Authored by Bai Xiaojun and Vincent Lanci

Backdrop: Big Picture Trends and Silver

From a high level we know there are secular trends gripping global markets and industry. Here are some of those trends

Commodity Collateral shortages- East to west1

Technology Embargoes- West to east

Supply-Chain Restructuring- Brics and G7

Complexity collapse/ Deglobalization- Globally

Monetary Multipolarity- Globally but agressively by BRICS

Net-Zero Energy Transition- Globally but by G7 aggressively

These backdrop issues serve to exacerbate the emerging problem surrounding our global Silver Supply/Demand imbalances.

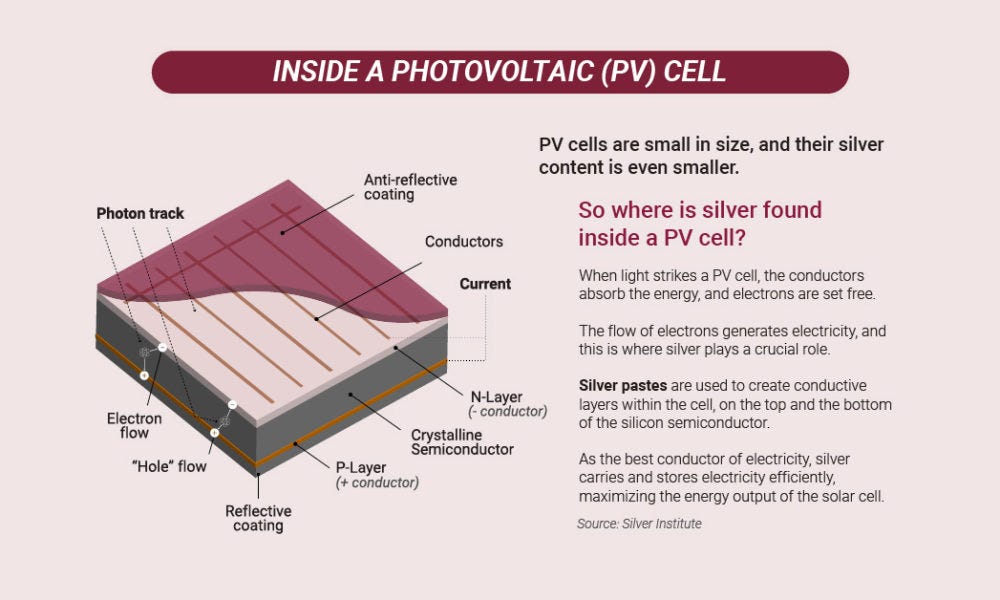

Therefore, a healthy examination of China's Photovoltaic (Solar) industry can give insight into how these emerging trends are manifesting in Silver itself.

Sections:

Purpose

China’s Solar Silver Supply-Chain

What is the Silver Value-Chain?

Value-Chain (Sweet Spot) Analysis

What Else the Value Chain Says

SOLAR CELLS> SOLAR PANELS

PASTE>

POWDER>

Bottom Line: China Not Likely an Exporter

Addendum: Not Enough Supply, Too Much Demand

About the Authors

Original PDFs

1- Purpose

Having gotten somewhat of a handle on Silver supply, the purpose of this piece is to break down China’s Solar Supply-Chain to better understand where demand trends. In doing so we will also answer a question surrounding trends in China’s import/export matrix. Part 1 was entitled Not All Silver is the Same.

2- China’s Solar Silver Supply Chain

Silver is pulled out of the ground. It gets refined. It gets put into solar panels. The panels get installed. This is the supply chain.

Greatly Simplified, this is China’s Photovoltaic Silver Supply-Chain:

Mining>Refining>Solar Panel Creation> Panel installation

In our previous piece we discussed the mining portion of the Supply-Chain above. That helped us understand industrial supply issues. To summarize it here: based on proven reserves at current consumption rates due to net-zero energy applications, Silver will be in short supply in as little as 5 years.

In terms of Supply-chain analysis , that covers the “Mining” section in the above flow.

This piece will be about the portion of the supply-chain schematic above between Mining and installation. This is where Silver gets fabricated into Solar panels and is referred to commonly as the Value-added section of the chain or Value-chain.

The value-added parts of this supply chain (as in most chains) are the middle parts in CAPS below

Mining>REFINING>SOLAR PANEL CREATION> Panel installation

Here are all those sections broken out in more detail…

3- What is the Silver Value-Chain?

We can differentiate between Supply-Chain and Value-Chain this way:

The main difference between a value chain and a supply chain is that the supply chain deals with building the product and getting it to the consumer, while the value chain looks for ways to enhance the product's value as it moves along that supply chain.

Value chains are sufficiently complex enough to get their own focus. But it is helpful to understand that in general, as Bai reminded us, save for the assembly of panels, almost the whole supply chain in Silver is the refinement process. Value-Chains are that part of the supply chain that add value to the raw material to be made into a product. There can be services and other abstract logistics as well. But for our purposes in discussing Silver, refinement and final assembly are the Silver value-chain.

4- Value-Chain (Sweet Spot) Analysis

Refining>Powder>Paste >Solar Cell>Solar Panel

China seemingly dominates most of the value-added section of their domestic production value chain ( “vertical integration” applies here) with one exception.

For that one exception we shall see China has taken measures (for now) to make that part of the chain as reliably secure as possible through inter-dependency. We will come back to that exception in a bit.

The subtitle uses the word sweet-spot because the value-added section has the highest profits as a function of needing the most technological expertise. It is where human ingenuity does its best work and where the most money is made. Humans add the value here.

Their Solar value-chain dominance should dispel western illusions that China is lacking in high-end technology skills for production.

As we go backwards (travel upstream in the value-chain section) from finished product back to raw material we can get a better feel for several aspects of Silver use.

5- What Else the Value Chain Says

The value chain also tells a story about industrial progress in China. Simply put: whereas China manufacturing once was relegated to the non-value portions of many supply chains, we now see not only that they dominate some value added portions, but it reveals a timeline of their progress getting there.

By examining various points we can see the amount of metal used, the cost inputs, and the marketshare in that process2. We can also get an evolutionary view of how Chinese industry has grown into providing much if not all of the added value in the finished goods it now sells to the west.

Here is the value-added portion of that supply chain again

Refining>Powder>Paste >Solar Cell>Solar Panel

We will start on the right of this flow chart above and work our way left now.

6- SOLAR CELLS> SOLAR PANELS

Working backwards (upstream) we start at Solar Panels and Solar Cells. According to Bai, China accounts for a large part of this value-added piece.

China is the world's largest manufacturer of photovoltaic panels [Solar Panels] and modules [Cells], with a global market share of 70%; 90% of China's photovoltaic panels and module products are exported to European and American countries.

This is pretty straight forward. China makes the solar cells and subsequent panels that get shipped overseas. The main takeaway here is, China has all but absorbed this part of the chain into its industrial base.

7- PASTE>

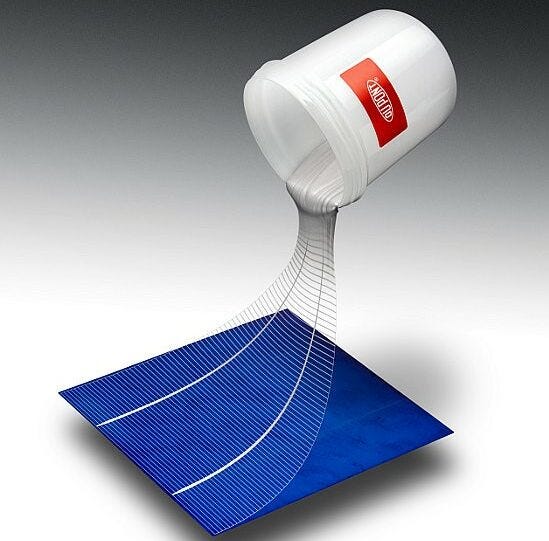

Working upstream from there towards the Paste section, we see China’s presence in Paste manufacture is also massive. The detail by Bai here (pdf at bottom) is impressive. But for summary purposes: Silver Paste is very expensive. Photovoltaic silver paste is the second largest cost and key material for photovoltaic panels, accounting for approximately 10% of the total cost.

In 2010, China did not have the production capacity for silver paste and relied entirely on imports. By 2021, China had already produced 1934 tons of high-temperature silver paste annually, basically achieving self-sufficiency…

Again, we see value-added dominance growing in a portion of the chain traditionally not even Chinese 10 years ago.

China still is somewhat dependent on imports for some of the paste it uses, but it is moving to become entirely self-sufficient in this area using multiple approaches.

Foreign manufacturers like DuPont are relocating there. Organic growth is also happening. As it stands now, China operates 5 of the 10 largest Silver paste facilities in the world. If current plans bear fruit, within 5 years China will be the world’s largest manufacturer of Silver paste and be 100% self-satisfying in its own demand. If successful, they will have vertically integrated most of the value-added part of the supply chain for Solar power.

Before we go upstream one more time to the Powder section here again is the detailed supply chain for Solar Silver broken out as Bai listed it.

①Silver Mining → ② Silver Refining → ③ Silver Powder (High Purity Silver Powder) → ④ Photovoltaic Silver Paste (High Temperature Silver Paste and Low Temperature Silver Paste) → ⑤ Photovoltaic Panels → ⑥ Photovoltaic Modules → ⑦ Photovoltaic Power Stations

China dominates every part of the value chain except that can be dominated except Installation which is overseas, and Powder which we will get to next.

The takeaway for Paste is, China has almost completely removed reliance on outside sources on this part of the chain and is moving to secure the remaining piece of the Paste puzzle. That leaves Powder.

8- POWDER>

Powder is the weak link in China’s vertically integrated supply chain so to speak.

Bai notes:

China currently does not have the production capacity for this product and relies entirely on imports. The products mainly come from Japan's DOWA Hi-Tech, accounting for 91.48%, while the rest come from the U.S at 6.81%.

But it is here that we also see China’s progress and foresight in planning for contingencies.

Let’s assume for the moment that China is unable or unwilling to break into the Powder part of the supply chain. As substitute, they have fostered a symbiotic relationship with their main powder supplier to minimize dependency risk.

Meaning: Japan makes Silver Powder but does not mine significant Silver. China, on the other hand mines Silver and does not make powder. China therefore sells Japan silver which in turn is processed into powder and sold back to China. They are each others customers.

Geopolitical tensions being what they are, this could change rather quickly, but for now, it remains in place solidly. We are closely watching for policy announcements that may affect this relationship going forward.

There is also normal business risk in being so dependent on one supplier in general for sure. But given where they were 10 years ago, and where they have progressed to in such a short time in this emerging industry; it is hard to believe China is not working on lessening this potential problem as well.

To summarize; China has no self-sufficiency in this part of the supply chain yet. But that is not from neglect. Their behavioral pattern in every other section of chain thus far is: they secure a section of the supply chain first. Then they move into another section.

They haven’t gotten Powder yet and will likely set focus on it after they are finished with the Paste integration. That is not to say it is an easy task. Just that they seem to have thought this through.

9- Bottom Line: China Not Likely an Exporter

In aggregate, Bai notes that as complex as the Photovoltaic Silver Supply Chain is, it is still essentially Silver being progressively refined from raw material to end product in low waste/ high correlation fashion. This makes his confidence in the demand calculations done very high.

Returning to the question of China as potentially becoming a net exporter of Silver from that BOA analysis; Bai believes that based on his calculations (see the report below) and the growth rate of value-added supply chain Solar manufacturing within China, it seems very unlikely that Silver mined in China, whatever there is left of it, is going to net be sold abroad when their domestic demand for Silver is exploding.

In 2017 while doing China PBOC gold analysis we discovered this:

95% of all gold imported into China since 2000 has remained in China.

Gold is not allowed to be exported without the PBOC's consent, merely being traded form one "bank" to another without ever really leaving the SGE vault. Source

We do not think China is slinging silver back and forth like some day trader either.

Paraphrasing Bai again: China produces approximately 4800 tons of refined silver annually, of which 2800 tons are provided by Chinese silver miners. According to public data, China's annual net export of silver ingots is about 1300 tons. Most of that goes to Japan and then made into paste for China).

Using that information the amount of silver used and needed with the growing demand. And according to his calculations, there may not be enough Silver in a few years to satisfy current global demand growth.

China's silver reserves of underground resource are drying up at an accelerated rate, and it is likely to be the second country after Mexico that has exhausted its silver resource depletion. If silver mines in one of these two countries is depleted, the world's silver resources will not be able to meet the rapidly growing demands of the photovoltaic industry, EVs industry, as well as AI and flexible electronics industries.

If that happens, two things will follow. First is exploding price. Second is a halt to the industries dependent on the metal for Net-Zero energy transition.

There are mitigating factors to this. Improvements in technology will continue to allow for thinner applications of the metal. The above ground supply of Silver scrap is also deceptively big and “clunky” in our experience. That scrap does not generally trickle out continuously. Historically it comes out when a price is hit making Silver recovery economically viable. Then afterwards, nothing is available until he next economic price level is breached.

One should assume that bullion banks such as JPMorgan have identified major scrap sources and will tap them at various price points.

However, given the ambitious global plans for de-carbonization, the ability of these factors to offset the growing demand and the seemingly diminishing supply seems stretched.

We will face two dilemmas: firstly, silver prices are out of control, reaching four digits or higher; Secondly, the runaway price of silver seriously hinders demand in emerging industries, as humans cannot find silver substitutes within 20 years.

10- Addendum: Not Enough Supply too Much Demand

An emerging crisis may be manifesting in the front part of the supply chain (Mining>some Refining) involving procurement of raw materials due to: decreasing mine yields, fragmenting global trade from nationalization/mercantilism trends, and growing competitive demand.

Meanwhile as China grows its influence on the Value-added portion of the supply chain, investors should assume more global drainage of above ground silver leading right to their domestic manufacturing facilities.

Much more in attached PDFs below

11- About the Authors

About Bai Xiaojun: Bai is a respected entrepreneur and industrialist in China with over 50 years experience in precious metals and related fields including industrial applications of Silver. As such, Bai is a trusted, acknowledged advisor within China’s burgeoning PV industry in addition to his precious metals acumen

About Vincent Lanci: Vincent has over 30 years experience successfully trading and modelling Energy and Precious Metals physical commodities and their derivatives for institutions and his own Firm. He manages institutional fund money and is a Professor of MBA Finance at University teaching Commodity and Derivative risk Management courses.

Previous collaborations

PDFs for Premium Subscribers