Good morning.

What is this?

This is an extemporaneous podcast preview on the title topic made specifically for the Founders group in preparation for an in depth Premium analysis later this weekend.

Why now?

Given the events of the past year marking China’s progress in internationalizing gold ownership, as well as their own currency, it’s a good thing to look at what they have done to underpin their goals. And indeed they have done a lot.

This is a breakdown of their goals for gold, their progress towards that goal, and the risks along the way.

As such we will be doing a weekend write up of what China has done and what they will do to ensure success in the rollout of what we call euphemistically “China is taking gold public“.

Call this piece a nuanced preview of the written premium piece coming this weekend. (Please excuse ambient noise and occasional throat clearing.)

Topics discussed

1. Eastward Shift of Gold Demand and Supply Chain

Start: ~00:00

The discussion begins by establishing the decade-long migration of the gold supply chain from West to East, notably starting around 2013 when Western banks opened vaults in Singapore. The core point: “Demand dictates location of pricing power.” Gold is increasingly bought, stored, and refined in the East.

2. The Structure of a Supply Chain (Gold and Silver Examples)

Start: ~03:00

A functional breakdown of the full supply chain is given for both gold and silver, emphasizing how each commodity moves from extraction to end-user delivery. Key insight: gold is both input and final product, unlike silver.

3. Rise of Non-Dollar Pricing and Payment Chain Shift

Start: ~06:30

Explains how the final phase of the Eastward shift is the payment chain, meaning gold must no longer be priced in dollars. China and BRICS want gold denominated in yuan (CNY) to suit regional buyers.

4. Symbiotic Relationship Between Gold and Yuan

Start: ~08:00

China’s monetary policy around gold is likened to the post-WWII U.S. dollar-gold system. The country is using gold convertibility to boost yuan credibility and usage in satellite economies.

5. China’s Infrastructure vs. Rising Demand

Start: ~10:30

China demand may be outpacing infrastructure, though China’s planning has helped. Gold’s unique properties (durability, non-consumption) make it easier to structure.

6. China’s Gold Market Structure Evolution

Start: ~12:00

Introduction of four or five key areas China is focused on in transforming its domestic gold market:

• Production shortfalls

• Investor demand > jewelry demand

• Import logistics

• Market structure via exchanges

• PBOC reserve strategy

7. Production Decline and Import Strategy

Start: ~13:30

China’s domestic gold production is falling relative to its demand. The country must import more refined product, primarily from Switzerland, Canada, Hong Kong, South Africa, and Australia, with PBOC controlling bank quotas.

8. Shift from Jewelry to Investment Demand

Start: ~15:00

Investor interest in gold has overtaken jewelry. China introduced ETFs and small-bar availability to accommodate this, creating a more fluid but hotter money flow into gold.

9. Shanghai Premium Arbitrage & FX Constraints

Start: ~17:00

When Shanghai gold trades at a large premium to London, arbitrage kicks in—but due to mercantilism triggering financial fragmentation, only physical delivery can close that gap now. Yuan weakness presents challenges, but China uses SGE International as a workaround.

10. China’s Dual Gold Market Access: Domestic and Global

Start: ~19:00

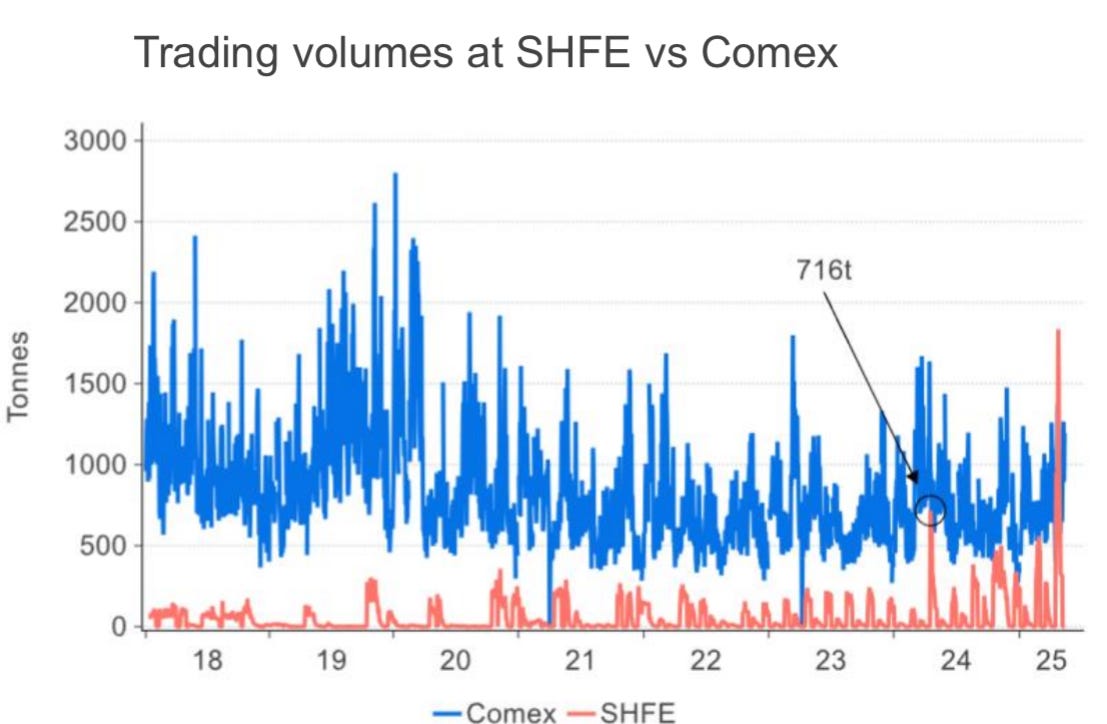

China has bifurcated access:

• SGE and SHFE for local investors

• SGE International for BRICS and foreign participants

Chinese banks actively promote physical gold to retail, unlike the U.S., where contracts are too large and inaccessible.

11. PBOC’s Gold Accumulation Strategy

Start: ~22:00

While officially holding less than 7% of reserves in gold, the PBOC is gradually increasing gold holdings publicly and privately, carefully managing perception to support global trust in China’s monetary intentions.

12. Strategic Transparency and Global Integration

Start: ~24:30

China is using gold purchases to meet international standards (e.g., SDR inclusion), but won’t shock markets by declaring large holdings all at once. Transparency is strategic and political, not accidental.

13. Summary of Key Focus Areas for Upcoming Coverage

• Production decline and import need

• Investor demand overtaking jewelry

• Yuan-sensitivity of the domestic market

• Market structure: SGE, SHFE, SGEI

• PBOC’s allocation strategy and global positioning

China is poised to become the global gold trading hub.