China's Unfinished Business With Silver

The Chinese Silver Standard's Historical Journey

Introduction

This analysis while being about Silver as a monetary standard, is a lesson in history underscoring the interplay between global trade dynamics, monetary systems, and political events. ( Sourced here)

History Repeating Itself: Exploring the Chinese Silver Standard

Columbus Started It

China Prefers Silver over Gold

The Opium Wars and the Decline of China's Sovereignty

Development of the Chinese Silver Standard

Chinese Private Banks

End of an Era

What Made Western Fiat Work?

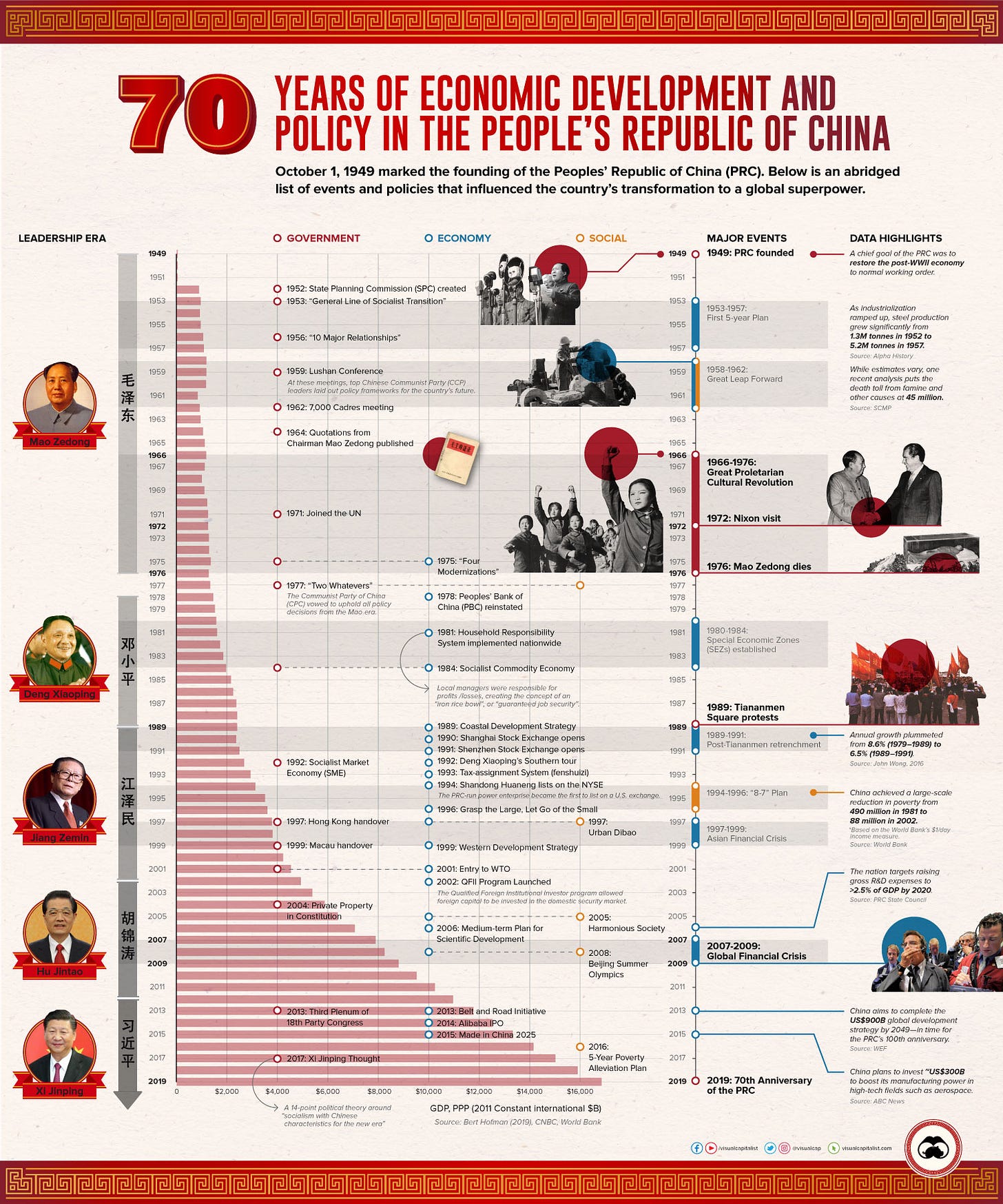

Impact on China: Depression and the Rise of Mao

History Rhyming Now?

***Early Draft, footnotes

1- History Repeating Itself: Exploring the Chinese Silver Standard

Mark Twain's famous words about history rhyming and not repeating itself echo the common sentiment that humans learn nothing from history. Nevertheless, it is always valuable to delve into the annals of the past.

This is particularly true in the case of the Chinese silver standard, which not only endured as one of the longest-existing coin standards but also successfully unfolded with minimal intervention from the Chinese government.

Its origins can be traced to a development on the opposite side of the world: Christopher Columbus' (re)discovery of America in 1492, paving the way for Spain to rise as the first truly global power.

2- Columbus Started It

By the mid-16th century, the Spanish Empire had established the first global trade network. They brought silver from Mexico, Peru, and Chile across the Pacific to China, purchasing tea, porcelain, silk, and spices in return. The Manila Galleon served as the pivotal transshipment port, ferrying Chinese goods back to the east.

The treasures were then unloaded in Acapulco and transported overland to Vera Cruz on Mexico's east coast. From there, alongside other precious metals and New World commodities, the goods made their way to Spain through the Spanish treasure fleet.

The profitability of this trade system during the 17th and 18th centuries was astronomical, with returns on investment reaching 200-300% per trip. However, the emergence of new players like the United States and the British Empire, coupled with changing trade routes, led to a decline in Spain’s profits by the end of the 18th century.

Despite the Spanish trade system's demise in 1821 with Mexico's independence, its effects persisted through the establishment of the silver standard that endured well into the 20th century.

3- China Prefers Silver over Gold

During the 17th, 18th, and 19th centuries, China showed little interest in foreign goods. European products and those from European colonies overseas failed to capture the attention of the Chinese populace.

The Chinese were primarily interested in acquiring silver, which held a significantly higher relative value in their domestic economy compared to gold. The gold/silver ratio in China stood at 1:3, while in Europe, it fluctuated between 1:15 and 1:20. These European figures better reflected the natural distribution of gold and silver in the Earth's crust.

Europeans, however, were captivated by Chinese goods, particularly tea, silk, and porcelain. Spices, precious stones, and woods were also highly sought after. This created an imbalance in trade, with the Chinese amassing substantial surpluses while the Europeans, especially the Spanish and later the English, faced significant deficits vis-à-vis China.

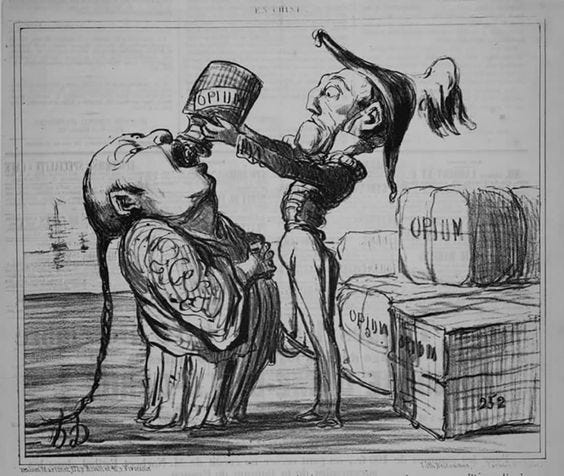

The Spanish, buoyed by seemingly boundless silver mines in Mexico and Peru, supplied approximately half of the silver mined in the Americas from 1500 to 1821 to China. The British, however, found an unethical trade-balance solution in opium.

They heavily promoted its cultivation in Bengal and India through private merchants and smugglers. This trade strategy transformed the deficit into a massive surplus, resulting in the outflow of around 20 million silver dollars from the Chinese empire between 1820 and 1835.

The British Empire's pursuit of this economic advantage, along with the struggles of Central and South American countries for independence, significantly reduced silver mining and altered transpacific trade routes.

4- The Opium Wars and the Decline of China's Sovereignty

China responded to the rampant smuggling of foreign opium by aggressively cracking down on its illegal importation. While China did cultivate its own opium, mainly in the region of Guangzhou (Canton), the British Crown's monopoly in India enabled them to flood the market with vast quantities.

This created a social crisis in China, as addiction spread rapidly and its population faced an embarrassing and humiliating situation. China's attempts to curtail the opium trade ultimately led to the outbreak of the First Opium War (1839-1842), resulting in a British victory.

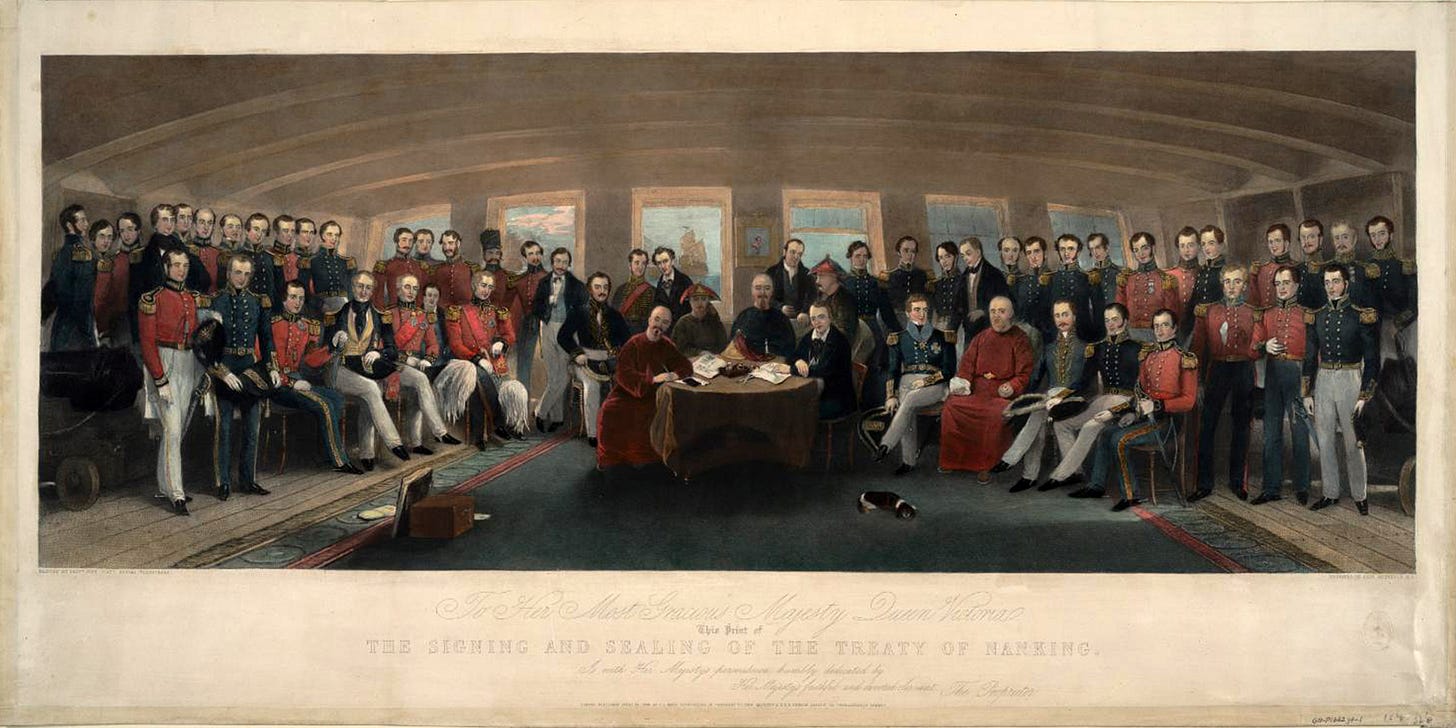

The Treaty of Nanjing in 1842 forced China to cede Hong Kong to the British, open up several ports to foreign trade, and grant extraterritorial rights to foreign residents.

These events marked the beginning of a new era in China's economic and political landscape. The influx of foreign goods disrupted local industries, and the trade imbalance only widened. The Chinese government struggled to find a solution to this crisis, leading to the eventual adoption of the Chinese silver standard to curtail outflows to the UK.

5- Development of the Chinese Silver Standard

The Chinese silver standard evolved gradually, largely untouched by state intervention. As silver flowed into the country, it formed the basis of China's monetary system. The Great Tax Reform implemented by Zhang Juzheng in 1581 officially recognized silver as the standard medium of exchange.

While the Chinese silver standard existed for over three centuries, it lacked uniformity. The system relied on various coins and silver certificates, each with their own weights, shapes, and fineness.

Foreign silver dollars, particularly those minted in the United States, gained popularity due to their standardized specifications, making them widely accepted in Chinese trade.

6- Chinese Private Banks

China's banking system also differed significantly from its European counterparts. Private banks, rather than state-controlled institutions, played a crucial role in financing trade and facilitating economic activities.

This also undermined monetary unity then. Incidentally, these private banks held considerable influence in the financial landscape and continued to play a significant role even in the early days of Deng Xiaoping's economic reforms in the late 1970s.

7- End of an Era

The Chinese silver standard, a monetary system that had stood the test of time for nearly 350 years, faced an abrupt and dramatic end in the early 20th century. This demise was largely influenced by external factors that significantly impacted China's monetary landscape.

The return of the British Empire to the gold standard1 ( yet another way to counter China’s continued hoarding of Silver to the UK’s detriment while the US also bought it) and the US Great Depression2, among other factors, contributed to the decline of the silver standard in China. As global economic dynamics shifted, China was forced to adapt to new monetary systems.

The rise of fiat currencies backed by the governments' credit and economic policies gained prominence worldwide. Fiat currencies, such as the U.S. dollar, were not linked to any specific commodity like silver or gold but derived their value from the trust and confidence placed in the issuing government. This departure from commodity-based currencies posed a challenge to the traditional silver standard and prompted China to adapt to new monetary systems.

8- What Made The West’s Fiat Work?

The above is extremely important when considering where we are now. How did the West pull this off, getting China’s silver standard to collapse by introducing trust/confidence-backed Fiat? Where did this “confidence” come from?

It came from innovation, industrialization, and increased efficiencies in using other commodities for creating value. This was not about “trust/confidence” at all.

As the Western economies eclipsed them, China had to join the crowd monetarily, and use the leverage that fiat enabled, or fall behind even more. That, incidentally resulted in hyperinflation in the end.

9- Impact on China: Depression and the Rise of Mao

The United States' commitment to purchasing silver3 at a high price created a situation of depression in China. The sudden withdrawal of this support further destabilized the Chinese economy. In 1935, China abandoned the silver standard, banned private silver ownership, and introduced a new fiat currency. However, this marked the beginning of a tumultuous period for China's monetary system.

Between 1947 and 1949, the country experienced hyperinflation, further exacerbated by the Chinese Civil War and the rise of Mao Zedong's Communist Party. The collapse of the silver standard became a pivotal moment in China's history, ultimately leading to the establishment of the People's Republic of China.

One can say, the end of the Chinese Silver standard helped pave the way for Communism’s growth. One can also say, more speculatively, the policies of the UK starting with Opium trade to balance their books and then abandoning the Silver standard also contributed to Communism’s rise.

10- History Rhyming Now?

Think about this in the context of now. China’s economy has eclipsed most of the West’s. So where is this “confidence” in the West’s economic superiority? There is none currently except for militarily. But..using military on a large scale to “win” loses.

Skirmish (Opium, Ukraine etc) wars do not take down a giant economy such as China anymore. As to “trust”; that is now gone with the confiscation of Russian reserves.

Now China has a Fiat-based economy with which it can also back itself in Gold if it chooses to do so. Further, it has a renewed voracious appetite for silver, ostensibly for industrial use. But it would be naive to think of Silver only as industrial when studying China’s history.

How important was Silver? It forced the British to go off their own silver standard because they did not have enough, even after opiating the Chinese economy and taking much of their wealth as an ersatz drug dealer. Now, its importance rises again.

/end