Housekeeping: Good Morning. **Taking the next few days off**

“The Gold reset is a process, not an event”

Today

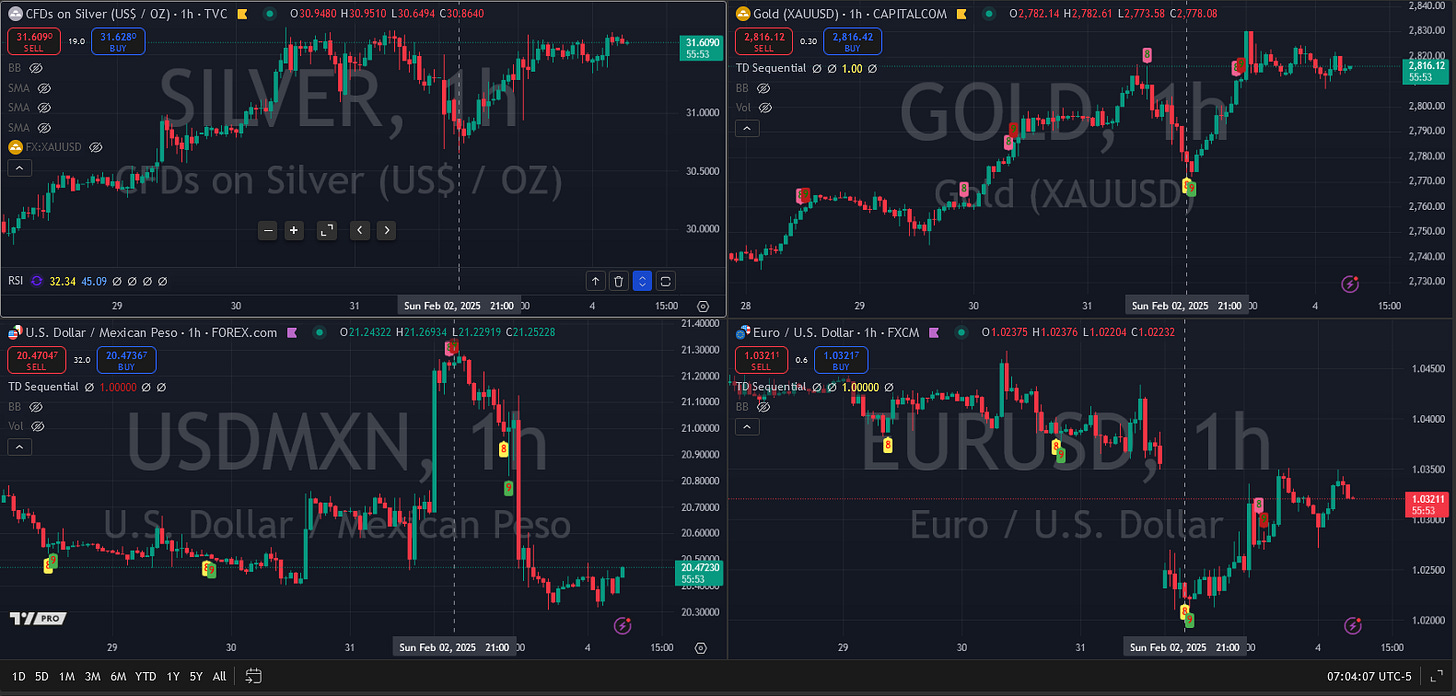

Discussion: Markets React to Tariffs

Premium: Analysis from 3 Banks

Discussion: Three Banks Discuss Tariff Risks

Ross Norman asks About Those London Gold Shortages

London is sitting on about 8710 tonnes of gold according to the latest LBMA vault stats and the drawdown has not exactly moved the dial (see below). Yes, less than half of this is owned by other central banks, but the majority is ready and available.

This is a logistical and conversion problem … temporary log-jams happen.

The scale and speed of the drawdown in gold has reduced liquidity in the market temporarily and the cost of borrowing gold has rallied from sub 1% to north of 10%. This has a detrimental impact on gold borrowers who optimize their working capital by borrowing gold r ... yes, the very infrastructure that interfaces with gold consumers and makes our markets possible is being damaged.

First Takes on Tariff Risks to Precious Metals

SWISS BULLION BANK

We believe the metal is due for a revival in 2025, with its price trajectory likely to be anything but gradual over the next 12 months.

Robust industrial-application demand (around 55% of silver consumption) should combine with rising interest from value conscious buyers who look to Silver as a way of buying into expectations of even higher prices of the yellow metal.

Stronger supply bears watching, but the biggest risk to prices is related more to President Trump's policies that could be inflationary and the Fed's response via changes to its stance on US monetary policy, rather than any silver-specific news flow, in our view.

So, what is our view on the silver price? Weighing the different scenarios, our view remains unchanged and positive, with silver prices expected to appreciate to USD 36-38/oz over 2025.

Continues at bottom…

CANADIAN “BULLION” BANK

Gold price implications long-term positive: Ultimately, an extended period of tariffs introduces higher inflation and slower global economic growth, both of which positively affect gold prices.

Silver price implications less constructive. Silver's 50% of demand from industrial usage, vs. gold at 10%, could see a larger negative impact on its demand from key end markets impacted by tariffs, including solar power…

Equity views: North American miners could face some degree of input cost pressures, while royalty companies could benefit on a relative basis given their insulation from costs. They go on to give details names and numbers

Continues at bottom…

US BULLION BANK

President Trump has imposed a 25% import tariff on Canada and Mexico (10% on energy imports from Canada) and a 10% levy on China to take effect from 4 February (1-Feb, White House , 1-Feb, BBC). Besides aluminium and steel, we think the US sufficiently reliant on imports of copper, gold, and silver from Canada and Mexico for this to drive meaningful further outperformance of US vs Ex-US metal pricing.

We see further tariff escalation as bullish for gold to $3,000/oz and silver to $36/oz on a 6-12M basis and bearish copper to $8,500/t over the next three months, on an ex-US price basis

Continues at bottom…

News/Analysis:

Markets Recap:

US equities retreated on Monday as investors assessed President Trump's tariff decisions. Large caps bested small caps: S&P 500 (-0.76%) vs. Russell 2000 (-1.28%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) lost 0.73% and 1.17% respectively.

Market News:

The U.S. struck last-minute deals with Mexico and Canada to delay new tariffs, after separate calls with the leaders of both nations.WSJ

Shares of Temu parent PDD Holdings plunged after President Donald Trump announced new tariffs on the country’s top three trading partners. Trump’s order struck down the “de minimis” trade exemption, which allows packages under $800 to enter the U.S. duty free. CNBC

"Meta’s total investment in virtual and augmented reality is set to top $100bn this year, as its chief executive Mark Zuckerberg has declared 2025 will be a “defining year” for its smart glasses.FT

Geopolitics/ Politics: Trade War

via Newssquawk

TARIFFS

The new 10% tariff on all China exports to the US took effect after the deadline passed.

China is to levy countermeasures on some US imported products with 15% tariffs on coal and LNG, as well as 10% tariff on oil, agricultural machines and some autos from the US, while China's Finance Ministry said tariffs imposed are to counter 10% Trump tariff and will take effect on February 10th. China is also to probe Google (GOOGL) over alleged anti-trust law breaches and it imposed export controls on tungsten, tellurium, ruthenium, molybdenum, and ruthenium-related items.

US President Trump said on Monday that the US will probably speak to China over the next 24 hours and China will not be involved with the Panama Canal for long. Furthermore, he said China tariffs were an opening salvo and will increase if they cannot make a deal, while he warned that tariffs will be substantial if can’t make a deal with China.

US President Trump said on Truth that Canada agreed to ensure the US has a secure Northern Border and the tariffs announced on Saturday will be paused for a 30-day period to see whether or not a final economic deal with Canada can be structured.

Canadian PM Trudeau said he had a good call with President Trump who will pause the tariffs for at least 30 days and Canada will send almost 10,000 troops to protect the border, while Canada will also name a fentanyl czar.

US President Trump likes the idea of reciprocal tariffs on more countries and said that nobody is out of tariffs, while he had a great talk with Mexico but added that they have to stop fentanyl. Furthermore, he said they have not agreed on tariffs yet with Mexico and he had a good talk with Canadian PM Trudeau but added the US is not treated well by Canada.

China's UN envoy said China firmly opposes the unwarranted increase in tariffs by the Trump administration and in violation of the WTO, China will be filing a complaint. Furthermore, the envoy said Beijing may be forced to take countermeasures against the US, as well as commented that the US should look at its own problem with Fentanyl rather than shifting the blame onto others.

US President Trump reportedly considering plans to impose a 10% tariff on the EU, according to The Telegraph.

US President Trump is to host a bilateral meeting with Israeli PM Netanyahu on Tuesday, according to the White House.

US reportedly readied a new USD 1bln arms sale to Israel, according to WSJ.

US shipments of arms to Ukraine were briefly paused last week but resumed on the weekend, according to Reuters citing sources.

US Secretary of State Rubio said there are no talks to recognise Maduro as the legitimate leader of Venezuela and commented that they cannot continue to have the Chinese exercising control of the Panama Canal area.

Philippine Air Force spokesperson said Philippines and US joint air patrol exercises were underway in the South China Sea.

Data on Deck: Unemployment Rate

MONDAY, FEB. 3 PMIs

TUESDAY, FEB. 4 Factory Orders, Lots of speakers

WEDNESDAY, FEB. 5 PMI, more speakers

THURSDAY, FEB. 6 Productivity.. speakers

FRIDAY, FEB. 7 U.S. employment report Jan.175,000/ Jobs; 4.1%/ Rate1

Final Market Check…

Premium: Analysis from 3 Banks

DO NOT SHARE THESE