Housekeeping: Many will be receiving GoldFix Weekly for the first time. It is different than the dailies. This post is more like a magazine. The content touches many areas of markets. GoldFix complete watchlist here

Founder’s Class : 2 p.m. SUNDAY Prem recording available early in week

Index

Market Summary

GOLD: China’s Back

SILVER: The Big Silver Stockout of 2025?

OIL:

Stock Sectors

Bonds:

Crypto:

Friday WatchList:

Technical Analysis

Popular Posts

Calendar

Charts

Research

Why did Biden wait until a week before Trump's term begins to unleash the tightest of sanctions of Russian oil? Probably just a coincidence, right

-ZH

1. Market Summary

Bond yields finally hit stocks this week. Commodities broadly rallied. Inflation fears spiked again. All this against the backdrop of good economic data and a Trump transition incoming.

Friday Payrolls Confirmed it….

OVERVIEW:

Data releases showed a strong economic situation, including Friday’s payroll. This, in turn stoked bigger inflationary fears manifesting in socks, bonds, and commodities. The message was clear, Commodities are now outpacing stocks to the upside and bonds are telling us the inflation fight is far from over.

It seems like the outgoing administration is hellbent on torpedoing Trump’s agenda. Two weeks ago Yellen started panicking in order to prevent Bessent from refinancing debt further on the yield curve. This week, Biden decided as winter hits the northern hemisphere to add heavier sanctions on Russian oil. i nthe very least, Trump will not be easily able to justify any tax cuts to Congress.

The week ended with STIRs going from hopes of two more cuts to barely one more, with that one actually pushed out to October.

STRONG ECONOMY, INFLATION ISSUES

Inflation breakevens have spiked taking treasuries along with them entering Hartnett’s area of danger (for stock longs) discussed in this space several times the last few months.1 If Powell gets publicly more hawkish it could get ugly fast. We dont think he will push it down more, but he is not unhappy either. The Fed needs long term rates higher to take some stock market froth out of things. They jsut want it t oremain orderly. The old “frogs in hot water” analogy applies here.

Zooming out just a bit, the market is prone to selloffs even more right now given the profits yet to be taken in the Trump-trades that started before the election. For perspective: What happened to Gold after the election may be on deck for stocks post the inauguration.

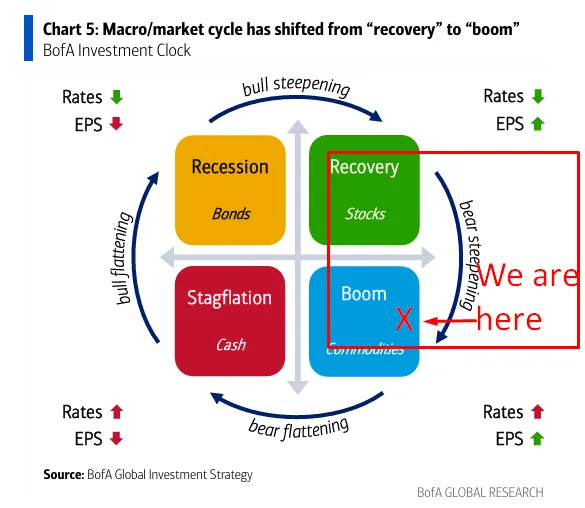

In any event, if this continues, Hartnett will be right about his BOOM concept (more on that later in our weekly Flow Show walthrough) and Gold will outperform stocks with Oil perhaps running the table this year.

GOLD: China’s Back

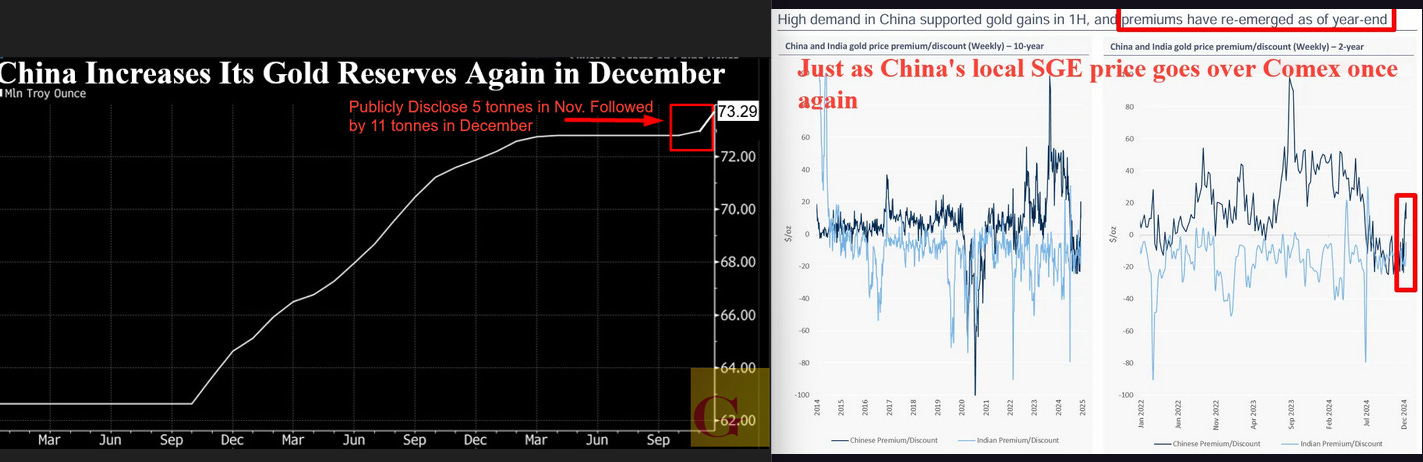

Disregarding “opportunity cost” of higher bond yields and a stronger dollar, Gold rallied. Physical demand out of China both at the PBOC and retail level have started working their magic again.

This is in spite of Goldman punting their $3,000 bull call out to 2026 duie to Fed hawkish behavior2

SILVER: Tariffs, EFPs, and Stockouts

By all rights Silver should have been much weaker on Friday given its industrial applications and proclivity for Gold longs to sell it. But, the Tariff concerns are forcing that mindset to cover shorts. GoldFix friend and physical market expert Bob Coleman of Profitsplus (link goes to Bob’s explanation of the Tariff implications) has been all over this as it manifested in the Silver EFP before anywhere else. 3

Here’s a synopsis of that explanation: Anyone who has sold short Silver contracts on Comex with expectations the physical metal they have access to can be used for delivery may be in for a rude awakening if that metal they have is refined or shipped by a nation subject to tariffs. That metal will then be priced with the tariff added on top and paid4.

This leaves the person holding potentially tariffed metal against a short Comex contract with a decision with multiple unknowns.

How likely are the tariffs to get implemented?

When would that be effective?

How much would it cost him if he had to pay them?

Not knowing any one of those and assuming he is not prone to speculation , he is smart to cover the short and just move on.

The MSM is now picking up on it. 5Here’s a decent explanation to that effect. This is Daniel Ghali of TD Bank (someone we respect in this area) discussing the potential for a silver stockout in light of Tariff fears…

Tariffs as Instigator of Silver Stockout Risk

Stockouts seem simple enough to understand. They are. But how you get and handle them is key. Stock-outs are not about the supply you see. They are about the unspoken for supply you see in metals.

There are several key concepts in here. One worth mentioning is Daniel’s reference to the price itself not manifesting the risk.