Weekly: It’s Unofficially a Recession,The Alternative is Much Worse

JPM, GS, BOA on GDP and European Energy

Housekeeping: Many will be receiving GoldFix Weekly for the first time. It is different than the dailies. This post is more like a magazine. Content touches many areas of markets. The index may help.

Founder’s Class : 3 p.m. SUNDAY: Preview and Zoom Link Here. Topic will be Fear/Greed indicators and what they truly mean.

By scapegoating responsibility to avoid blame for inflation, political leaders also guarantee nothing meaningful will be done to solve the problem.

SECTIONS

Market Summary

Technicals

Podcasts

Calendar

Charts

Premium divider

Analysis

Research Recap

1. Market Summary

Friday ended a brutal month for stocks, bonds, crypto, and people on budgets. The month and the week served up a lot of “worst since…” type data points.

Dow fell 1000 Friday erasing second-half of March gains in one session

S&P's 3.6% drop is the worst day since June 2020

Nasdaq ended April down almost 13%, its worst month since Oct 2008

Small Caps were the worst on the week, closely followed by Nasdaq

Trying to not be doom and gloom here, but the market may be nowhere near its nadir given the divergence between Fed rate hike expectations (see Bonds graphic) and where the Nasdaq actually is. Not a prediction at all. An observation that if the market starts to track things it had forgotten about, it could get a lot uglier. And, feeling as we do that the Fed will rescue stocks, but not with the zealousness it has in the past, if the market starts thinking half-empty then we got problems

It’s Unofficially a Recession

To put it in perspective, we believe the US and likely world economy is already in recession by the actual definition of one1. We also believe that due to politics and job security, neither the Fed nor politicians will admit this as there is nothing to be gained until the data comes out.

We also believe this is not an accident as they must get inflation under control. The supply-side inflation being fought is well outside their purview and they can only try to control it by restricting the demand (money) to buy these things.

From the April 5th post: We Are In a Recession By Design

We are already in a recession, they know it, and just don't want it to get ahead of itself before they finish their hiking cycle. They need to instigate a recession before markets overheat. Job security and group think is why the Fed is scared to tell those leaders the truth.

They need price stability. And that is fine. Say it. We know there's a war in Europe and China is screwing with supply side economics. Just say it. Fighting inflation is risking recession.

If someone would manage expectations better, then maybe the coming recession would be easier to understand. The reality is, if we do not get a recession as a byproduct of controlling inflation, things can get very bad very quickly.

Putin Did It

Many of the problems the Fed and the government are dealing with are out of their control. They cannot fix the supply chain. They cannot make Russia uninvade Ukraine. They could not have prevented (we think) the Covid pandemic. But what they could have done is be respectful of risk.

They could have taken responsibility commensurate with the control we give them. They could have done their jobs instead of lining up scapegoats for our misfortune. They did not. They told you it is because of (pick one): Covid, China, supply chains, greedy oil companies, the text book, meat packers, and Putin that we are where we are.

If our leaders are so powerless to deal with the problems we have now, and all these factors are outside their control and foresight, did they all of a sudden get stupid? It sure seems like it. The answer is, they were always this stupid. Now they are also unlucky.

For decades they have been taking credit for every good thing that happens to us. Yet now, they are completely flummoxed? Could it be they were just lucky morons who happened to be there when things went well? Economic photo bombers.

President Jogger At Your Wedding proposal…

Most Leaders are Lucky, Not Good

The truth is: Government can only influence the speed, not the direction of a secular trend. Government policy can only slow down or speed up a grass roots phenomenon that takes hold of the world. Policy is to the economy what cold medicine is to a sick person. It helps symptoms, not causes. We’ve been saying a version of this for over a decade.

From Not My Fault To ‘Not My Job’

Here’s a fresh corollary for you. When leaders do not take responsibility2 for a situation and instead seek to spread the causality of a crisis among scapegoats, they also effectively dissipate personal responsibility for fixing the problem as well.

Therefore, when leaders blame inflation on: Covid, or Putin, or whatever, they are also diffusing the responsibility to fix that problem.

By scapegoating responsibility to avoid blame, they guarantee nothing will be done to fix the problem.

By deflecting even just a little of the responsibility off themselves, they refract it like light through a prism. They distort it and make it almost impossible to see who3 should be handling it. No-one is therefore incentivized to step up.

A hand grenade has been thrown in a crowded room. By the time the debate of who’s to blame is over (who let the guy in, who made budget cuts to security, who made it too easy to buy hand grenades etc) no-one even feels compelled to do something. No-one dives on it for shit-sure. Maybe someone kicks it away from themselves towards the kitchen help. But no-one does the right thing. Not unless it is politically expedient.

Politicians On a Fishing Trip…

In spreading the blame these morons have also made it impossible to decide who is responsible to fix the grenade problem.

“Putin caused inflation. Therefore I can try, and say I did my best, but it’s not my fault guys.”

This shirking of personal responsibility by leaders is exactly like the slacker union worker who says: That’s not my job, man. Here’s the punchline: They suck at their jobs but truly think you are the problem. How else did they get where they are while you are just a pleb?

Where were we? Oh yeah…. The point of this was to say: We are in a recession.

It could get bad, very bad. The alternative (inflation) may be much much worse. How bad? Here is what India is dealing with right now:

Another devastating heatwave has parched large swathes of India this week resulting in power blackouts. In the capital New Delhi, high temperatures hit 104 Fahrenheit. -source

Here’s how they are dealing with it: Power Cuts. They are telling citizens they will not be able to use any power for large chunks of time per day.

pic via OSHO a GoldFix Founding Member

Remember the freeze in Texas last year? Over 240 people had to die because we did not plan for the energy outage. The US remains unprepared and our leadership is too busy shirking responsibility in matters such as these. Other countries do not have that luxury.

When our courageous leaders finally do “get in front of it” (from behind it) they will use the chastising tone of: We all have to do our part; Nobody is without fault here; and our personal favorite: “This is reality now, we can debate it or we can fix it.”

But those statements, as true as they are in a vacuum, should have been said years ago. When they are finally uttered, it will merely be another play to yet again disburse responsibility.

Anyway: we’re in a recession. If we are not, we should be. The risk and margin for error if another black swan event happens is too great.

We leave you with an excerpt from The Credit Strategist, one of our favorite newsletters:

The most compelling case for stocks recalls the joke about a funeral where the mourners were struggling to say something nice about the deceased, who was a terrible person, until someone finally blurts out, “Well, his brother was worse!”

The case for stocks is bad enough right now, but the case for bonds is even worse. For stocks to be attractive, you have to invest for the long term (longer than 12-18 months) or be willing to suffer losses in the interim if you are unwilling to sell or sit out.

As for bonds, those suggesting purchases of Treasuries at rousing 2-3% yields or investment grade bonds at slightly higher yields are dishing out terrible (and almost always self-interested) advice. 2 And anyone promoting high yield bonds is trying to pick your pockets because nobody should be buying bonds that lack yield, covenants and liquidity.

Stocks were the only game in town for a very long time because bonds offered negative real and nominal yields for years, but now that stocks suffered losses of up to 80% in the most extreme cases, the season is cancelled until further notice. Sure, there will be brief short term rallies until the bear market runs its course, but stocks are still overvalued, especially those of the infinite duration variety (i.e. those with long waits until achieving earnings – assuming they can do so - or growing into their valuations).3

Many of those stocks are down significantly already but will almost certainly see further losses as the Fed moves deeper into its tightening cycle.

TWTR, TSLA and Musk

I still believe there are serious doubts regarding whether Elon Musk will actually buy TWTR. The sharp drop in TSLA stock after TWTR’s board accepted the bid (the stock dropped ~$190/share between 4/21 and 4/28) may offer a convenient escape hatch if Musk decides he wants to abort the deal. Musk is taking a $12.5 billion margin loan against his TSLA stock to finance part of the deal for which he is required to pledge $62.5 billion of TSLA stock, a significant (and growing!) amount of his holdings. If TSLA stock drops ~43% (to $570/share) he will suffer a margin call which will require him to post more collateral or sell some shares, which could cause further downward pressure and possibly a downward cascade in a stock that remains absurdly overvalued by any reasonable measure other than whatever floats around in Cathie Wood’s head. If TSLA stock continues to fall sharply, Musk can easily claim that the TWTR deal places TSLA at risk and that TSLA board members and shareholders oppose the transaction (which if they were real board members instead of puppets they would).

Sectors:

FANG stocks have lost over $1.6 trillion in market cap since their peak over $5 trillion in Nov 2021

Staples were the only sector to end the month green

Tech and Discretionary puking over 10% and Financials almost as bad

Yuan saw its biggest monthly drop against the dollar since Jan 1994, and stocks rallied because of it.

Commodities:

Gold ended April back above $1900, pretty much flat on the month

Copper collapsed (along with silver)

Oil was higher on the month

Dollar exploded higher in April - up almost 5% against its fiat peers (its biggest monthly jump since Jan 2015)

There is one currency The Dollar did not advance against: Gold

Bonds:

Bonds were a bloodbath with 10Y Yields soaring 54bps

Yield curve steepened on the month with the back’s rising like Zoltan (and GoldFix) predicted.

50bps hike is now a done-deal for next week's FOMC meeting

STIRs are now pricing a near 50% chance of a 75bps hike in June

That would be The Fed's first 75bps hike since 1994

US equity markets are not "pricing in" that level of hawkishness

Some data and graphics courtesy of Zerohedge

Crypto:

Cryptos had a very rough month with Bitcoin & Ethereum down around 15% each

GoldFix Friday WatchList:

Complete Watchlist Here

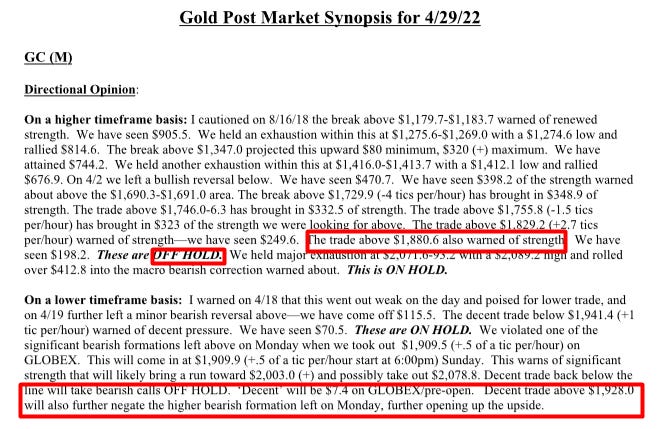

2. Technical Analysis

Report Excerpts Courtesy MoorAnalytics.com

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Energy

Bitcoin

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

3. GoldFix and Bitcoin Podcasts

More GoldFix Broadcasts HERE

Bitcoin Podcasts HERE

4. Calendar

Some upcoming key data releases and market events

MONDAY, MAY 2

9:45 am S&P Global U.S. manufacturing PMI (final) April 59.7 59.7

10 am ISM manufacturing index April 57.8% 57.1%

10 am Construction spending March 0.8% 0.5%

TUESDAY, MAY 3

10 am Job openings March -- 11.3 million

10 am Quits March -- 4.4 million

10 am Factory orders March 0.9% -0.5%

10 am Core capital goods orders (revision) March -- 0.2% Varies Motor vehicle sales (SAAR) April -- 13.6 million

WEDNESDAY, MAY 4

8:15 am ADP employment report April 393,000 455,000

8:30 am International trade balance March -$106.7 billion -$89.2 billion

9:45 am S&P Global U.S. services PMI (final) April 54.7 54.7

10 am ISM services index April 58.9% 58.3% 2 pm FOMC statement -- 0.25%-0.50%

2:30 pm Fed Chair Jerome Powell news conference

THURSDAY, MAY 5

8:30 am Initial jobless claims April 30 180,000 180,000

8:30 am Continuing jobless claims April 23 -- 1.41 million

8:30 am Productivity (SAAR) Q1 -3.5% 6.6%

8:30 am Unit labor costs (SAAR) Q1 7.5% 0.9%

FRIDAY, MAY 6

8:30 am Nonfarm payrolls April 400,000 431,000

8:30 am Unemployment rates April 3.5% 3.6%

8:30 am Average hourly earnings April 0.4% 0.4%

8:30 am Labor force participation rate, 25-54 April -- 82.5%

3 pm Consumer credit March $30 billion $42 billion

Main Source: MarketWatch

5. Charts

Dollar Index

Gold

Silver

Oil

Bonds

Charts by GoldFix using TradingView.com

6. Analysis:

The Weekly report was broken into 2 pieces this weekend. Here is the other piece posted yesterday. While we know without a doubt that Goldman is talking their book here - They have been bearish on the dollar for over a year now; the trends they describe are very real and very serious. Gold is the beneficiary here. Goldman just can’t say it in the same document they say bearish things about the USD. We can.

7. Research:

JPM on Q1 GDP

Real gross domestic product (GDP) contracted at a 1.4% annualized pace in Q1, disappointing expectations for about a 1.0% pace of expansion. While consumers and businesses increased spending last quarter, much of that demand growth was met by foreign production, as imports surged at a 17.7% pace. Overall, foreign trade subtracted 3.2%-points from GDP growth

GS on Recession Risk:

US: recession risk and equities: Despite rising concerns about a hard landing, we don’t think the current inflation overshoot and overheated labor market have made a US recession all but inevitable. The most immediate unknown, in our view, is how long ongoing supply-side problems will last. While we expect a large decline in core inflation this year and next driven largely by goods prices, the pandemic and war in Ukraine pose obvious risks to this assumption.

BOA on Russian Gas Embargo:

The likelihood of a full gas embargo is rising The Russian invasion of Ukraine prompted a swift response from Europe in February. We were (unfortunately) right assuming the war would then escalate further, leading to further sanctions. However, our baseline does not include an end to all energy trade, whether through EA sanctions or Russia turning off the tap. This remains a risk scenario, though a prominent one. It is now becoming more likely as Russian aggression escalates, on the one hand, and Russia’s stops supplying gas to Poland and Bulgaria because they didn’t comply with the early April demand to “pay for gas in roubles,” on the other hand, Both the technical details and Russia’s end game remain unclear.

More at bottom…Zen Moment:

More at bottom…