Housekeeping: Many will be receiving GoldFix Weekly for the first time. It is different than the dailies. This post is more like a magazine. The content touches many areas of markets. GoldFix complete Watchlist here

Founder’s Class : 2 p.m. SUNDAY Prem recording available Monday.

Index (links go to section)

1. Market Summary

According to ZH the S&P 500 has closed lower to start the year for four of the last six years.

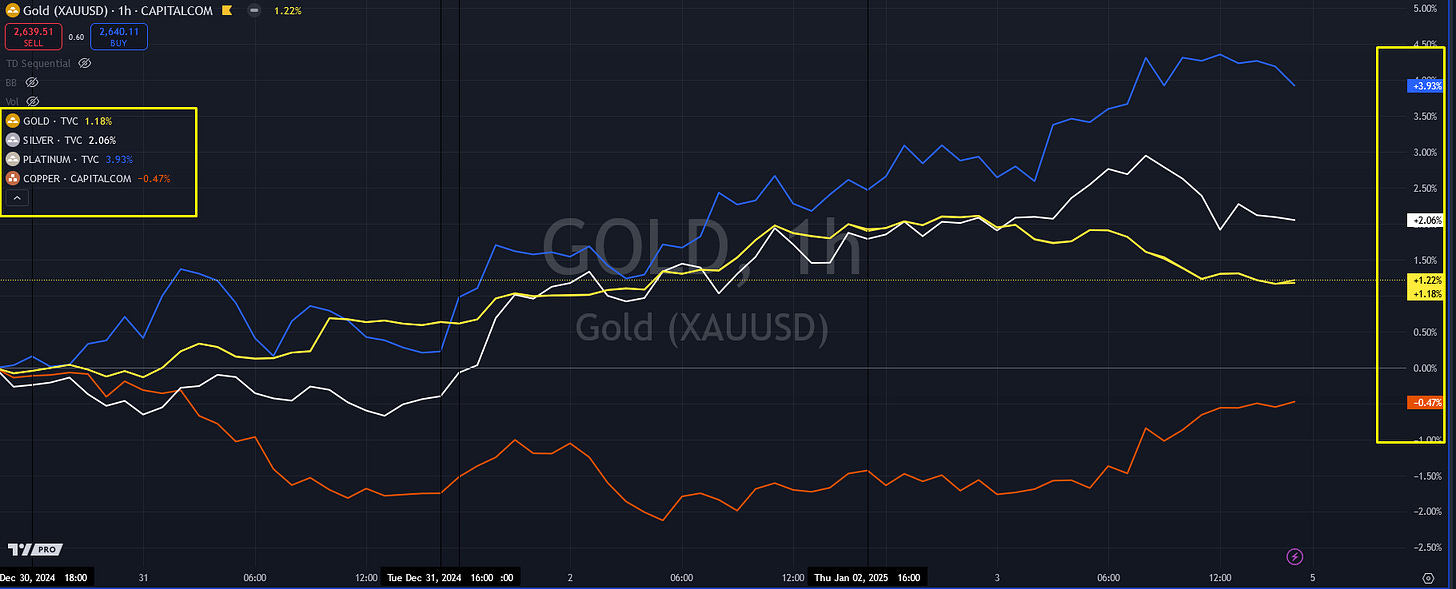

This week Dollar was very strong and most everything ignored that correlation except stocks and Copper. Gold, Silver, Platinum, were up, Oil was up, Bonds were even up. The S&P 500 had another bad week down 3 of its last 4. Friday, however saw it turnaround just as Gold turned lower off its Thursday highs.

Stock weakness can possibly be attributed to several things. There are definitely some Trump-Trade unwinders for starters. Next, China’s stock market softness is spilling over for sure as their own liquidity pulls in reins anticipating Trump Tariffs. Next and possibly on the horizon are US liquidity issues. These would be of the variety we saw during the SVB banking crisis. While that risk is being watched much closer this time, it is not unreasonable to think regional banks will get pummeled again and drag other stock lower with them.

Platinum is Starting to Look Like Silver…

Bonds started the week very strong, almost intending to recover the disaster experienced the previous two weeks. Friday a lot of those gains were given back, but not enough to go net negative.

Last Year’s Performance….

Silver tracked Gold in muted and delayed fashion actually upticking on Friday as Gold softened.

POWELL’S PROBLEM

We are bearish on stocks headed into Trump’s inauguration with no position on yet.1 Why? Aside from the above, one cannot help but think that what Powell did on September 18th ( lower rates 50bps) was timed too nicely for political purposes. He may have had authentic reasons. But the scale was tipped based on his own ideological preferences.

Extrapolating that out. Now Powell worried about inflation again just as Trump enters office. On top of that, Yellen last week, went into a tizzy worrying about the debt ceiling *after* she leaves office.2

Anyway…. Powell may have his reasons to be stingy again, but he’s not a fan of Trump. Most importantly, he wants his legacy repaired; and while inflation remains well above 2%, he still has work to do. His priorities have shifted again

Complete GoldFix Watchlist Here

Stock Sectors

Big tech down 5 of its last 6 days

Energy stocks were the week's biggest gainers (AI and oil plays)

Banks are starting to take on water

Basic Materials (Copper style) and Consumer Discretionary were the biggest losers on the week.

Alcohol producers were slammed Friday after Biden's Surgeon General might put cancer warnings on bottles.

Utilities were split along Nuclear/ AI potential lines

Commodities:

Natural Gas started the week very strong on weather news, but faded almost immediately. This is a topic we touched on. Cold weather is indeed bullish, but buying futures *after* a spike with hopes they will catch up to spot is not a smart game.

Gold and Silver: Gold ignored dollar strength and rallied to its best week since Thanksgiving despite going out weak on Friday. The 50 and 100DMA sandwich are in play. CTAs are selling Silver one again. Look to China for upside surprises next week if any come.

WTI- A big week for crude oil (up 5 days in a row) - breaking out of its recent range.

Bonds:

Dollar: The dollar rallied for a 5th straight week continuing to exhibit “American Excellence”even if stocks are not. (Chart section)

Bonds: Treasury yields were all slightly lower on the week

Crypto:

Big recovery for Bitcoin back to just shy of $100k again. Perhaps the Saylor Bitcoin party had something to do with it. This was the best week for Bitcoin since Thanksgiving

GoldFix Friday WatchList:

Complete Watchlist Here

2. Technical Analysis

3. Popular Posts

GoldFix published over 30 stories last week, here are some of the more popular ones

4. Calendar

Some upcoming key data releases and market events

MONDAY, JAN. 6

9:45 am S&P final U.S. services PMI Dec. -- 58.5

10:00 am Factory orders Nov. -0.3% 0.2%

TUESDAY, JAN. 7

8:00 am Richmond Fed President Tom Barkin speaks

8:30 am U.S. trade deficit Nov. -$78.4B $73.8B

10:00 am ISM services Dec. 53.4% 52.1%

10:00 am Job openings Nov. 7.7 million 7.7 million

WEDNESDAY, JAN. 8

8:15 am ADP employment Dec. 130,000 146,000

2:00 pm Minutes of Fed's December FOMC meeting

3:00 pm Consumer credit Dec. $10.6B $19.2B

THURSDAY, JAN. 9

8:30 am Initial jobless claims Jan. 4 -- 211,000

10:00 am Wholesale inventories Nov. -0.2% 0.2%

FRIDAY, JAN. 10

10:00 am Consumer sentiment (prelim) Jan. 74.0 74.0

8:30 am U.S. employment report Dec. 155,000 227,000

8:30 am U.S. unemployment rate Dec. 4.2% 4.2%

8:30 am U.S. hourly wages Dec. 0.3% 0.4%

8:30 am Hourly wages year over year 4.0% 4.0%

Main Source: MarketWatch