Weekly: Pros and Cons

BOA, RBC, HW, TD, CITI

SECTIONS

Market Summary— Pros and Cons

Research— More Gold, and Crypto

Week’s Analysis/Podcasts— Alot of Gold

Charts— Metals, Energy, FX

Calendar— Holiday, PPI, Retail Sales

Technicals— “Opening up the upside to higher trade”

Zen Moment— Bears

Full Analysis— BOA, RBC, HW, TD, CITI

1. Market Summary

The last five days have seen one of the largest 'easings' in financial conditions on record. Stocks, Bonds, Gold, & Crypto soared as markets called the Fed's bluff once again. In short order here are the key concepts both pro and con emerging last week and likely going forward the next week or two.

On the Pro Side: The words Soft-landing and Goldilocks are being floated again. China reopening is a driver of things as well. Europe will avoid a recession. Fed Rate hike expectations have backed off considerably. Bank stocks are suggesting the yield curve inversion pain (they make more money when the curve is not inverted) is coming to an end.

To that we can add, based on their designated leaker Nick Timiraos’ (NikiLeaks as ZH calls him) comments— it truly feels like the Fed wants to back off hikes now. But, because they have made a big deal of being data-dependent (in hopes to avoid inflation reasserting itself) they must wait until the numbers show it.

On the Con Side: China reopening is not conducive to the Fed backing-off hikes. Last week’s commodity behavior tells you that. Fed rate hike expectations have backed off, but spiked on Friday once again. Earnings season has been a reliable drag on stocks euphoria each of the last 3 quarters and is coming up once again.

While stocks are pricing in a 'soft landing', Goldman's Jan Hatzius warns the biggest red flag: downward earnings revisions have been extreme and have only looked like this in past recessions (2000 and 2008). We are hesitant to look through this dependable market indicator and believe prudent portfolio managers should at least consider the implications if a hard landing transpires.

The Debt ceiling debate is a risk to markets. The Yield curve inversion got even worse last week. How that is good for the market is beyond us. But it is good right now.

Taken together: Nothing has materially changed. The Fed does want to back off its hikes. The Fed also sees major slowdown risk out there. The Fed reserves the right to not back off, and will continue hiking at a slower pace for longer if need be. Their behavior has helped them re-establish credibility in markets. The worst of this cycle is over now. But the Pivot concept remains less and less a reality. Why? Because the Fed and Yellen’s treasury have worked behind the scenes to quell some problems so far without broadly pumping the market. Lowering rates now will seem like a shotgun blast. They do not need to do this when they have become more adept at using snipes to stop problems.

Therefore: until something breaks that cannot be addressed behind the scenes, stocks will rally in expectations of Fed-fold until earnings season. Then if earnings are poor, watch how they act afterwards.

We continue to think this is the beginning of a new regime in fiscal/monetary policy. The Fed is slowly being reduced to a policy brake pedal while the Fiscal side is the accelerator. Incidentally, this was the economic model used between WW2 and the 1979. Noone knew the Fed president until Volcker was hired. While it won’t go back to that in terms of Fed anonymity, there is a definite internal change as to what will drive the economy going forward. In five years we suspect the financial press will be talking about the Treasury Secretary more than the Fed chair again.

One final thing. Fed reserve balances jumped last week. This in combination with RRP money coming out and being put to work again is possibly an early signal that the financial markets are looking at uninversion (more commonly called steepening) as a reality after all.

Sector/Technicals

Basic Materials, Gold did very well

The S&P 500 closed at 3999, just above its 200DMA.

Consumer defensive suffered

The Nasdaq closed a tick or two above its 100DMA.

Healthcare, especially Vaxx stocks did poorly

Commodities: Gold Is Going Up

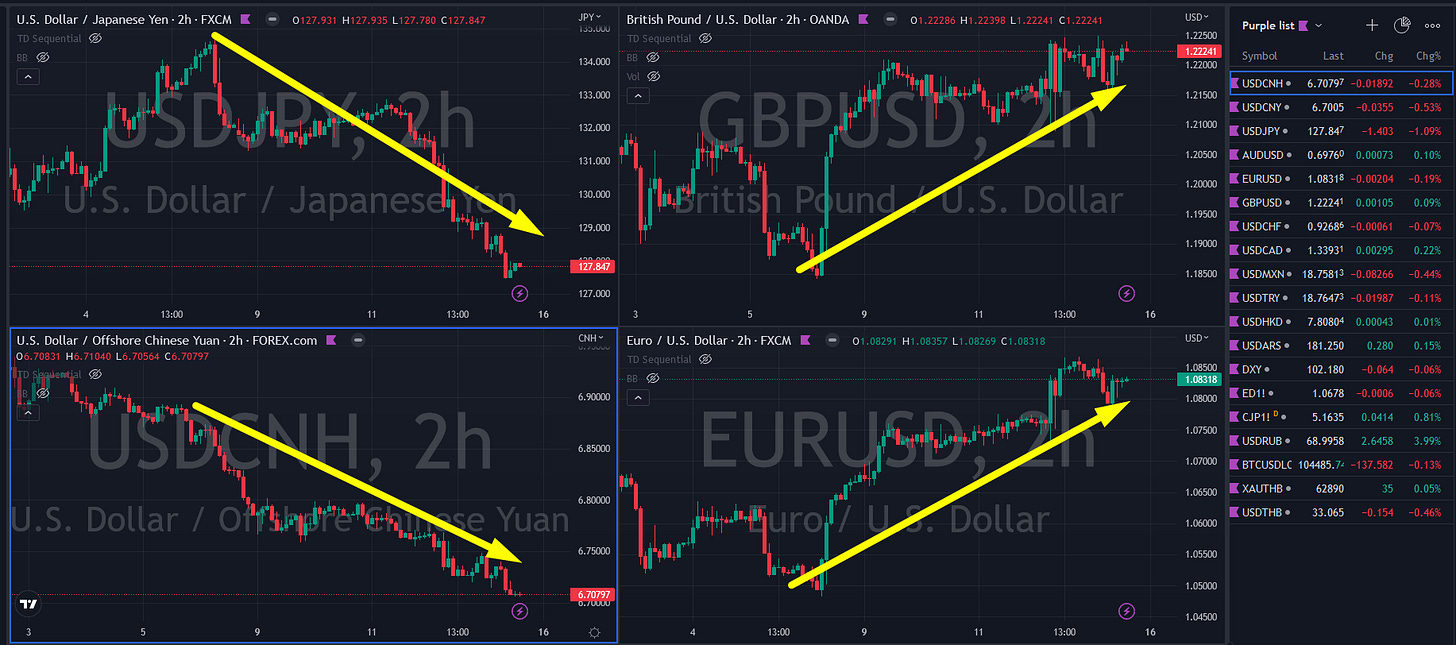

The dollar suffered its worst week in 2 months

The USD Index is down over 3% since the payrolls print last Friday.

Gold surged above $1925 Friday (up six straight days, +5% since payrolls), now at its highest since April 2022.

Gold's gains triggered a 'Golden Cross' this week (50DMA crossed above the 200DMA)

Oil prices are up for the 7th straight day, the longest streak of gains since Dec 2021, with WTI ending just shy of $80

Bonds: Biggest Inversion Ever

Bonds were bid this week, also extending their gains from the payrolls print last Friday

This is - by far - the deepest inversion of this key recession indicator... ever...

The yield curve (3m10Y) has done nothing but flatten (invert more deeply) since the start of the year

Crypto: Tracking Metals?

Bitcoin is up 10 straight days, its best run since Oct 2021

Ethereum also surged this week, topping $1400

Big follow through this weekend

H/t Zerohedge for data and some graphics.

2. Research Excerpts:

Top Mining and Energy Picks of 2023

BOAs Hartnett Flow Show

RBC Global Precious Metals Equities

2023 Gold Price Predictions aggregated

Citi: Crypto Report

TD CTA report

CONTINUES AT BOTTOM…

3. Week’s Analysis/Podcasts:

ACTIVE TRADERS: Technical Podcast Excerpt Gold and S&P (Beta)

ACTIVE TRADERS: Technical Podcast Excerpt for Gold, S&P (Beta)

4. Charts:

Metals and DX

Metals/PGMs

Energy

Forex

5. Calendar

MONDAY, JAN. 16 None scheduled. Martin Luther King Jr. Day

TUESDAY, JAN. 17

8:30 am Empire state manufacturing index Jan. -7.0 -11.2

WEDNESDAY, JAN. 18

8:30 am Retail sales Dec. -1.0% -0.6%

8:30 am Retail sales ex motor vehicles Dec. -0.4% -0.2%

8:30 am Producer price index, final demand Dec. -0.1% 0.3%

9:15 am Industrial production Dec. -0.1% -0.2%

9:15 am Capacity utilization Dec. 79.6% 79.7%

10 am NAHB home builders' index Jan. 30 31

10 am Business inventories (revision) Nov. 0.4% 0.4%

2 pm Beige Book

THURSDAY, JAN. 19

8:30 am Initial jobless claims Jan. 14 220,000 205,000

8:30 am Continuing jobless claims Jan. 7 -- 1.63 million

8:30 am Building permits (SAAR) Dec. 1.37 million 1.35 million

8:30 am Housing starts (SAAR) Dec. 1.37 million 1.43 million

8:30 am Philadelphia Fed manufacturing index Jan. -10.0 -13.8

1:15 pm Fed Vice Chair Lael Brainard speaks

FRIDAY, JAN. 20

10 am Existing home sales (SAAR) Dec. 3.96 million 4.09 million

1 pm Fed Gov. Christopher Waller speaks at Council on Foreign Relations

Main Source: MarketWatch