Housekeeping: Good Afternoon

Main Points:

OI Analysis: Macro is selling, who is buying dips then?

CFTC Report: Banks are getting their short calls back somewhat

Sunday Spike and Slam: Someone got burned Sunday Night. Not a fund

“Sideways is the new down” based on OI and briefness of current dips

The thing that negates #4 above is a dip with OI dropping

CTAs do not matter right now

Contents:

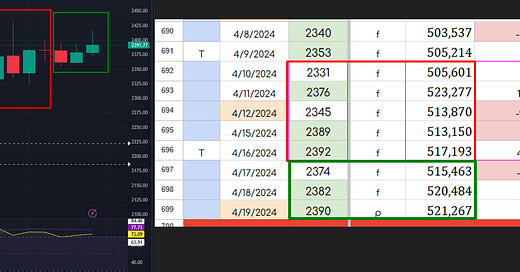

Oi Analysis

CFTC Analysis

Title Topic: 22:00 to 26:30 minute area

Goldman’s CTA Analysis

TME Commentary (excellent)

Goldman Institutional ETF comments

BOA CTA Analysis

1- Oi Analysis

Oi up = mkt up

OI sideways= mkt sideways

OI down = market sideways

Macro discretionary started Mar 1

This is how they play.. and when they net or whoever stop adding, you can tell by dip behavior, not rally behavior… OI doesn’t come in on a selloff until they are no longer looking to add.

Look for Oi to base where it used to top out

Look for clues of OI bigger now. Divergences from this new normal will still be governed by the rules learned here

It’s always strong hands to weak hands

you have to figure out who the strong hands are- currently dip buyers, not dip sellers (OI confirms this)

Like: OI down, market down = warning of macro getting out, OR buyers of dips not there. Until that happens, sideways is the new down.. look for RSI to come off overbought.. but mkt to stabilize higher