Breaking: The Gold Smackdown Rule | Market Rundown

Something has been changing in Gold slowly over the past 2 years.

Today:

Market Rundown

JPM Gold comment

Breaking: Gold’s 2% Smackdown Rule

GS AI educational piece, companies in play

1- Market Rundown:

Good morning. The dollar is up 19. Bonds are lightly stronger across the board. Stocks are all up between 55 and 125 bps. Gold is down $6. Silver Fu are up 2c. Crude oil is up 73c. Nat Gas is up 5.8%. Grains are all strong up between 40 and 100 bps. BTC and ETH are very strong up 2 to 4.5%

2- JPM Gold Comment:

As a reminder: We are midway through Gold’s most important week ever and holding steady.

JPM moved its price target of $2100 by 2024 forward to being possible by end of 1st Half 2023. We’d note 2 things here. Part of this is business as usual. Goldman has been in front of JPM on Gold for a little while recently and like all content carriers, their own client base must be showing interest too. So in a business as usual way, bullish, but a nothing burger.

JPM Yesterday on Gold…

But given the recent major uptick in interest on MSM and other banks (Goldman, Bloomberg, Citi, FT and now Barclays (premium tomorrow!) and the prevalence of bulls in other disciplines like Technical Analysis (cup and handle talk is everywhere), this is shaping up as rather large groundswell long term and a hot fever short term.

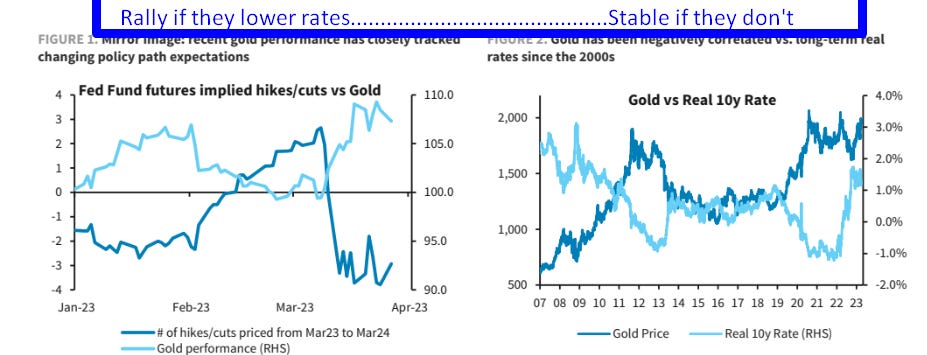

Rally on rate easing, rally on hi real rates lately…

We have made it clear, almost a mantra, that Gold benefits both ways going forward and as US citizens get re-sensitized to inflation and bank failure simultaneously, it will create a multi-year bull market, not unlike what happened between 2001 and 2011.

3- Two Percent Rallies are Always Punished…

The cure for bullish behavior historically has been a spoof-and-slam1 lower which gets Gold out of the headlines. But it has not happened yet in a meaningful way this year.

To that point, Gold statistically does not farewell after a 2% up day move. We did the data going back to 1987 once, and it was obvious. Meaning historically, a 2% up day in Gold almost always ends with a 2-4% drop below within 2 weeks of the move. Gold was almost always lower than where it started after a rare 2% rally. Gold rallies just did not persist historically. We know why, and have said as much here, but can’t prove it.

…Or Are They?

Yet something has been changing in Gold slowly over the past 2 years and may now be accelerating.