Housekeeping: ***Support Independent Media***

Things are Happening Faster Now

Featured Posts on News Sites :

Scottsdale Mint — BREAKING— It’s China Zerohedge — Selling Germany’s Gold Would Be A Strategic Mistake Yahoo — Venezuela Oil Reform Bill Seeks to Cut Taxes and Lure Private Investment X.com — Germany’s $599 Billion Gold Hoard Rekindles Debate Over Reserves and Risk

Featured Analysis:

News & Analysis:

ICYMI

Coming Soon/ Chat:

Data on Deck:

MONDAY, FEB. 2TBAAuto salesJan.16.1 million10:00 amISM manufacturingJan.47.9%

TUESDAY, FEB. 310:00 amJob openingsDec.7.1 million10:00 amISM servicesJan.54.4

WEDNESDAY, FEB. 48:15 amADP employmentJan.41,000

THURSDAY, FEB. 58:30 amInitial jobless claimsJan. 3110:50 amAtlanta Fed President Raphael Bostic speaks

FRIDAY, FEB. 68:30 amU.S. employment reportJan.50,0008:30 amU.S. unemployment rateJan.4.4%8:30 amU.S. hourly wagesJan.0.3%8:30 amHourly wages year over year3.8%10:00 amConsumer sentiment (prelim)Feb.56.43:00 pmConsumer credit$4.2 billion1

Charts and Final Market Check:

Coming Soon Good morning:

Until the truth is spoken clearly, misinformation travels faster than understanding.

If you actually want to understand what is happening in gold and silver right now, particularly across Shanghai, Shenzhen, and the U.S. markets, you should pay attention to this conversation and info generated by our colleagues, particularly Eric Yeung

At GoldFix, we know what is happening as does Eric .

We both know why it is happening.

And to a meaningful extent, we and Eric understand how it is happening and how it is likely to resolve.

For example: the silver prices does not include vat tax. Full stop.

Today, after the Morning Rundown, we are publishing a special post that explains the last few days price action directly.

What you are seeing elsewhere are stories designed to generate engagement, not understanding. Headlines that tell you silver rallied because of speculators. Stories that suggest nobody wants to buy anymore. These narratives are not outright false, but they are incomplete in a way that is convenient. They rely on surface explanations and assume the reader will not question them.

We do not assume that.

Our goal is not to entertain you or trigger a reaction. It is to make you more informed than the people writing those stories. Not through jargon or complexity, but through clarity. This market is understandable once you stop viewing it through the usual media lens.

The reality is that market structure is distorted. Price signals are compromised. Flows are misinterpreted. This is the result of policy decisions and incentives embedded over years. We are not here to moralize or assign blame. We are here to explain what is actually happening, mechanically and practically.

You can finish a piece of content feeling excited.

You can finish it feeling disappointed.

Or you can finish it understanding something you did not understand before.

We intend to deliver the third outcome.

Later today, we will walk through what is happening conceptually, practically, and mechanically across the silver and gold markets. We will explain why it is happening and why our interpretation holds together when others do not.

This is not a hot take.

It is a framework.

Tune in after the Morning Rundown.

It will be the first written work product of collaboration between Eric and Vince and hopefully it will help. Depending on interest, we will follow it up with a podcast later this week to add color and take questions

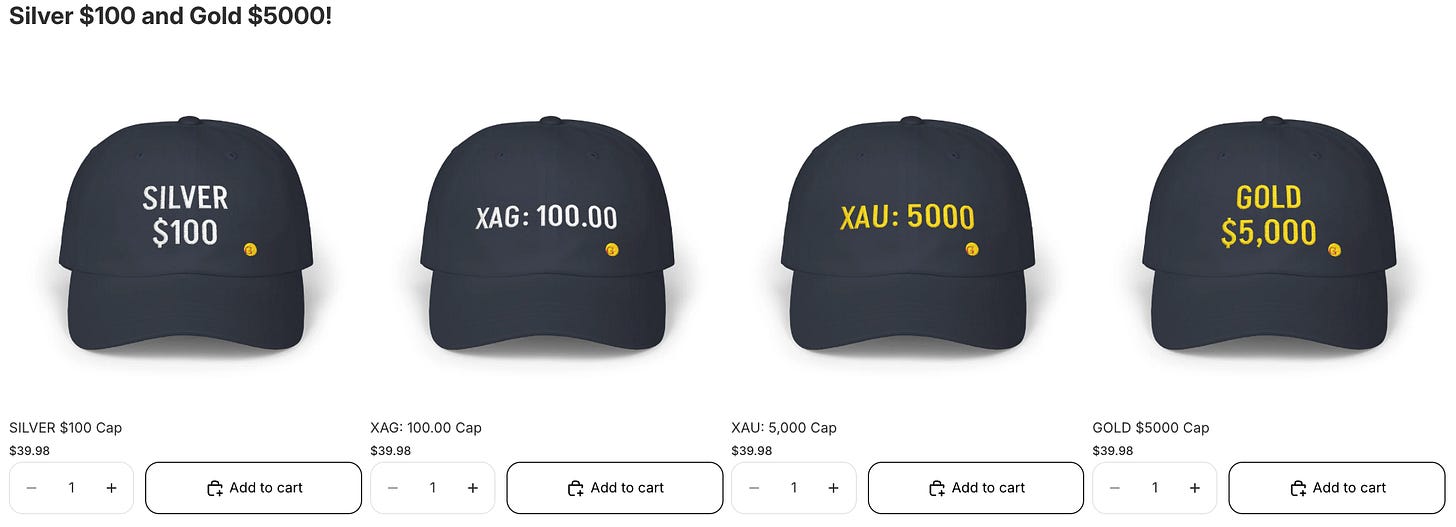

***Please support Independent Media by taking a look at our new Silver and Gold hats!***