Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today

Discussion: Gold Caught in the Middle, NVDA Crash

Premium: NVDA Crash

Discussion:

Gold Caught in the Middle

A Chat with a friend

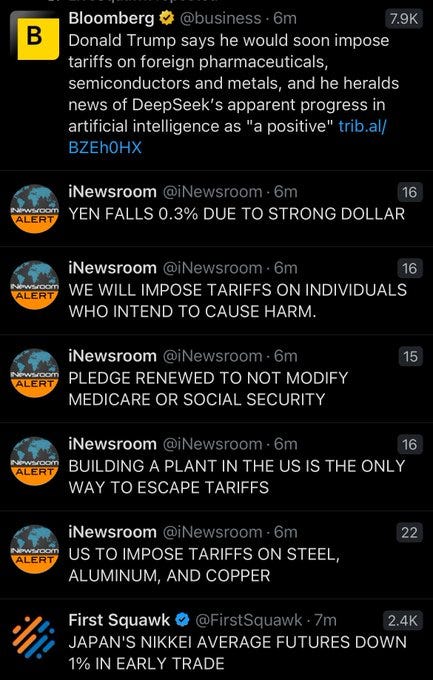

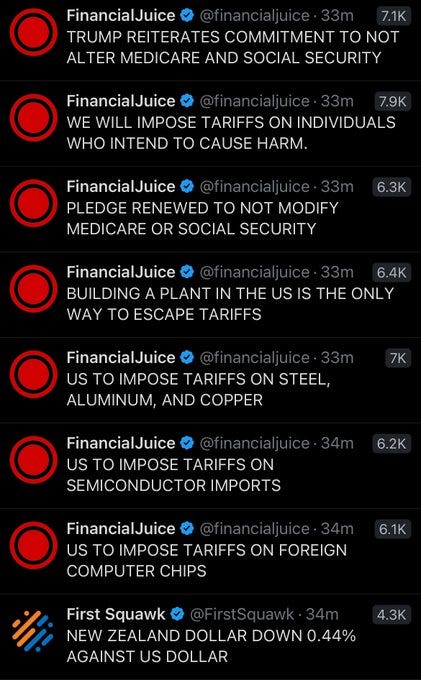

Barrage of public statements.

Trump Sends a Message

I’m a patriot, but all the stuff doesn’t seem like it was done out of strength. Wouldn’t the dollar be a lot higher otherwise? Stomping on markets that reflect poorly on the US like gold and buying a dip in Nvidia is one thing A ban on foreign chips will probably help Nvidia as well. But nobody wins in these when equal economic powers go head on. It’s only who survives best.

Source: VBL Global Headline News

For Access to 24 hour global real time News Feed Headlines form Reuters, Bloomberg, DJI, adn others FREE save this link

NVDA Crash

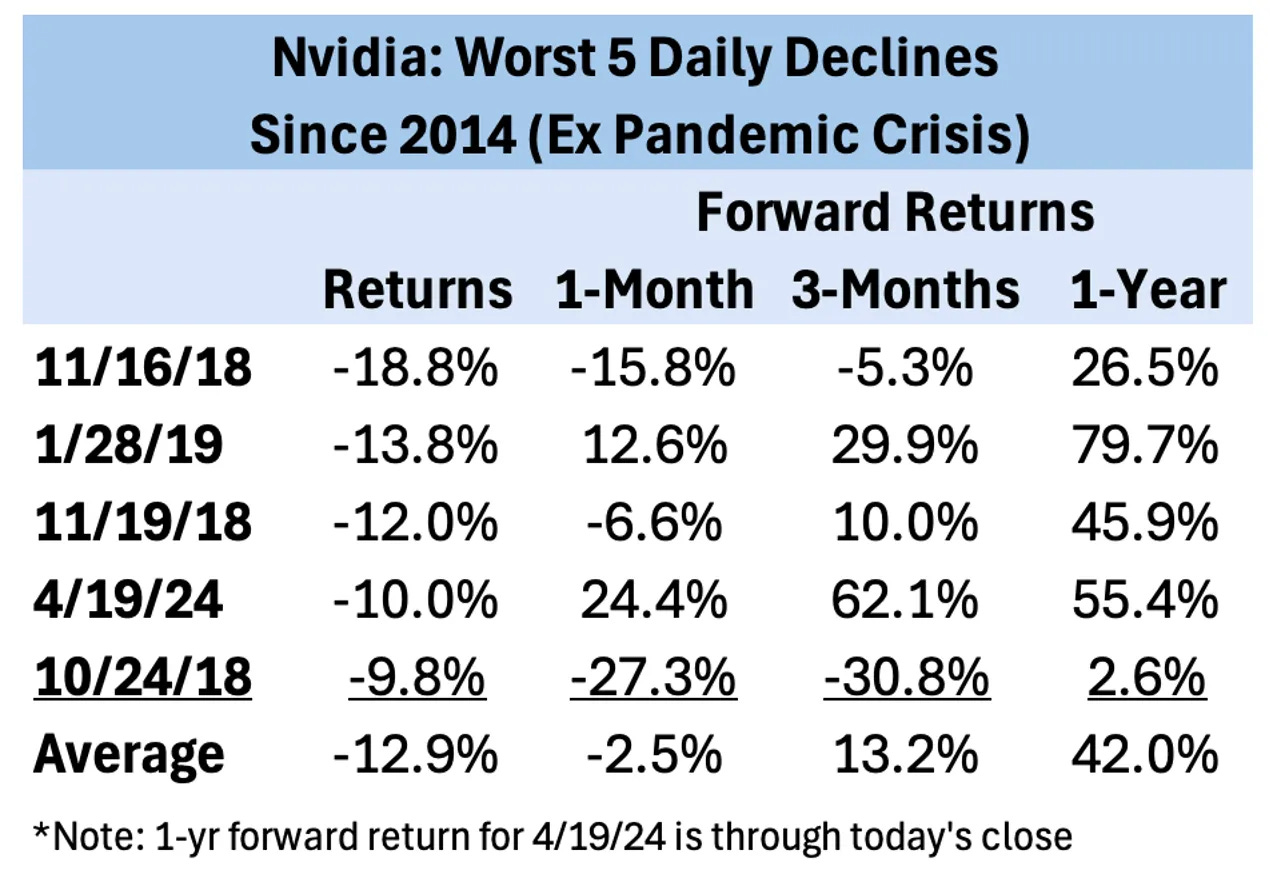

#1: Today was Nvidia’s third worst daily decline since 2014 (i.e., since the start of the US Big Tech’s slow-motion takeover of the S&P 500), so let’s put that move in historical context. Here’s a table of NVDA’s 5 worst daily declines since 2014:

1: Here’s why Nvidia swooned on its worst days since 2014:

October 24th, 2018 (-9.8 pct): NVDA fell along with other Tech shares due to concerns about corporate earnings. Markets were also worried about a slowing economy due to rising rates.

November 16th and 19th, 2018 (-18.8 and -12.0 pct, sequential losses on a Friday and following Monday): NVDA missed analyst’s expectations for Q3 2019 revenue. It also reported weak guidance for Q4 amid surplus inventories.

January 28th, 2019 (-13.8 pct): NVDA cut Q4 revenue guidance sharply due to “deteriorating macroeconomic conditions, particularly in China”.

April 19, 2024 (-10.0 pct): Super Micro Computer, one of the vendors that build Nvidia-based servers, declined to give its usual preliminary financial results and said it would report earnings later that month.

Price performance post crashes

History shows a mixed picture as to how Nvidia might perform over the near-term (next 1- 3 months), No analysis gives us comfort

What to Watch for

Pay close attention to client earnings calls later this week (Microsoft and Meta both report on Wednesday).

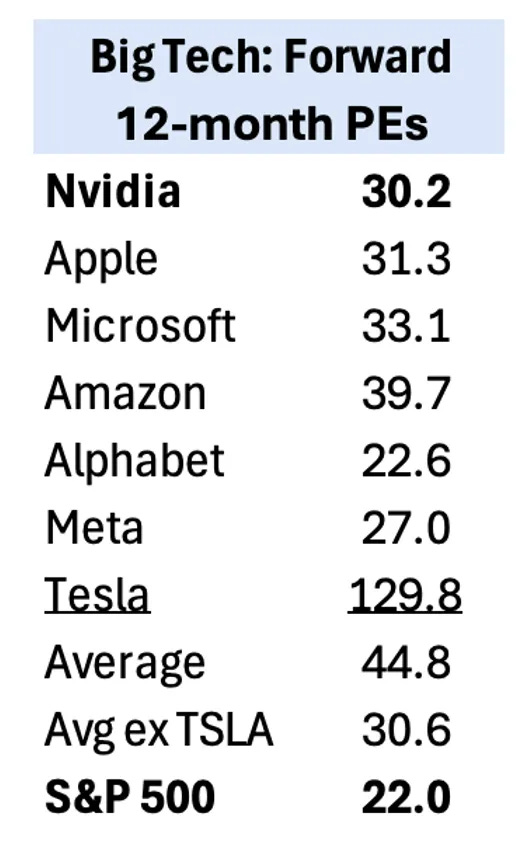

Comps

Nvidia’s valuation is average relative to its Big Tech peers when excluding Tesla’s outlier multiple.NVDA is still a full 8 points rich to the S&P, not leaving it much room for unexpected shocks, as today’s price action showed.

NVDA’s worst daily declines were due to concerns about weakening fundamentals, much like today’s sudden concerns related to future demand. The company’s next earnings report is not until February 26th

Nvidia’s decline was 13 percentage points worse than the next largest Big Tech laggard (Alphabet -4.0 pct).

Nvidia now has the third lowest valuation of the 7 Big Tech stocks, but it’s still quite rich to the S&P 500 overall.

As for the Claims gripping the social media crowds

DeepSeek is not innovative any more than ChatGPT is. it may not beless expensive to make. But it is going to bludgeon American companies ( VC and the like) that have invested so much money in thinking prices for AI access will not drop

News/Analysis:

Markets Recap:

US equities fell sharply on Monday after Chinese startup DeepSeek's free open-source large language model spurred concerns about Big Tech's investments in AI. Large caps lagged small caps: S&P 500 (-1.46%) vs. Russell 2000 (-1.03%). MSCI Emerging Markets (EEM) dropped 1.82% and MSCI EAFE (EFA) was flat.

Market News:

"DeepSeek, the viral AI company, has released a new set of multimodal AI models that it claims can outperform OpenAI’s DALL-E 3. The models, which are available for download from the AI dev platform Hugging Face, are part of a new model family that DeepSeek is calling Janus-Pro... DeepSeek, a Chinese AI lab funded largely by the quantitative trading firm High-Flyer Capital Management, broke into the mainstream consciousness this week after its chatbot app rose to the top of the Apple App Store charts." Source: TechCrunch

"Nvidia shares plunged 17% on Monday, resulting in a market cap loss of close to $600 billion, the biggest drop ever for a U.S. company. The sell-off, which hit much of the U.S. tech sector, was sparked by concerns about increased competition from Chinese AI lab DeepSeek. Data center companies that rely on Nvidia chips also plummeted, with Dell, Oracle and Super Micro Computer all falling by at least 8.7%." Source: CNBC

"The US Senate confirmed Scott Bessent as the next secretary of the Treasury, becoming the chief economic spokesman for President Donald Trump and his sweeping agenda of tax cuts, deregulation and trade rebalancing."

Geopolitics/ Politics

US Secretary of State Rubio had a call with Jordan's King Abdullah and discussed the implementation of a ceasefire in Gaza, the release of hostages and a pathway for stability in the region.

"Iranian foreign minister told Sky News: If Iran's nuclear facilities are attacked, it will be answered "immediately and decisively"", according to Sky News Arabia.

"Hamas: Mediators have begun the process of taking the pulse of the two sides to start the second phase of the agreement", according to Al Arabiya.

US President Trump to sign an order to begin the process of creating the next generation of missile defence, while the order will call for the creation of an 'Iron Dome' for the US.

UK Foreign Secretary Lammy and US Secretary of State Rubio spoke on the phone and said the UK and US will work together in alignment to address the situation in the Middle East, Russia’s war in Ukraine and challenges posed by China.

via Newssquawk

Data on Deck: Unemployment Rate

MONDAY, JAN. 27

10:00 am New home sales Dec. 671,000 664,000

TUESDAY, JAN. 28

8:30 am Durable-goods orders Dec. 0.7% -1.1%

WEDNESDAY, JAN. 29

2:00 pm FOMC interest-rate decision

THURSDAY, JAN. 30

8:30 am GDP Q1 2.5% 3.1%

FRIDAY, JAN. 31

8:30 am PCE index] Dec. 0.3% 0.1%1

Final Market Check