Housekeeping: This is the PM GoldFix post combining AM emails with additional intraday posts.

Contents

Morning Rundown:

Macro-Economics/Commodities:

Geopolitics/Elections:

Founders:

(NEW) GOLDFIX Intraday Chat

Market Recap as warranted

Morning Rundown:

Macro-Economics/Commodities:

Geopolitics/Elections:

Founders:

(NEW) GOLDFIX Intraday Chat:

Intraday analysis, commentary, and observations in threaded form

Market Recap:

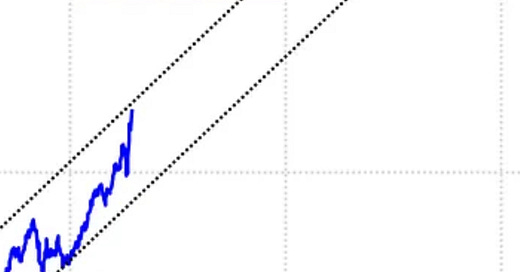

Gold posted another $100 gain today. The psychologically significant levels appear to cluster around $100 increments or roughly 3% moves. But who’s counting?

Today’s activity came with no major headlines or new data. Instead, it offered more confirmation that neither side—be it monetary policymakers or geopolitical actors—is backing down.

One notable development: Trump’s escalating attacks on Federal Reserve Chair Jerome Powell. This signals, in our view, that whatever informal accord, mutual respect, or operational space they had previously afforded each other is now likely over. More than that, it may reflect Trump attempting to redirect public focus away from negotiations that may not be progressing as he would like.

Meanwhile, pressure from Europe is intensifying, especially regarding de-dollarization. It’s starting to look as if Europe is piling on—exploiting the moment to America’s detriment—while China accelerates its exit strategy.

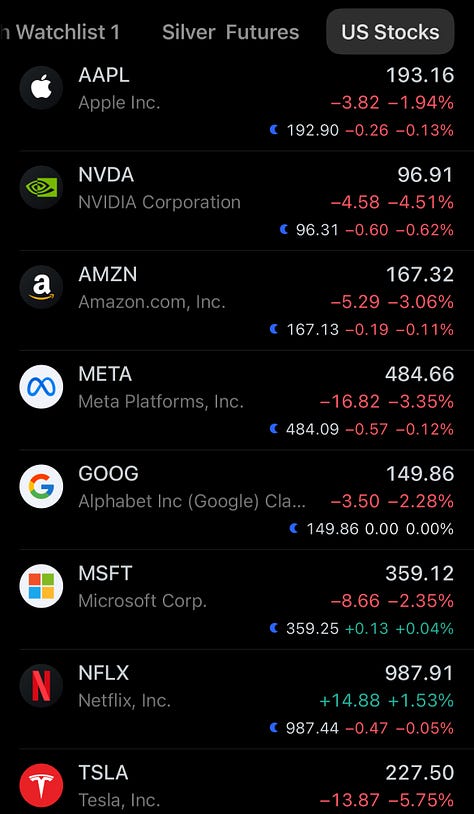

China is buying gold. China is selling U.S. Treasuries. This is not speculation. It is preparation.

Even if Trump and Treasury Secretary Scott Bessent have gamed out worst-case scenarios, one must ask: Given the current internal divide in the U.S., are we politically and economically capable of handling what’s coming?

In the meantime, gold holders are getting paid to watch.

We are long. We hope you are too.

Good Night

Very long.