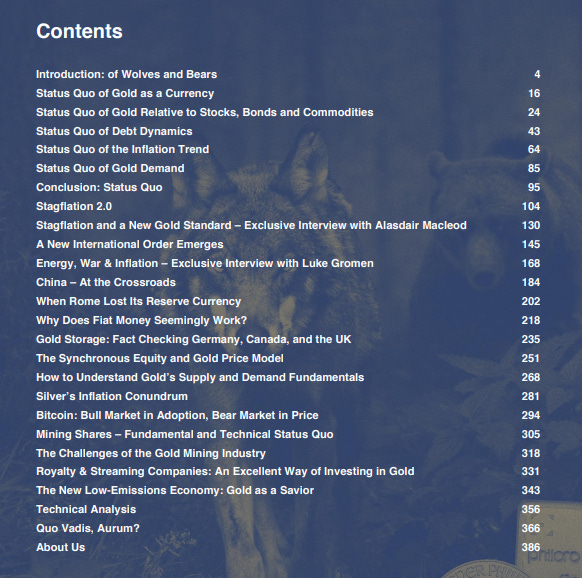

Research: IN GOLD WE TRUST

Feature: In Gold We Trust

Incrementum’s popular report, “In Gold We Trust” was released this week and included for readers below. The 300 plus page missive covers Gold as Currency, compares it to stocks, inflation, and of course, stagflation. Also: It is excellent.

We normally do not like marketing pieces, but this one is very long on good content.

Go to bottom for complete report. Lots to choose form read this week. Enjoy the day off and share with your friends. Thanks

1. Market Summary

US data has disappointed for 6 straight weeks with May set to see the biggest plunge in reported data relative to expectations since the collapse in April 2020. This is once again bullish for stocks. Why?

The market is telling us for the moment it believes inflation is headed the right way and stocks have given up enough ground at the moment. Therefore, as long as economic numbers ( especially house prices) are disappointing and inflation numbers continue to drop, stocks should have less pressure on them.

Nasdaq is up 10% off last Friday's lows

Small Caps and S&P +9%

When Stocks drop and Volatility does not pop, that is a (not foolproof) sign that longs are not nervous and as corollary, money is getting ready to add to longs…

Dow +8%

Nasdaq into the green for the month

Tech sector within the S&P 500 is down almost 20% ytd

Housing Losses Are Stock Gains

Housing cracked late last week, which as we said earlier paraphrasing Zoltan Pozser ( yes we are tired of quoting him too but have to until he’s wrong), ‘To the extent that housing and crypto drop, stocks can drop less’.

Mortgage rates have exploded in 4 months time…

Home As Piggy Bank in Danger

Homebuyers struggle with spiking mortgage rates which make the high home prices that much more difficult to deal with. And with each increase in mortgage rates, entire layers of potential buyers abandon the market, and sales volume plunges.

Do not expect homes to benefit as they have in the past if rates come back down again. This is all by Fed design. House as piggy bank is done in our opinion. Downpayments, maintenance, and other related costs will continue to disincentivize home buying. Yes they will go up again, but not like before.

From To Get Inflation Down, Unemployment May Go Up:

Stocks of course are not the only egg in the proverbial wealth basket. Housing and crypto assets are in the basket too, and wealth declines there should determine how much damage will need to be done to stocks, that is, how much more financial conditions will have to tighten.

It’s almost as if stocks lead housing lower now. Then, when housing follows as it did last week, stocks can rally again, albeit to lower highs. In fact, that is exactly what happens in a self-reinforcing negative cycle. Both asset classes eventually resolve even lower.

Technicians call this “lower highs and lower lows”. Macro traders will call this a product of an interest rate tightening cycle. 1 . Anyway, bearish data now takes pressure off stocks again; at least until inflation data turns negative again.

Just look at Friday’s moves, Nasdaq +3%, S&P up over 2% all triggered at 0830ET when Core PCE came in as expected and then extended gains on the terrible UMich print with inflation expectations hovering at 40 year highs.

The market is now buying back into the belief that The Fed will fold like a cheap lawnchair way before it said it would.

This week also saw rate-hike expectations tumble and subsequent rate-cut expectations rise.

Fed Political Bias Behavior

Political observation: If you think the Fed is beholden to political power as we do, and you believe the nation’s voters are worried about inflation ( they are). Then the Fed will “fight inflation” up until the election; After which it will soon have political permission to fight recession. Alternatively, The Fed will stop hiking and lower rates prior to the election if and only if polls suggest inflation is no longer a worry and/or if stocks substantively crap out quickly in a wash below 3500. Citation depicted:

Liquidity Cuts Both Ways

Finally, we note that financial (not economic) conditions bounced higher this week after the FOMC Minutes, finding support at what has been historically a 'tightness' that has sparked Fed flip-flops in the past. This ties in with the lack of liquidity still present in the market. Until liquidity returns ( perceptions of Fed tightening abate) the market will be negatively biased with massive violent short covering rallies. The trick as a bullish trader is to know how and when those rallies will happen.

H/t Newsquawk and Zerohedge for data and some graphics.

Sectors:

Consumer Discretionary best performing sector in the S&P 500

Energy second best performer a beneficiary from China sentiment

Tech third best

All sectors were green with Utes and Healthcare having big weeks

FANG Stocks soared this week

Pabst Blue Ribbon2 above took hit as people went for imports this Memorial day

Commodities:

USD fell significantly for the second week in a row, closing at 6-week lows

Biggest two-week drop in the dollar since June 2020

Oil prices soared nearing 11-week highs (post-Putin highs)well above Biden-SPR levels

WTI back above $115

Gold and Silver managed gains on the week back above $1850 and $22 respectively- All consistent with a lessening of tightening and a growing relief/fear of premature easing

Natural Gas continues to smoke everything in no small part from US exports of LNG to Europe driving domestic prices higher.

Bonds:

Bull steepening: Meaning the curve got steeper from short term rates dropping (fear of more hikes lessen) net relative to long term rates. This makes opportunity-cost of owning stocks drop.

Bonds rallied a second week leading stocks higher

Since the FOMC Minutes, bonds and stocks have both been bid

Stocks watched STIR pricing for rate-hikes and bounced along with dovish shift in rates.

Crypto:

Cryptos had an ugly week (again) with Ethereum the biggest loser (and Bitcoin relatively outperforming… Luna/Terra is still being digested especially by all non Bitcoin cryptos. Luna 2.0 was launched already ( can you believe this) and promptly gave up 75% of its opening price.

Perhaps most notable on the week was crypto's decoupling from big-tech with correlation crashing. This, we believe, is from major crypto-specific anxiety surrounding all coins because of growing perceived risk of Tether. This is less so in Bitcoin but weighed on it nonetheless.

If stocks remain bid and some good news on this comes out, watch to see how Bitcoin/Ethereum react to see if there is in fact pent-up money waiting for the right time to get in.

GoldFix Friday WatchList:

Complete Watchlist Here

2. Technical Analysis

Report Excerpts Courtesy MoorAnalytics.com

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Energy

Bitcoin

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

3. GoldFix and Bitcoin Podcasts

How option open interest affect Gold price at expiration. Why Banks are recommending Bitcoin now.

More GoldFix Broadcasts HERE

More Bitcoin Podcasts HERE

4. Calendar

Some upcoming key data releases and market events

MONDAY, MAY 30 None scheduled -- Memorial Day holiday

TUESDAY, MAY 31

9 am S&P Case-Shiller national home price index (year-over-year) March -- 19.8% 9 am FHFA national home price index (year-over-year) March -- 19.5%

9:45 am Chicago PMI May 55.9 56.4

10 am Consumer confidence index May 103.9 107.3

WEDNESDAY, JUNE 1

9:45 am S&P Global U.S. manufacturing PMI (final) May 57.4 57.5

10 am ISM manufacturing index May 54.5% 55.4%

10 am Job openings April 11.4 million 11.5 million

10 am Quits April -- 4.5 million 10 am Construction spending April 0.6% 0.1%

2 pm Beige book Varies Motor vehicle sales (SAAR) May -- 14.6 million

THURSDAY, JUNE 2

8:30 am ADP employment report May 301,000 247,000

8:30 am Initial jobless claims May 28 208,000 210,000

8:30 am Continuing jobless claims May 21 -- 1.35 million

8:30 am Productivity revision (SAAR) Q1 -7.5% -7.5%

8:30 am Unit labor costs revision (SAAR) Q1 11.6% 11.6%

10 am Factory orders April 0.7% 1.8%

10 am Core capital goods orders revision April -- 0.3%

FRIDAY, JUNE 3

8:30 am Nonfarm payrolls May 325,000 428,000

8:30 am Unemployment rate May 3.5% 3.6%

8:30 am Average hourly earnings May 0.4% 0.3%

8:30 am Labor-force participation, ages 25-54 May -- 82.4%

9:45 am S&P Global U.S. services PMI (final) May 54.3 53.5

10 am ISM services index May 56.8% 57.1%

Main Source: MarketWatch

5. Charts

Gold

Silver

Dollar

Oil

Bitcoin

Charts by GoldFix using TradingView.com

6. Analysis:

The world is being torn into two distinct and separate trading and currency blocks.

The new system planning has been in the works for many years.

Russia and China are risking war to break out of the Western Alliance’s dollar system and America’s global domination.

If the new system is successfully launched many will join it from as far away as South America, Africa and the Middle East.

The attraction is that for the recipient country the currency offers an intrinsic value in contrast to the ‘Fiat’ currency of the US dollar system.

In recent years various countries have intimated that at a point in time in the future they won’t pay for their imports in US dollars but in their own currency.

Now a new system could unify these national arrangements in creating an alternative structure to the existing dollar-based system

A key question then is what currency will exchange traded commodities be priced in – still the US dollar, the Yuan or the New Currency when/if it is launched?

Commodity producers should favor the new currency as it gives them real value for their exports.

CONCLUSION

Volatility in US Dollar terms should explode for Gold and Silver while it lessens for those metals in comparison to Copper and Oil

Trading in metals will get more efficient as they shed their Dollar peg.

This volatility will be the signs of a new monetary order as manifest in metals

7. Research

Incrementum, Goldman, and TS Europe

***More at bottom***