Housekeeping: Good Morning.

Bretton Woods Three is a Process, Not an Event

Today:

Premium: Starbucks and Stagflation

Commentary: China Gold Influence

Markets Yesterday:

US equities declined on Tuesday ahead of the Federal Reserve's rate decision

Markets: China Gold Correlations

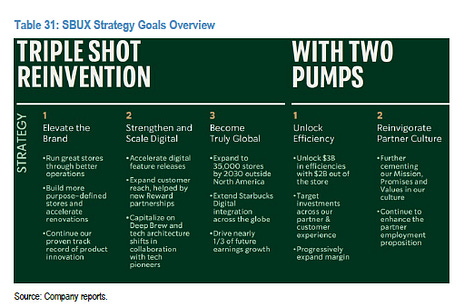

Premium: Is Starbucks a Short?

Bottom Lines

US Business is drying up- Still cant buy a home

People are not buying food there- coffee only, even with delivery

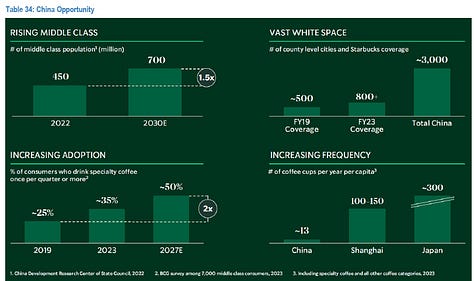

China is a problem so far- slow going

Mgt is troubled- Middle East, Unions, Schultz is back

More at bottom…

Market News:

"The Biden administration is seeking to reclassify marijuana as a less dangerous drug... a historic move that could make it much easier to buy and sell pot and make the multibillion-dollar industry more profitable. Source: WSJ

"The world’s largest food and drinks companies have said that poorer consumers in the US are cutting their spending in the face of persistent price rises, in a sign that the lowest earners are bearing the brunt of sticky US inflation. Source: FT

"Defaults are reaching historic levels in the office market, as a growing number of owners capitulate to persistently high interest rates and weak demand. Source: WSJ

"Home prices in February jumped 6.4% year over year, according to the S&P CoreLogic Case-Shiller national home price index. It marked another increase after the prior month’s annual gain of 6%, and the fastest rate of price growth since November 2022." Source: CNBC

Geopolitics:

Walla's Elster citing a senior Egyptian source who told local media that efforts to reach a truce agreement continue in a "positive atmosphere"

Hamas official says the group still studying recent ceasefire offer

Philippines Coast Guard official said China's Coast Guard has elevated the tension and level of aggression, while the official added the Chinese Coast Guard's use of a water cannon is still not an armed attack but is using higher water pressure, according to Reuters.

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, APRIL 29None scheduledTUESDAY, APRIL 30 9:00 am S&P Case-Shiller home price index (20 cities)

WEDNESDAY, MAY 1 2:00 pm FOMC interest-rate decision 2:30 pm Fed Chair Powell press conference

THURSDAY, MAY 2 8:30 am Initial jobless claims April 27

FRIDAY, MAY 3 8:30 am U.S. employment report April1

Premium:

***DO NOT SHARE THIS***