Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

“China and The US have an understanding on Gold”

Today

Discussion: Gold as Indicator of Things to Come in China

Premium: Goldman Economists Answer 10 Questions for 2025

Discussion: Gold as China Indicator

Reserve Requirement Cut Delayed

The PBOC had signaled the possibility of a reserve requirement ratio (RRR) cut by the end of 2024 but opted to defer the move. Analysts now expect this measure, which frees up cash for banks, to occur in the first quarter of 2025. By holding back on a high-profile tool like the RRR cut, China aims to retain its ability to respond to escalating trade tensions or other economic shocks.

Instead, the central bank used reverse repos and government bond purchases to boost liquidity, a move that exceeded the impact of its once-dominant medium-term lending facility (MLF), now being phased out. These measures added a net 550 billion yuan to the financial system, effectively mimicking the impact of a 25-basis-point RRR cut.

Strategic Timing Ahead of Tariff Risks

The RRR cut is being positioned as a response to potential U.S. tariff increases. Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group, anticipates a potential window for the cut before the Chinese New Year holiday starting January 28. This aligns with a strategy to stabilize markets and counteract external economic pressures.

Market Effects of This:

Gold as China Indicator:

News/Analysis:

Equity Recap:

n/a

Market News:

Terror Attacks, Plane Crash..

US dockworkers and port employers are poised to restart negotiations on January 7th, according to Bloomberg

Apple is offering discounts of up to CNY 500 on its iPhone models in China from January 4-7th.

European bourses give back early morning strength; US futures gain with modest outperformance in the NQ.

USD began the session on a weaker footing but is now flat.

USTs firmer after China Manufacturing PMI and ahead of their own metrics

Crude on a firmer footing while base metals are capped by sub-par Chinese PMIs.

Looking ahead, US Jobless Claims, Manufacturing PMI, Refunding Announcement.

Geopolitics/ Politics

US President-elect Trump is reportedly preparing to increase activity against the Houthis, according to journalist Stein. "Trump and his people are interested in increasing their activity against the Houthis. Among other things, the administration is expected to turn to the Gulf states to upgrade the regional coalition.". "It is possible that if Trump agrees to give the capabilities to defend themselves against the Houthis to the UAE and other Gulf states, such as Saudi Arabia, they will agree to join actively."

Data on Deck:

MONDAY, DEC. 30 Pending home sales

TUESDAY, DEC. 31 Case-Shiller home price index (20 cities)

WEDNESDAY, JAN. 1 New Year's holiday

THURSDAY, JAN. 2 Initial jobless claims, Construction spending

FRIDAY, JAN. 31 SM manufacturing1

Final Market Check

Premium:

Goldman Economists answer 10 Questions for 2025:

Will GDP grow faster than consensus expects?

Will consumer spending growth beat consensus expectations?

Will core PCE inflation net of tariff effects fall below 2.4% year-on-year?

Will the Fed cut at least another 50bp?

We expect the Fed to cut three times next year to a terminal rate of 3.5-3.75% while also continuing to bump up its estimate of the longer-run neutral rate.

Will the FOMC’s median neutral rate estimate rise from 3% to at least 3.25%?

Will President-elect Trump try to fire or demote Fed Chair Powell?

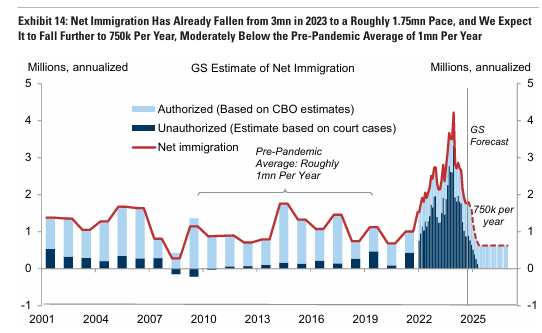

Will net immigration turn negative?

Changes to immigration, trade, and fiscal policy under the second Trump administration will likely be meaningful but stop short of some of the more dramatic proposals. We expect net immigration to slow to about 750k per year.

Will the White House impose a universal tariff?

Will Congress meaningfully reduce the primary deficit?

Why Not More Deportations?