Housekeeping: Last week Tom Luongo graciously invited this author onto his Gold, Goats & Geopolitics Podcast to revisit previous concepts discussed and add new ones. Chief among those were the evolving lenses we use to evaluate markets with a hattip to Danielle DiMartino Booth's work. Speaking for my experience: enlightening, impassioned, and educational. Podcast link here

Show Footnotes1

Weekly: No Pause From the Wicked

SECTIONS

Market Summary— Recession Depression

Week’s Analysis/Podcasts— China Gold

Research— Silver’s Time to Shine

Charts— Metals, Energy, FX, Bonds, Crypto

Calendar— Retail Sales, Bernanke/Powell co-panel

Technicals— GC, CL, BTC, S&P

Zen Moment— Happy Mother’s Day

Full Analysis— BOA, Hartnett, TD, Debt Ceiling Straight talk

1. Market Summary

This past week saw an awakening across asset classes as everything was sold in favor of the dollar as safe-haven. A late Friday bounce pulled Nasdaq green on the week but The Dow and Small Caps lagged along with the S&P

ZeroHedge summarized sentiment:

Higher inflation expectations, weaker sentiment, regional bank crisis growing (deposit data after the bell Friday), and record high risks of a debt-ceiling event appeared to finally break through the sentiment shield in stocks this week as Washington does what it does best - nothing until the last second.

Despite nine Fed rate-hikes and sliding actual inflation and market expectations, UMich respondents haven't been this worried about inflation since 2008 (the red region is Biden's administration). Full Story

Sectors/Technicals

Ignoring Google and Amazon, which had company announcements, the whole market rotated hard from inflation to recession

The behavior was as if the Market did not think the Fed cared about weaker inflation.. To twist a phrase, there might be no pause from the wicked

Consumer defensive earned its keep as did a few utilities

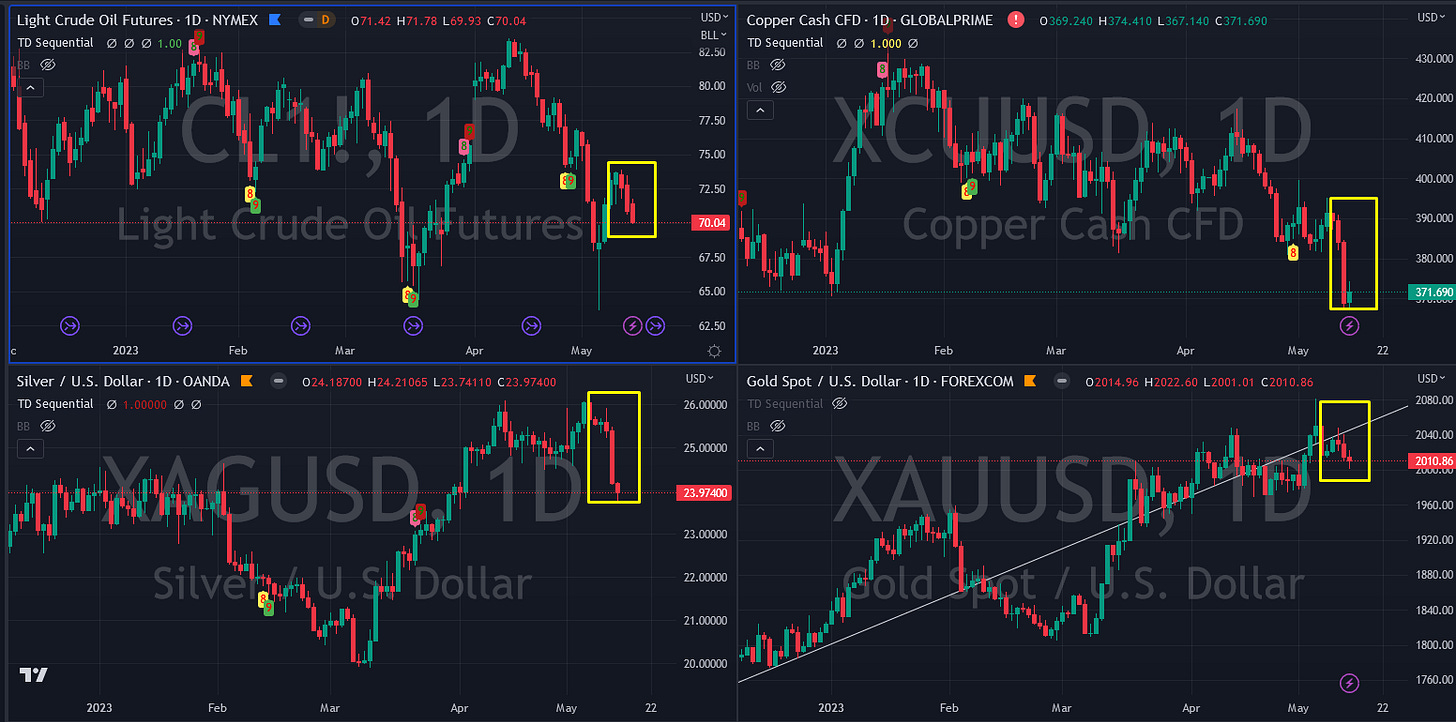

Commodities:

The dollar soared this week - its best week in 3 months

Industrial commodities took it very badly.

Oil started strong due to smaller funds buying to cover shorts from the previous Thursday’s swan dive; then followed with everything else lower

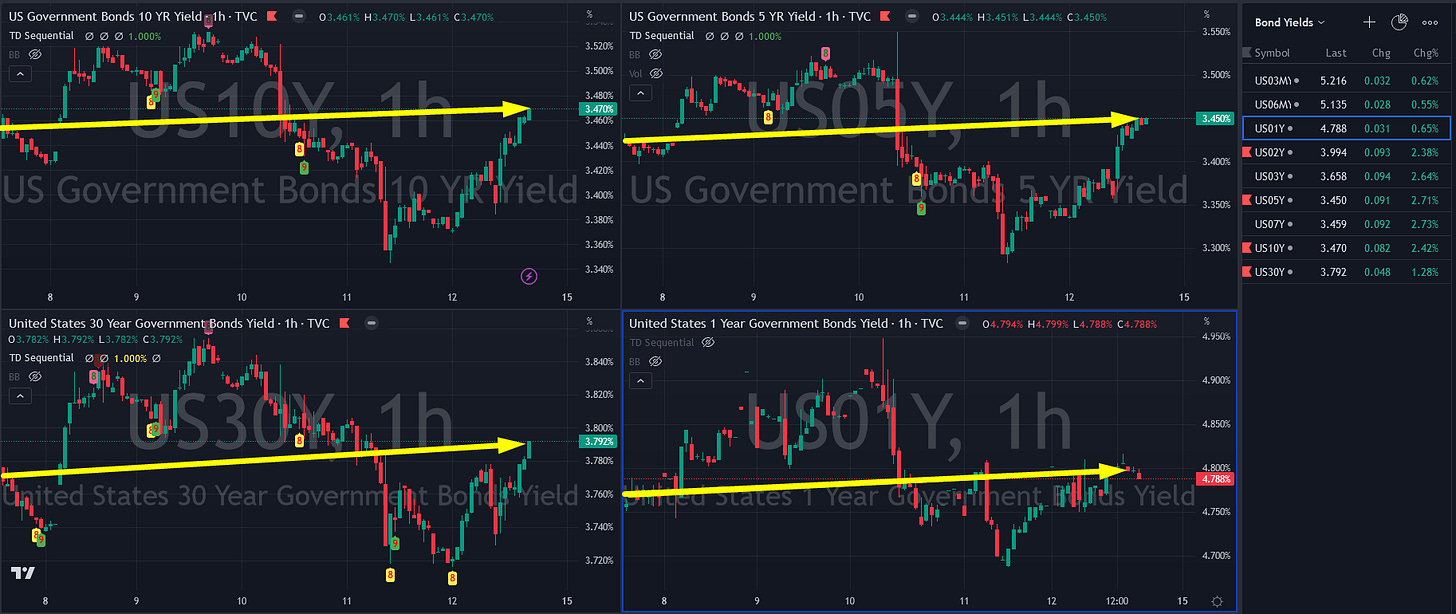

Bonds:

Bonds were somewhat soft despite stock weakness.

Stagflationary shades adn Debt ceiling fears maybe

Crypto:

Not a good week. BTC lead everything lower

Worst week since Nov '22

2. Week’s Analysis/Podcasts:

This week GoldFix posted over 20 original and curated stories for readers which can all be found HERE

Five Key Stories from Last Week:

3. Research Excerpts:

BOA: Silver Deficit Recognized:

It is worth noting that above-ground-stocks, especially at storage sites linked to CME and LBMA have fallen steadily

AS: No B.S. Debt Ceiling Analysis:

When I start to think about the debt ceiling debate, I have to start with one premise: Politicians love the debt ceiling!

Hartnett on Fed Pause:

Maybe not a good idea for the Fed to pause when inflation is 5%, maybe June risk isn’t debt ceiling fears but another month of “rate hike” jobs & inflation data.

ANALYSIS AT BOTTOM…