Housekeeping: The weekly reads like a Saturday Barrons. We also went a little cray with Zen Moments this week.. new tech practice

SECTIONS

Precious Metals Comment— This ain’t bad

Research Highlights— GS, BOA, JEFF

Week’s Analysis/Podcasts— BRICS Convertibility, Neo-Liberalism Crisis

Calendar— Retail, Housing starts, FOMC

Technicals— GC, CL, BTC, S&P

***Zen Moments— DIRECT UPLOAD NOW.. so we went a little crazy

Full Analysis— Gold, Oil, Stocks, and Russia

1. Precious Metals Comment

Over the last 12 months we’ve happily given readers access to every bit of Precious metals and monetary insight we laid our eyes on. Nobody gives Gold and Silver the love we do. So when we sadly say this is not the time of year to be looking for write ups or actionable rallies in metals, we mean it.

Looking good…

Still, we have found something from Goldman that also tells us to be patient. (That is at bottom.) Next: Bad News, Good News.

Bad News:

Last week we had seen Gold back on Hartnett’s radar, which is very good. That is a sign to his clients to start closing shorts. But Goldman, our early indicator which we gleefully handicap going back years, has not followed through yet. Nor do we expect them to for now. Why?

Between August and October, Gold typically goes sideways at best

The Bitcoin hype is now hurting a little

Oil, which is up because they want oil, actually hurts gold this time of year due to limited and shrinking funds for commodity allocation. Rates matter

We are on the cusp of commodity liquidation season.

They just lost Jeff Currie.

Goldman did say last week their client book is increasingly looking to buy a break out above recent highs. Great! Then buy it above recent highs. The meta message is: They are watching and being patient for now. Unless there is an event, then we wait.

Bias comment. We have profits in a long GLD, Short TLT trade on and are getting nervous. All the shorts in bonds, combined with risk of China deflation, and the fact that higher rates will keep Gold and Stocks lower at this point in the rate cycle make us want to get out. But for now we are just not adding.. That is our bias. We fear the day gold drops big and bonds rally due to some hiccup in China.

Gold can give us a rally for sure, but don’t expect it. Expect it in November.

Good News:

The BRICS thing tells us that the Bullion banks are not as in control as they used to be. No news in a sideways market used to at least be good for a follow through slam. They will do this again, but there is an uncertainty in this market right now due to BRICS behavior that these banks do not have a handle on yet. Information is not reaching them as efficiently as it used to.

The other one is less opinion and more data based. Silver is lining up for another rally, and possibly before the August to October Sell season is over. Why? Because Aug-Oct is when funds close *all* positions. Not just long, but short as well. And in Silver, every so often they get extra short right before the liquidation time. They did so last year, and we let you all know.

Chronologically last time:

May 2022: Silver CTAs are too long, do not buy. LINK

Sep 12 2022: Silver is getting ready LINK

Sept 22: Silver short covering is coming.

A couple things. We are likely very early here again. Please, we are once again begging you… there are people out there who make money selling you metal, they are always telling you it is oversold. We agree. But you need a catalyst that makes shorts fearful. Sometimes capitulation of longs getting out is not enough. You need suckers to get good and short and for them to wonder “Why ain’t Silver going down George?”

Silver can get relentlessly hammered for a month before this starts (look at the rectangle below). But the longer they wait, the worse it gets on the other side. Also keep in mind they will sell Silver and it will drop if recessionary news comes out— just like in April of last year.

IF SILVER RALLIES $3 NEXT WEEK , that changes nothing. It just sets us up for another move in November.

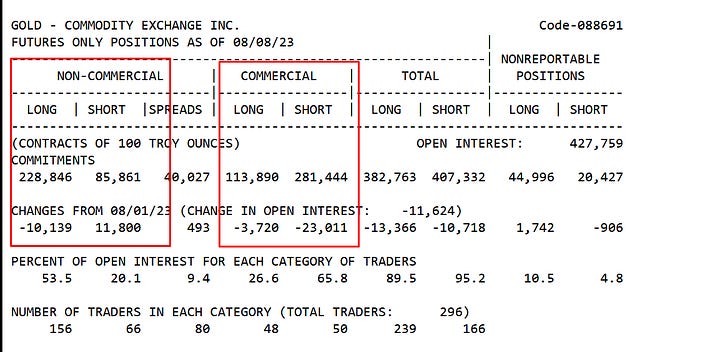

FOUNDERS: We will cover the COT Gold and Silver this Sunday in Founders Discussion available for Premium Tuesday

Sectors/Technicals

This is recessionary behavior except for Energy.

Tech down, consumer defensive up, industrials mixed

Energy did well purely on Oil prices

Healthcare did well.

CHiPS continue to get a reality check

Commodities:

Oil defied the dollar.. because correlations do not matter when they want the physical oil

Gold and Silver did not perform badly considering dollar strength.

Some of the metals selling is fund money rolling into Oil

Combined with the COT report, this is not bad stuff. Not out of the woods, but the beginning of CTA oversold signs are here.

Bonds:

Bond yields rose on the week. Consider this: With Japan raising the ceiling on YCC rates, and the BOJ likely selling US TSYs to finance its purchase of Yen if intervening again. This all makes sense and is inline with our comment that Japan raising the ceiliing on their own rates raises the floor for everyone else’s.

Things started out ok. but China deflation and US disinflation took a back seat to stickier future inflation perception on Friday

ZH Notes almost record shorts in TSYs now… which will be rocket fuel if bonds get off the mat.

Crypto:

Bitcoin continues to have hi vol of vol (goes nowhere.. then spikes or dives)

ETH similarly, but less so

Ripple seems hung-over from recent good news

2. Research:

Energy is key to all this. Since by the Fed’s own admission goods prices are much less in their control; with service inflation still not killed, they will be in big trouble policy wise especially with CRE markets teetering -GoldFix April

Goldman: Metals comment on Gold and Copper- Not yet

Jeff: Return of Oil inflation- Told ya

BOA: starts to make their overvalued stock case- Nice Cheat sheet

GS: Russia: Second Quarter GDP Growth Surprised to the Upside- Uh oh

Hartnett Flow Show: Treasuries are weak- Brief and to the point

DB: Better Demand, No Green Shoots - Good survey of company managers.

TS: Market is not pricing what the Fed will do yet- still expects rate cuts

MORE AT BOTTOM…

3. Week’s Analysis/Podcasts:

This week GoldFix wrote and curated over 15 articles and podcasts on Precious Metals, Geopolitics, and monetary economic matters. They can be found here. Below are some of week’s more popular ones: