Gold: If you are pressed for time and want to hear the good New insights on metals::

Gold 8:09 to 25:18

Silver: 25:34 to 32:44

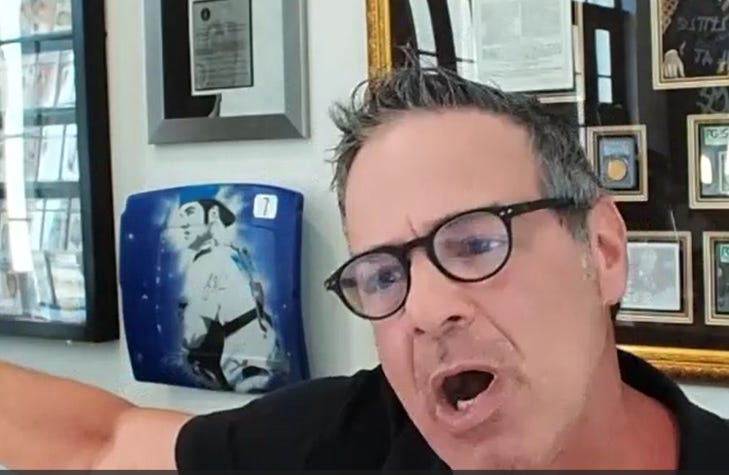

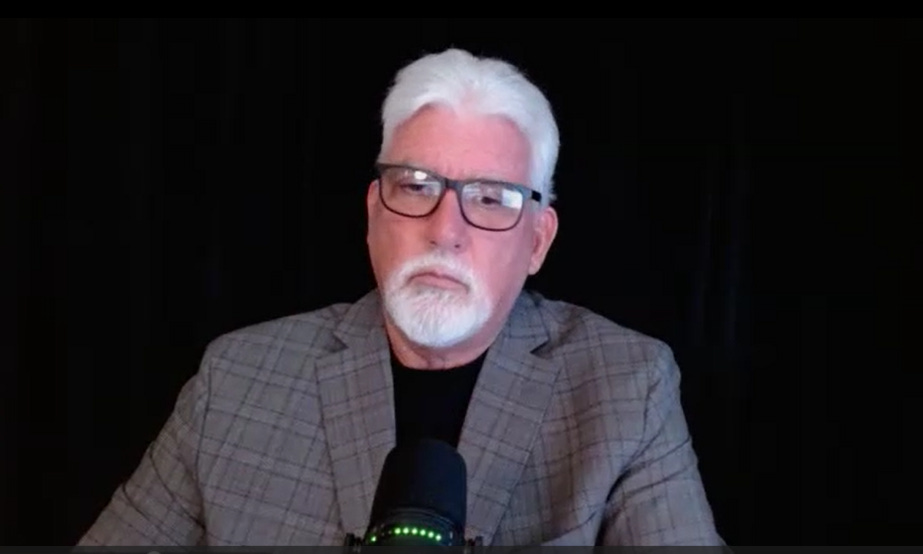

Today Peter Grandich interviewed Andy, Greg, and Vincent for his “Dream Team” segment. Peter’s video for this will be out today at 4p.m. We asked Peter for an advance audio to share with GoldFix Premium. It was that good. Here it is with transcript.

Peter asks each participant 4 questions. Those questions and topics:

Gold and The China Whale that hurt JP Morgan

Silver price and behavior in this BRICS environment

Peter on market complacency and Vix as a risk proxy

US politics’ and Geopolitics’ effects on markets

One year hence, what will the financial markets realize they got right and wrong?

**Unfortunately the audio has to be behind the paywall since Peter’s post is not public yet. We will unlock it in a week after Peter’s has gotten proper airplay. **

About Question 1

We would excitedly recommend Both Andy and Greg’s responses to the first question on Gold. After Vincent answers Peter’s question about the China versus JPMorgan Gold play, Peter expertly moderates an extraordinary give-and-take of insights between the participants.

First, Andy essentially ties together in a neat bow the events of the last 2 years covering the BRICS behavior, Gold repatriation, commodity issues and much more. We’ve discussed almost every one of these events as they unfolded to some extent, *but* this is the best integration of them we’ve heard yet. Truly.

Greg, who, while having a deep knowledge of markets also has a lot more exposure to the “normie” world— then describes how under-aware everyone is to these things. He then points to global currency debasements to Gold of which most seem oblivious to. The list of devaluations he enumerates is kind of breathtaking.

Vincent then adds something not spoken publicly before ( it is the rationale for believing the BRICS currencies will seek partial Gold backing), with regard to the BRICS use of Gold in their UNIT basket.

He describes (using game theory) why the BRICS members will keep buying gold until they can insert their own currencies in the UNIT basket.

Bottom line: Not only are they using 40% Gold in the UNIT, they will also most likely at least partially back the other 60% FIat in the UNIT with some Gold exposure.

Andy finally adds more color on the topic worth listening to before Peter ties it together and corrals us to the next question which is on Silver

Truly it was the best give and take conversation on Gold and Silver have been a part of in years.

In Question 2 Andy gives some impassioned commentary on where the country is and where it is going as a society while Greg discusses the complacency to the things Andy has brought up

For Question 3 Peter asks some predictive questions on markets which we all answer

The whole discussion is excellent and the transcription is attached.