Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today

Discussion: CITI Calls for $3400, Tariffs, GLD, and Hartnett

Premium: CITI , Hartnett, Tariffs, Bullion Panic

Discussion:

Metal Matters: Why gold’s bull market is based on physical fundamentals and is set to continue

“Our forecasts for investment and industrial demand as a share of mine supply, using historical relationship between the share and gold price changes, point to $3,400/oz prices by 4Q’25, while we take a more conservative base case”

Table of Contents in The Analysis

Setting the Table: More Upside is Coming

As of two days ago, with Citi (and UBS) raising their targets, every major bullion bank has now raised its short term price target to $3,000 now. Two of them, BOA (and today) Citi have raised their soft targets even higher to $3333 and $3400 respectively.

The team of analysts, lead by Kenny Hu, and Max Layton both CFAs describe not just the reasons for their belief, but give a glimpse of the logic and data giving good reason for the beliefs

CITI’s Reasons Simplified:

Central banks are buying at record levels, investment demand is absorbing nearly all new supply, and concerns over de-dollarization are keeping gold in focus. The report outlines why these trends are likely to continue while also highlighting potential risks from trade policy, interest rates, and economic shifts.

While breaking it down, GoldFix found 4 main evidentiary factors embedded in the bank’s deep-dive.

The Bank describes in much more detail their rationale than most other banks, and in doing so give show the data to prove their points. We’d have to say, this is excellent report— excellent in that it raises the bar for every other bullion bank to either catch up or fall behind.

Full Analysis …

GLD Shares Get Squeezed as Free Bullion Window closes

Bob Coleman and Ronan Manly have noted GLD Shares have become ridiculously hard to borrow for shorting.

Historically, going back to the SLV debacle in 2011, this is believed to indicate that GLD custodians have now started to protect their bullion from raids as shortsellers will use borrowed shares to extract GLD bullion for other purposes… making GLD essentially a source of Bullion leasing.

This indicates panic in London as a decades long crowded trade of borrowing and waiting for some miner to hit the bid for them comes to an end

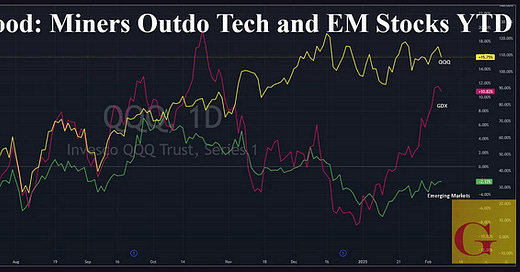

Hartnett Says Buy the Miners without saying it

If Hartnett likes EMs and Int’l stocks in general, while loving gold, he should be bullish miners soon. We think he already is and describe why.

Michael Hartnett has noted in previous reports when 'Leadership changes between Gold and Tech, that will be a very bullish sign for Gold due to recessionary fears, weaker USD needed, and tech bubble shrinking.

Full Analysis

News/Analysis:

Markets Recap:

US equities retreated on Friday amid concerns about tariffs and inflation. Large caps bested small caps: S&P 500 (-0.95%) vs. Russell 2000 (-1.19%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) fell 0.09% and 0.95% respectively.

Market News: Trump Tariffs & DeepSeek Dump

“Donald Trump said he would on Monday impose 25 per cent tariffs on steel and aluminum imports, expanding his trade conflicts to the metals sector in a new burst of protectionism from Washington. The US president made the announcement during a briefing with reporters as he flew from his Mar-a-Lago estate in Florida to attend the Super Bowl in New Orleans on Sunday evening. In addition to the measures on steel and aluminum products, Trump said he would later in the week unveil new reciprocal tariffs targeting imports from a wide range of countries that impose levies on US exports.” Source: FT

“Big Tech’s massive spending on artificial intelligence is set to continue unchecked in 2025 after Amazon topped its rivals with a planned $100bn-plus investment in infrastructure this year. FT

“Deepseek’s AI model “is probably the best work” out of China, Demis Hassabis, the CEO of Google DeepMind said on Sunday CNBC

“SoftBank is close to finalizing a $40 billion primary investment in OpenAI at a $260 billion pre-money valuation, sources told CNBC’s David Faber. CNBC

Geopolitics/ Politics

"Negotiations for the second phase of the Gaza agreement have not started and Netanyahu has broken their date due to his visit to the United States", according to Sky News Arabia citing Hamas leader. "Hamas leader Musa Abu Marzouq told Sky News Arabia: We expect that the negotiations will proceed and take their normal course".

Iranian Defense Minister said "It is not possible to reach an agreement with the current US government on the nuclear agreement", via Sky News Arabia.

Israeli PM Netanyahu dispatched a delegation to Qatar’s Doha for the next phase of ceasefire talks

US President Trump said on Friday that he has spoken to Russian President Putin by phone regarding ending the Ukraine war, according to the New York Post.

US President Trump said he does not want to talk about his conversation with Russian President Putin but believes they are making progress and expects to have more conversations with Putin. Furthermore, Trump declined to say when they talked and noted that he would meet with Putin in person at the right time, according to Reuters.

Russia’s Kremlin said it can neither confirm nor deny publications regarding the Putin-Trump conversation, while Russia’s envoy to the UN said Russia awaits appropriate signals from the US regarding contacts with Moscow and that Russia has not yet seen positive steps from the new US administration on disarmament, according to RIA.

via Newssquawk

Data on Deck: Powell, CPI, PPI

MONDAY, FEB. 10 None scheduled

TUESDAY, FEB. 116 Jerome Powell testifies to Congress

WEDNESDAY, FEB. 12 CPI and Powell Testifies day 2

THURSDAY, FEB. 13 Producer price index

FRIDAY, FEB. 14 Retail sales 1

Final Market Check

Premium:

See discussion section