Housekeeping: This is a very wonky think-piece and the product of market research. Be forewarned. If you are pressed for time: Read Section 1, then Sections 7 and 8. This is a starting point for more research. Read the full disclaimer footnoted1 -VBL

Would you be willing to bet the Bullion used to create these derivatives is not double-claimed given that months ago we did not even know they existed as Gold bets at all?

Contents:

Summary:

What are Structured Derivative Products?

What happens when these SPs expire?

But what if a bunch of these expire at the same time as Bob notes?

What if the SP closes and the client(s) want(s) the gold?

How do we know if the Banks Are Buying Metal from miners?

What About Comex Deliveries?

What happens if the counterparties Want the Gold?

Brics Behavior Observed

1- Summary:

Reading Bob Coleman’s analysis in Gold and Silver ETF flows diverge with price caused this publication to take a closer look at correlations previously seemingly written off as semi-coincidences this past year in the Gold market. They never are coincidences at all it seems.

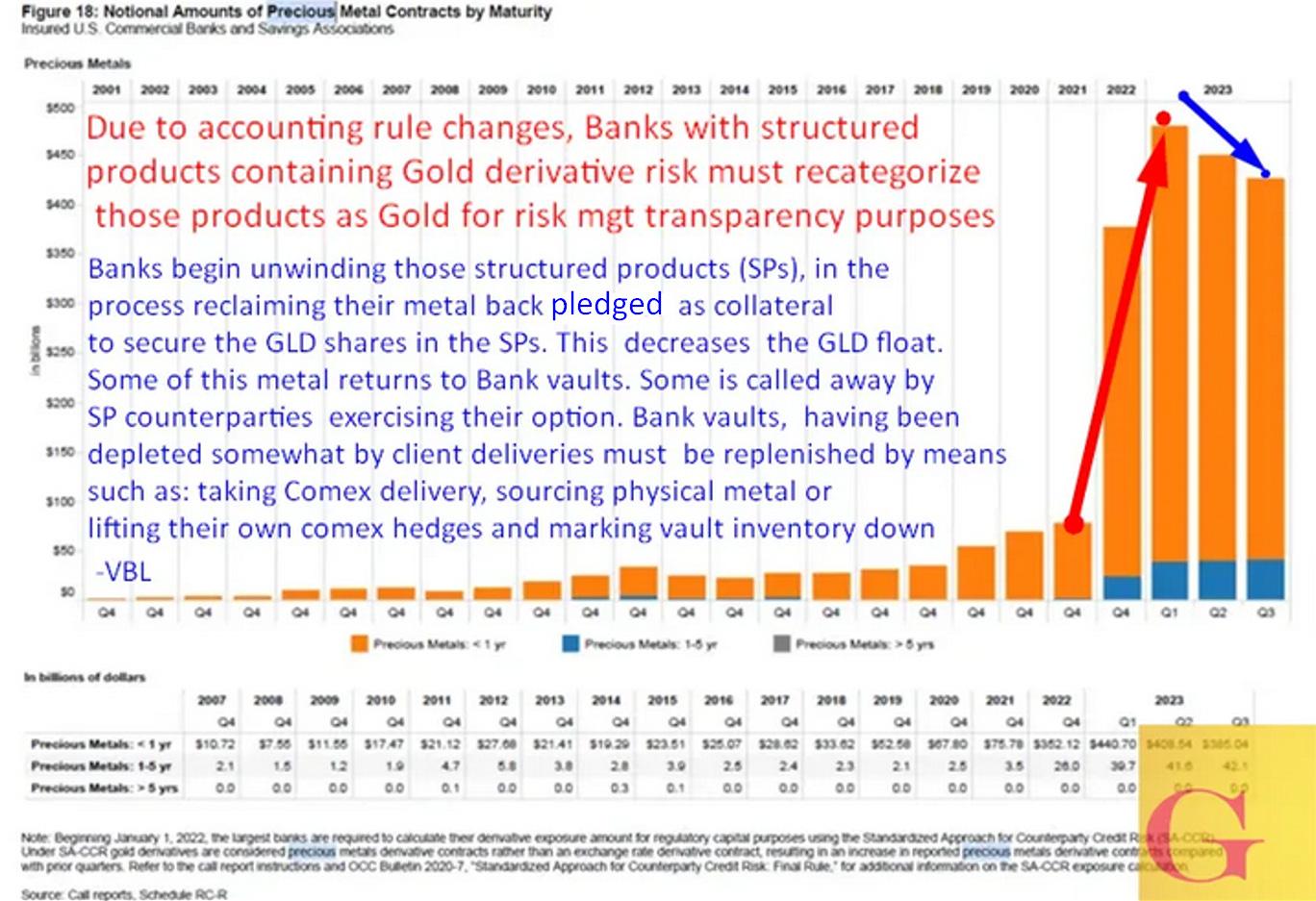

Gold Derivative positions exploded in 2022 due to accounting changes. Since Q2 of 2023 they are now being drawn slowly down concurrent with: ETF bullion holdings dropping, Comex being drained, and price making new all-time highs.

Coincidence? We do not think so and seek to explore the connection. Let’s start by understanding what much of these big orange bars represent. Namely, they represent Stuctured Products, a type of exotic derivative class for institutional investors.

2- What are Structured Derivative Products?

“Structured Products” are paper derivative contracts that can encumber physical assets. Structured Products are custom private instruments created by banks to accommodate risk plays clients wish to implement.

They can be similar to prop bets in a gambling house. Remember The Big Short and the Jenga tower scene? That was a structured product.