Housekeeping: Many will be receiving GoldFix Weekly for the first time. It is different than the dailies. It is more like a magazine. Content touches many areas of markets. The index may help.

Founder’s Class : Founders class today at ***2pm ET*** ( one hour earlier for members in different time zones). Separate post will be sent this morning with details. Previous Founders recordings (30 of them) located here

SECTIONS

Market Summary

Technicals

Podcasts

Calendar

Charts

Premium divider

Analysis: Retirement Report

Research: RBC, MS, Goldman

1. Market Summary

Good news is Bad news

Until Friday's "good" news in the jobs data, stocks were loving the "bad" news from US data. But all that went bust as jobs surprise-beat and another bear market rally bit the dust Friday.

Jamie Dimon downshifted his economic outlook from "clouds on the horizon" to an imminent hurricane", Goldman President John Waldron confirmed Dimon's anxiety noting that "the shocks to the system are unprecedented," and finally, Elon Musk warned he has a "super bad feeling" about the economy.

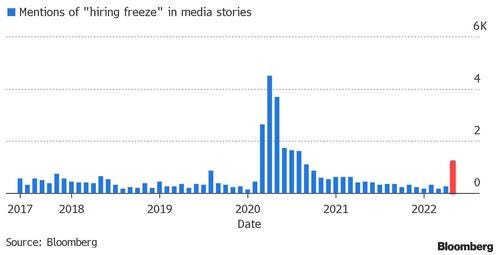

Apparently confirming the 'hurricane', the number of news articles mentioning “hiring freeze” has recently jumped to a level not seen since the first few months of the pandemic in 2020.

And so, despite a beat in the headline payrolls print Friday, other jobs data disappointed and just added to a week of ugliness for US economic growth expectations.

FedSpeak this week definitely put the hawkish narrative back on the table. Bostic admitted he was talking out of his behind about a September 'pause' and Mester piled on. That drove Fed rate-hike expectations significantly higher. Futures were already sliding but as the 'good' data hit, the selling accelerated hard. Nasdaq was down over 2.5% Friday.

Small Caps and The Dow were the best of a bad bunch on the day. But net net on tGe week stocks were fine as one can see below. That said, it does seem the Fed is insistent on keepin a lid on any rallies now that threaten to make people too affluent. it is as if the powers that be want the phrase Bear Market to keep playing over in headlines.

H/t Newsquawk and Zerohedge for data and some graphics.

Sectors:

Industrials and Energy stocks gains on the week (2 and 3)

Healthcare and Financials were the biggest losers. (1)

Aerospace benefits from war (2)

Basic materials start to pick up from Sino-stimulus (4)

Commodities:

The Dollar ended the week higher, bouncing of support at unchanged Friday

Gold whipsawed down then up and back down again to end the week unchanged at around $1850.

Copper had a big week, surging up to 6-week highs as China re-opened.

Oil prices exploded higher this week as OPEC+ didn't break up as so many hoped, production increases don't cover Russia's shortfall, tightening supply in the face of China demand re-igniting as lockdowns are lifted.

That pushed WTI up to $119 - its highest since the post-Putin peak.

Bonds:

Bonds lead stocks lower on Friday

Treasuries lower (in price) this week, with the belly underperforming on the holiday-shortened week (5Y +23bps, 30Y +15bps).

Crypto:

Bitcoin roundtripped on the week, ending back below $30,000.

Market is under influence of US macro way too much these days

GoldFix Friday WatchList:

Complete Watchlist Here

2. Technical Analysis

Report Excerpts Courtesy MoorAnalytics.com

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Energy

Bitcoin

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

3. GoldFix and Bitcoin Podcasts

More GoldFix Broadcasts HERE

More Bitcoin Podcasts HERE

4. Calendar

Some upcoming key data releases and market events

MONDAY, JUNE 6 None scheduled

TUESDAY, JUNE 7

8:30 am Foreign trade balance April -- -$109.8 billion

3 pm Consumer credit April -- $52 billion

WEDNESDAY, JUNE 8

10 am Wholesale inventories revision April -- 2.1%

THURSDAY, JUNE 9

8:30 am Initial jobless claims June 4 -- N/A

8:30 am Continuing jobless claims May 28 -- N/A

12 noon Real household net worth (SAAR) Q1 -- 8.5%

12 noon Real domestic non-financial debt (SAAR) Q1 -- 2.0%

FRIDAY, JUNE 10

8:30 am Consumer price index (monthly) May -- 0.3%

8:30 am Core CPI (monthly) May -- 0.6%

8:30 am CPI (year-over-year) May -- 8.3%

8:30 am Core CPI (year-over-year) May -- 6.2%

10 am UMich consumer sentiment index (preliminary) June -- 58.4

10 am 5-year inflation expectations (preliminary) June -- 3.0%

2 pm Federal budget balance May -- $93.6 billion

Main Source: MarketWatch

5. Charts

Gold

Silver

Dollar

Copper

Oil

Bitcoin

Charts by GoldFix using TradingView.com

6. Analysis: Retirement Plan Excerpt

We recommend you read this, as we did, in full for the following reasons1

It asks the right questions we all should be asking regardless of age group

It is their first publication like this, and as it is reputation making, first issues are frequently good in finance.- KEY IN REPORTS

The suggestions are not insane , the charts are helpful, some comments are obvious but sometimes we need to hear it from someone else to think clearly on it.

BOA as been putting out some very good analysis lately, as we took note in commodities and macro work. But it seems to be spreading now…

BOA- The Silver Lining: our annual report on retirement

A special report on the changing face of retirement was released last week. In first annual report on retirement, we address key questions, like:

Are Americans realistic about their own retirement needs?

Given the rise of target date funds, how have those funds performed?

Will Social Security save the day for under-invested workers?

How will upcoming retirement legislation affect markets?

We visited Washington, DC and discuss our findings from talks with key leaders. Included is an interview with Andy Sieg, President of Merrill Lynch Wealth Management, who offered insights on key retirement topics and on the value of tax loss harvesting.

We also conducted the first BofA RIC Retirement Survey, gauging the views of 2500 savers on their asset allocations, work expectations, and plans for future investments.

Excerpt:

American households are the prime movers of financial markets. US retirement assets, worth $44.5 trillion at the end of 2021, typically amount to 69% of the total value of US bond and equity markets (Exhibit 3).

And in any given year, 67% of global fund flows are to US-domiciled funds (Exhibit 4). The retirement landscape has changed drastically in the past 40 years. As Andy Sieg explained in our interview, retirement funding depends on four pillars of Social Security, pensions, private plans, and any continued work. For many savers, Social Security and pension benefits are a smaller share of their expected income in retirement

7. Research:

Precious

OANDA-

Gold prices edged lower after a robust nonfarm payroll report sent the dollar higher. Traders were expecting to see a stronger deceleration with job growth that could possibly make the Fed pivot away from a half-point rate hike in September(June and July are now widely expected to be 50bps hikes each).

The economy is not softening quickly and that took away the need for safe-havens today. Growing doom and gloom calls however should keep the precious metal supported over the short-term.

***More at bottom***Oil/Commodities

BLOOMBERG: DAILY BRIEF-

Oil headed for a sixth weekly advance after a keenly anticipated OPEC+ meeting delivered only a modest increase in output that failed to assuage concerns over a widening supply deficit.

The producers cartel agreed to a hike that amounts to just 0.4% of global demand over July and August. There had been speculation the Saudis were preparing to pump significantly more as part of a reset of relations with the US, and there were even suggestions that Russia might be exempted from the alliance’s monthly supply agreements.

***More at bottom***RBC Commodity Surveyor: Hitting Yet Another Level

The Commodity Surveyor is a holistic analysis of commodity investment flows and AUM. In it, we break down total commodity AUM by type and underlying as well as analyze the flows across the different types of investment vehicles. A key feature of our analysis is the breaking apart of underlying flows and price effects across index and ETP investments, as well as the effect of rolling commodity investments from one contract to another.

Previous index estimates were based on the CFTC’s Index Investment Data, which was discontinued as of November 2015 with October 2015 data marking the end of the series. We have since developed our own methodology for index estimates to serve as both an overall estimate for commodity-linked index AUM and to continue our ongoing flows analysis. We report our latest estimates as at the most recent month-end. All data may be subject to later revisions.

***More at bottom***GOLDMAN- Commodity Views From scarcity to hoarding

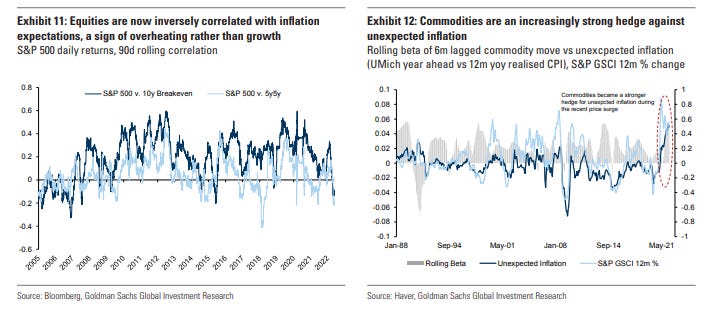

Slowing growth hits equities, not commodities. One concern of macro investors in allocating to commodities remains the near-term headwinds to overall demand from higher prices and rising rates.

Yet it is important to remember such headwinds take time to emerge, while continued growth above capacity – as we are seeing today – keeps commodity markets in deficit and commodities outperforming as an asset class. It is important to remember that slowing growth hits equities, not commodities. Crucially, for growth-based, forward-looking equities, the topping of US growth rate and household savings’ accumulation has driven a clear repricing in stocks, yet does not signal the end of price appreciation in commodities.

***More at bottom***Macro / geopolitical

MS - How Monetary Policy Affects Consumption

In collaboration with Morgan Stanley Financials analysts and Securitized Products strategists, we've modeled the effect of interest rate increases on US households. Our findings point to significant implications for the consumer outlook, with an unequal distribution across income groups.

Monetary policy affects the economy with long and variable lags. While most of the effect on consumption occurs over the first two years,even with no further interest rate increases consumer demand is depressed for several years beyond our forecast horizon. This dynamic highlights that monetary policymakers are likely to consider both past and prospective increases in the federal funds rate at upcoming meetings.

***More at bottom***Zen Moment

***premium below line***