Housekeeping: Good Morning.

“The reset is a process, not an event”

Topics:

Goldman Bull Case

CPI Prep

Market Analysis:

Goldman Reiterates $4,000 call on Persistent China buying, but...

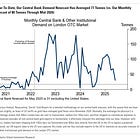

Goldman Sachs’ May nowcast of central bank and institutional gold demand came in at 31 tonnes, extending a pattern of above-average accumulation. The figure pertains to non-U.S. participants operating through the London over-the-counter (OTC) market and compares favorably to the pre-2022 average of just 17 tonnes per month.

The bank projects that persistent, structurally strong central bank buying will continue to underpin gold’s valuation. Their price targets remain unchanged: $3,700 per ounce by the end of 2025 and $4,000 by mid-2026. Alongside this, they reiterate their recommendation to remain long gold.

Full analysis in Premium Post: Goldman Reiterates $4,000 call on Persistent China buying

FoundersAM- CPI in Focus: Tariff Effect?

This morning’s Consumer Price Index release lands at a critical juncture in the Fed’s inflation management and Wall Street’s tariff recalibration. For months, inflation data has remained benign despite the imposition of new tariffs. Today’s print should ( will?) test whether that inertia has finally broken.

Wall Street Consensus

Street consensus anticipates a +0.3% month-over-month increase in both headline and core CPI for June, up from +0.1% in May. Year-over-year core CPI is expected to fall within a narrow range of 2.8% to 3.1%. This incremental acceleration reflects modest upward pressure, largely attributable to tariff-related pricing in consumer goods and services.

Gold's historical reaction function is an average change of 0.4% on CPI releases this past year

Related Posts:

Data on Deck: CPI/ PPI

MONDAY, JULY 14 None scheduled

TUESDAY, JULY 15 8:30 am Consumer price index

WEDNESDAY, JULY 16 8:30 am Producer price index

THURSDAY, JULY 17 8:30 am Retail sales

FRIDAY, JULY 18 8:30 am Housing starts

Full calendar1

Charts and Final Market Check

SILVER OPINION: Traffic light for Today’s Action

Greenlight

Yellow Light

Red Light for

REST OF DAY

MONDAY, JULY 14 None scheduled TUESDAY, JULY 15 8:30 am Consumer price index June 0.3% 0.1% 8:30 am CPI year over year 2.7% 2.4% 8:30 am Core CPI June 0.3% 0.1% 8:30 am Core CPI year over year 3.0% 2.8% 8:30 am Empire State manufacturing survey July -9.0 -16.0 9:15 am Fed Governor Michelle Bowman speech 12:45 pm Fed Governor Michael Barr speech 2:45 pm Boston Fed President Susan Collins speech 6:45 pm Dallas Fed President Lorie Logan speech WEDNESDAY, JULY 16 8:30 am Producer price index June 0.2% 0.1% 8:30 am Core PPI June -- 0.1% 8:30 am PPI year over year -- 2.6% 8:30 am Core PPI year over year -- 2.7% 9:15 am Industrial production June 0.1% 0.2% 9:15 am Capacity utilization June 77.4% 77.4% 10:00 am Federal Reserve Governor Michael Barr speech 2:00 pm Fed Beige Book 6:30 pm New York Fed President John Williams speech THURSDAY, JULY 17 8:30 am Initial jobless claims July 5 233,000 227,000 8:30 am U.S. retail sales June 0.2% -0.9% 8:30 am Retail sales minus autos June 0.3% -0.3% 8:30 am Import price index June 0.3% 0.0% 8:30 am Import price index minus fuel June -- 0.3% 8:30 am Philadelphia Fed manufacturing survey July -0.3 -4.0% 10:00 am Business inventories May 0.0% 0.0% 10:00 am Home builder confidence index July 33 32 10:00 am Fed Governor Adriana Kugler speech 12:45 pm San Francisco Fed President Daly speaks 1:30 pm Fed Governor Lisa Cook speech 6:30 pm Fed Governor Christopher Waller speech FRIDAY, JULY 18 8:30 am Housing starts June 1.30 million 1.26 million 8:30 am Building permits June 1.39 million 1.39 million 10:00 am Consumer sentiment (prelim) July 62.0 60.7

Share this post