Housekeeping: Good Morning.

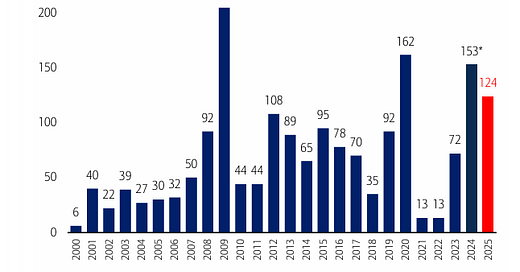

“The Gold reset is a process, not an event”

Today

Discussion: American Exceptionalism Crossroads

We forecast outperformance of Bonds, International stocks and Gold in 2025 vs US exceptionalism consensus.

-Hartnett

1- Hartnett: US Exceptionalism End is Near?

This week..Michael Hartnett’s report offers two broad choices as market drivers from here regarding Trump’s Tariffs

Tariffs reignite US inflation

Tariffs and their like instigate ROW recession

Michael Oliver paints a technical picture resembling Hartnett’s second scenario

2- Oliver: Stocks, Bonds, Will be The Early Tells for Gold

What he’s looking for in Gold and Silver as they relate to other Markets; which are increasingly sending warning signals to him. Specifically, The U.S. stock market, T-Bonds, and the Dollar Index.

The last two have jolted in the directions we expected, Bonds up/Dollar down, which should indicate two things.

First, a likely coincident but inverse move by the U.S. stocks vs. T-Bonds. Meaning, U.S. stock market to the downside.

And second, the start (for the first time in a long-time) of asset flows out of that bubble and into the only two viable alternatives: T-Bonds (viable as an alternative to stocks, but only for a while) and monetary metals.

TAKEN TOGETHER…

Taken together, Oliver’s scenario coincides with Hartnett’s situation where the ROW fails to stay out of recession, and in doing so, takes US stocks down, US Bonds up, and Gold up as the Fed must get even more aggressive fighting recession.

Oliver Again:

So what the stock market does in the coming days and weeks could well indicate the start of that major shift. Watching gold is important, but be fully aware of what the U.S. stock market is doing in terms of producing the initial breakages hence asset flows out.

With that in mind, here are some levels from Oliver we consider

If close this coming week of February futures at $2711 and consider it a breakout.

Having March silver settle the week above $30.88 should indicate a close out of downside momentum

Settling this week at $31.88 would similarly and credibly clear Michael’s trigger level in Silver

News/Analysis:

Equity Recap:

Holiday…

Market News: TNN is Back

US President-elect Trump demanded that BRICS nations commit to not creating a new currency to challenge the US dollar or they will face 100% tariffs.

Trump Nominates Kash Patel For FBI Director who played a pivotal role in uncovering the 2020 Russia, Russia, Russia Hoax

US President Biden issued a pardon for his son Hunter Biden after repeatedly saying directly and though his press secretary he would not as late as June this year. The pardon absolves him from anything done starting 2014, which is when he took his position at Burisma. Which is also how this Ukraine shit all started

French budget crisis comes to a head. The National Rally indicated in the strongest language yet it could topple the government as soon as this week, hours after the finance minister said his administration wouldn’t be blackmailed.

The US is placing new restrictions on China’s access to vital components for semiconductors and AI, escalating a campaign to contain Beijing’s technological ambitions. Chip stocks slipped in premarket trading.

BlackRock is nearing a deal to acquire HPS Investment Partners for $12 billion or more. A deal would mean BlackRock has clinched the two largest-ever acquisitions of alternative asset managers in less than a year.

HT: NS, BG, ZH

Politics/Geopolitics: Keeping Russia Busy

ME- Keeping Russia busy

Israeli PM Netanyahu told the mother of a hostage that conditions are ready to complete a deal in Gaza after the end of the war in the north, according to Israel's Channel 12

Israeli Foreign Minister said there are signs of progress on a deal with Hamas in light of flexibility that arose after the settlement in Lebanon,

Syrian opposition forces have taken control of much of the country’s second-largest city Aleppo, while rebel forces said all of Idlib province is under rebel control.

Syrian and Russian air forces stepped up strikes on the positions of Syrian rebels and their supply lines with scores reportedly killed and injured, according to TASS citing the Syrian army.

Turkey’s Foreign Minister spoke with US Secretary of State Blinken and discussed Syria, while the Turkish official also discussed Syria with his Iraqi counterpart.

EUR- Keeping Russia Busy

Ukrainian President Zelensky met with EU Council President Costa in Kyiv, while he said a NATO invitation is necessary for survival and that Ukraine will never recognise Russian occupation of its territory.

US State Department said it suspended the strategic partnership with Georgia and regrets Georgia’s decision to suspend EU accession. It was separately reported that Russian Security Council Deputy Chairman Medvedev said an attempted revolution is happening in Georgia and that Georgia is moving along the Ukrainian path into the abyss.

APAC- Taiwan arms deal

China’s Foreign Ministry also lodged stern representations with the US over weapons sales to Taiwan and said it will take resolute countermeasures regarding the arms sale.

Philippines President Marcos said the reported presence of a Russian submarine in the South China Sea is very concerning and any intrusion into the Philippine maritime zone is very worrisome.

Data on Deck: Unemployment

MONDAY, DEC. 2 U.S. manufacturing PMI

TUESDAY, DEC. 3 Auto sales

WEDNESDAY, DEC. 4 ADP employment, PMI

THURSDAY, DEC. 5 Initial jobless claims

FRIDAY, DEC. 6 U.S. employment report

FINAL MARKET CHECK…