What is this:

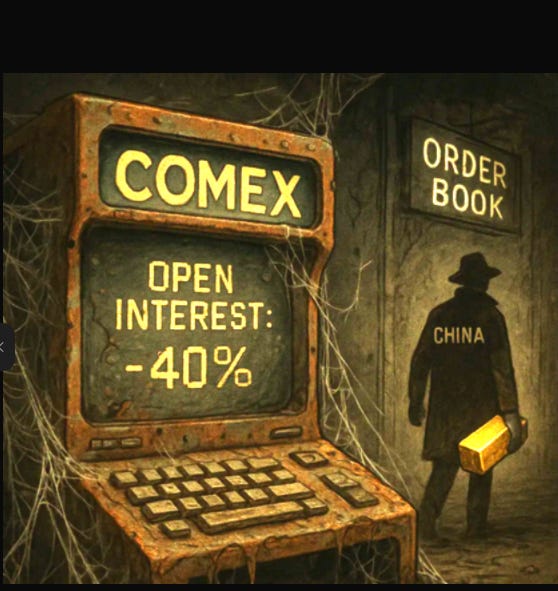

Upon seeing Comex OI make new lows as Gold made new highs with China activity surging ( domestically as well as in Shanghai) serve as an important signpost on the path to Comex pricing’s diminishing importance, and with it, Global dedollarization accelerating.

The Bottom Line:

Gold’s new highs now and going forward will come at direct injury to Bullion Banks, the Comex franchise, and USD hegemony. Too many events are converging on this to ignore anymore.

Find Attached Below:

i. a re-recorded voice note with conceptual slides; ii a readable transcript broken into sections; iii. and data sources

VBL

**Comex Deathwatch: China Sets The Gold Price

[SECTION 1 – OPENING THESIS + VENN FRAMEWORK]

[SECTION 2 – MARKET STRUCTURE: WHAT’S NORMAL VS. WHAT’S CHANGING]

[SECTION 3 – TWO INTERPRETATIONS: REGIME CHANGE OR CONTRACT DEATH]

[SECTION 4 – EVIDENCE OF DECLINE: VOLUME MIGRATION AND MARKET DISLOCATION][SECTION 5 – BANK BEHAVIOR, COLLATERAL CRISIS, AND EARLY WARNINGS]

[SECTION 6 – REGIME SHIFT OR TERMINAL DECLINE?]

[SECTION 7 – GLD, DOMESTIC CONTROL, AND THE QUIET SHUTDOWN OF COMEX

[SECTION 8 – POSITIONING, DISCIPLINE, AND THE TWO PATHS FOR COMEX]

[SECTION 9 – GLOBAL LEVERAGE, REGIONAL PRICING, AND GOLD’S REPRICING SETUP]

[ADDENDUM: VARIOUS CHARTS ON CHINA][SECTION 1 – OPENING THESIS + VENN FRAMEWORK]

Hi. I believe the recent decline in open interest—especially over the last few weeks—has shifted meaning. What began as a sign of a healthy market has become something else. Not necessarily unhealthy in the long run, but now a signal: risk is rising. Specifically, risk to the viability of the COMEX gold contract, and a slow-moving—but now quickening—effort to unwind short positions in the U.S.

What does it mean. It means over the next year or so 20% could be lower. But the next 50% to 100% will be higher usual disclaimers added. the metrics used to mange risk are just expanding insanely now. because of these factors coming together

Picture a Venn diagram with four circles.

One circle: Basel III implementation, dated July 1.

Another: Trump’s tariff negotiations and the economic standoff with China.

A third: the upward bias we’re seeing from swap dealers in COMEX trading—covering shorts faster than usual, while longs are exiting positions, often for profit, and also faster than usual.

And the fourth circle? Let’s call that a placeholder.

Actually, no—it’s not a placeholder. That fourth circle is gold repatriation: the U.S. is actively pulling back a significant chunk of gold.

Now, these circles intersect. Not just symbolically, but operationally. And we’re going to have to narrow down and eventually define what sits at the center of that intersection. For now, here’s what it contains:

July 1: Basel III implementation.

July 6–8: the BRICS summit.

And whatever internal deadline the Trump administration has set for escalation in the ongoing U.S.-China trade war.

So what else belongs in the middle?

The death of financialization.

The repatriation of payment chains.

The deconstruction of the rehypothecation-based carry trade that’s underpinned global markets for decades.

So what would this graphic actually mean? Well, we’ll get to that. But first, let’s go back to the open interest, because that’s what sparked this whole connection of dots—and this Venn diagram exercise.

[SECTION 2 – MARKET STRUCTURE: WHAT’S NORMAL VS. WHAT’S CHANGING]

Let’s talk about the plumbing—how markets function underneath. That’s where we need to begin. Not necessarily because it’s the foundation of everything, but because it’s critical to understanding what we’re seeing right now.

There are two areas to cover:

What healthy and unhealthy market structures look like, particularly in futures.

What Basel III actually implies, broadly speaking, and how it’s likely to manifest in the U.S.—presumably starting July 1, rolled out over three years.

From there, we’ll talk about how these two concepts—market structure and Basel—interact to change what we consider normal market behavior.

There’s a causative relationship in play. So let’s begin—at least for now—with how I look at things.

Let’s start with what a normal, functioning market looks like.

Now, I’ll get a little granular here. If you already understand how futures markets function, you can skip ahead. But some people need to hear it.

In a normal futures market, price direction is accompanied by PATTERN BASED changes in open interest.

But what we’re seeing now is very different:

COMEX open interest has been declining consistently, with almost no bounce, to levels we haven’t seen in years—while the price of gold continues to rally. That trend has accelerated over the last month. And it’s accelerated again over the last week.

So, what does that mean?

In a healthy market, when open interest drops as price rises, that’s typically just short-covering. Shorts are nervous, and you get what’s technically known as a “short-covering rally.” Happens all the time. Just like longs take profits and the market drops, shorts cover and the market rises

So yes—it’s normal behavior. But when it persists—and becomes extreme—it starts to raise new questions.

Before we go there, we need to take a step back and look at COMEX structure—specifically: who the players are.

Historically, Bank swap desk shorts have dominated this market.

They have:

The biggest pockets,

The most information flow,

And asymmetric control of market structure.

They also have physical gold, which gives them the ability to short anywhere from 5x to 20x what they physically hold—because no one ever actually takes delivery.

And that’s worked—for decades.

But occasionally, even they get nervous. They’ll proactively cover—not out of panic, but out of prudence.

You often see that before major events.

October 7th, for example—right before the Israeli conflict escalated. They got tapped on the shoulder. Same thing happened before both Iraq wars. The banks—the market-making shorts—covered not because they were sure they’d lose money, but because they weren’t sure they wouldn’t.

I had traders tell me, literally: “If nothing happens, I’ll kick them out Monday.”

That’s how it worked.

To sum up:

In a normal market, when shorts cover into a rally, open interest drops.

If it lasts tahts very rare, and it often reflects banks de-risking, positioning ahead of uncertainty.

But now—it’s different.

This time, open interest isn’t just falling. It’s falling to relatively extreme levels. And while open interest changes alone aren’t conclusive, in the broader context—in combination with:

Basel III implementation,

China stepping up as a gold futures and physical market hub,

The structural death of the rehypothecation trade,

And U.S.-China economic realignment—

…this open interest collapse is not just healthy short-covering.

It’s potentially something much bigger.

[SECTION 3 – TWO INTERPRETATIONS: REGIME CHANGE OR CONTRACT DEATH]

So let’s lay out what I think are the two possible interpretations. And it’s possible both are true—at the same time.

Scenario One: This is still a healthy market—but it’s entering a new regime.

The banks may have realized:

“This is now a buyer’s market. You have to be long.”

You can’t play the old game anymore. You can’t lean on leverage, can’t assume delivery won’t be demanded. The whole architecture has changed.

So they’re resetting their books—every chance they get.

They’re not panicking—they’re repositioning.

They see what’s coming.

They know Basel III is the real deal.

They know the gold trade is transitioning to a physical-first system.

They know China’s now center stage in futures, and physical.

So they adapt.

That’s what smart money does.

This scenario still qualifies as “healthy”—but it feels extreme because it’s a break from everything we’ve known.

It’s what you’d call a regime change in the structure of the market.

And to be clear: regime changes do happen. They’ve happened in other asset classes over the years.

But not in gold.

Not in my entire career.

Scenario Two: The contract is dying.

Open interest collapse while prices continue to rise can also signal a much darker outcome.

Not just repositioning. Not just short-covering. But disengagement.

It could be that the COMEX gold contract itself is dying.

We’ve seen this before.

Palladium is a prime example.

That market was squeezed by the banks. Funds got blown out repeatedly. Eventually, it became unusable.

Still exists, yes—but as a shell of its former self.

No one touches it now. Too thin. Too dangerous.

The same thing happened with the potato contract on NYMEX.

It got taken out—effectively destroyed—by interlopers.

In this case, the interloper may not be a fund or a rogue trader.

The interloper might be China.

They’re not trying to destroy COMEX.

They’re just buying physical.

And that’s collapsing the entire rehypothecation-based leverage system underpinning the COMEX structure.

So before we go further, let me ask it again:

Is the COMEX contract dying?

Empirically—on observable fronts—it’s already fading in relevance. not necessarily dying.. but giving up dominance for sure to china etc

[SECTION 4 – EVIDENCE OF DECLINE: VOLUME MIGRATION AND MARKET DISLOCATION]

Let’s look at the evidence.

First, market share.

COMEX’s share of global gold futures volume is declining.

Look at Dubai. Look at Shanghai.

Volumes are growing there—and shrinking here. note to include some pics to givea feel on this

Open interest in those foreign exchanges is rising.

Here in the U.S., it’s falling.

That’s not a blip. That’s a relocation.

demand.. business… vaults.. pricing all follow- supply chain exodus for the last 15 years is culmination in price now following….

Market interest is moving—geographically, structurally, permanently.

The neighborhood is changing for gold. And COMEX isn’t the center anymore.

This is something I discussed years ago with Tom Luongo.

We looked at the premise:

If China takes the lead in physical gold, and Basel III eliminates Western leverage—

then China benefits, and the U.S. does not.

That means COMEX—the old home of dollar-based pricing—starts to die.

Meanwhile, Shanghai Exchange thrives.

At the time, we framed it as a proxy for dollar death.

If you dominate global pricing, the dollar remains strong.

If you lose pricing power to another region, the dollar loses one of its key structural supports.

Global pricing becoming regional pricing for gold?

That’s not just a gold issue.

That’s a monetary regime issue.

And it’s dangerous for the dollar.

So again—where are we?

COMEX opening volumes are falling.

Foreign opening volumes are rising.

Open interest here is shrinking.

Overseas? Growing.

And here’s the kicker:

Rising volume doesn’t necessarily mean new players entering.

It often means existing players exiting—squeezed out, losing relevance, liquidating.

So when you see volumes spike and open interest fall, you’re seeing a market in liquidation.

That’s what COMEX gold looks like today.

[SECTION 5 – BANK BEHAVIOR, COLLATERAL CRISIS, AND EARLY WARNINGS]

Let’s keep building

Banks are losing money.

We don’t have all the data yet, but it’s clear: they’re losing money trading against China.

They’re likely making it up elsewhere—but in gold, they’re under pressure.

And open interest keeps falling.

This ties back to something we’ve talked about before:

A coming crisis in collateral.

Back in 2022, Zoltan pozsar issued a warning—subtle, dense, but critical.

He said a commodity crisis was coming.

Not because of price, but because of physical collateral.

His argument: the physical assets that back the financialization of Western markets were beginning to dry up.

And as they disappear, the leverage structure collapses with them.

That was the big picture.

In a follow-up report—equally difficult to parse—he described the potential unwinding of the gold rehypothecation trade.

That is, gold that’s lent, re-lent, and pledged as collateral multiple times across institutions.

It wasn’t the headline of his work.

He focused mostly on energy and oil.

But the gold piece stuck out to us—and to others.

Zoltan never discussed that topic it in his analysis again.

Still —the warning was there.

It came. It was public.

And now it’s playing out.