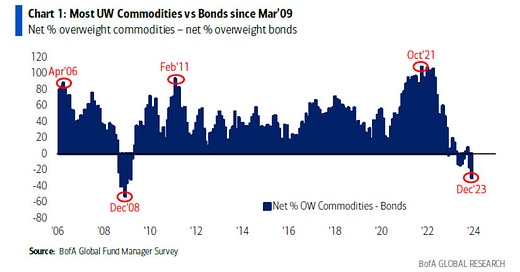

[When] the biggest consensus trade on Wall Street is to be long bonds, the corollary is the biggest consensus pair trade is to be long bonds and short commodities.

Thus, one way to trade ahead of this coming painful unwind …is a pair trade between rates (short) and commodities (long)

Comment: When ZH writes like this in conjunction with factually doing the work on US Bond issuance (they have) these last few months.. it’s not hype. The timing may be in question tactically as noted in the Albert Edwards companion piece just put out, but the bias is solid. Why?

The Hartnett analysis attached cements three independent theses all leading to dollar debasement:

ZH believes bonds will be weaker from increased supply (fiscal spending)

Our opinion that decreased demand (BRIC Dedollarization) will make a strongdollar an uphill battle

Zoltan’s cryptic comment that QE will in fact return in the form of YCC in 2024

“We are in the Anteroom of YCC, and therefore Financial repression.1

So far, manifestation of the dollar dump has been partly offset by Fed rate-hikes sopping up of global excess liquidity.

When that actually stops (as early as Q1 2024 as late as Q4 2024) Bonds could crash as the reality of prolonged fiscal spending and decreased global demand (Anti-Goldilocks stuff) reassert.

In that event, The Fed will be forced to use YCC to rescue bonds which will in turn transmit the pain to the short end of the bond curve, thus weakening the dollar.

All resulting in dollar debasement.

IF that happens monetary Inflation returns and will be stealthily tolerated to save stonks. Who knows; Powell may be long gone by then

Which is why one owns Gold. Hartnett report attached.

Caveat: No Gold recommendation in this one.. yet.