Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today

Discussion: Goldman, BOA Unshackle Gold

Premium: BOA, GS Key Excerpts

Featured: Goldman, BOA Unshackle Gold

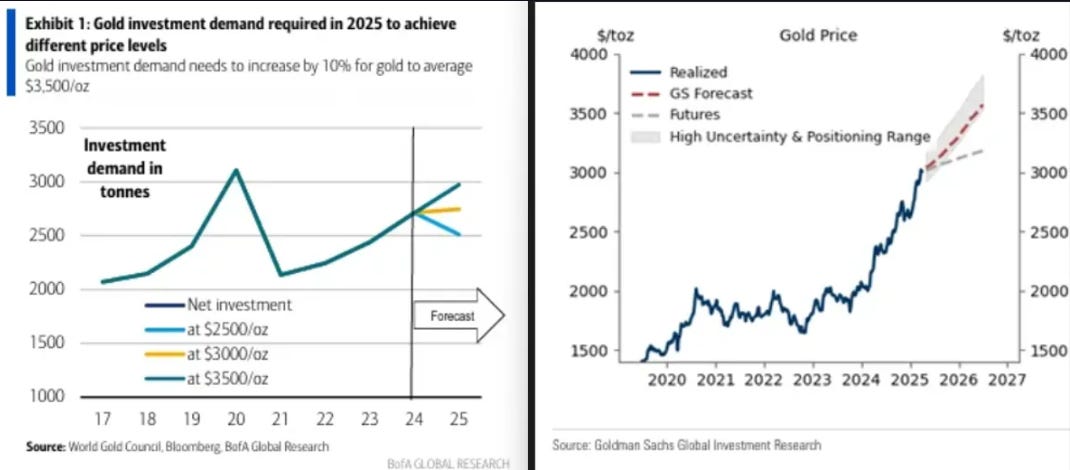

Bank of America says: Gold at $3,500/oz: We believe gold could rally to $3,500/oz if investment demand increases by 10%, so we make this our new price forecast.

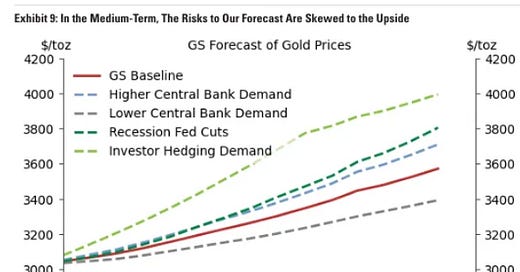

Goldman Sachs says: We raise our end-2025 forecast to $3,300/toz (vs. $3,100) and our forecast range to $3,250-3,520, In extreme tail scenarios gold could plausibly trade above $4,200/toz by end-2025 and exceed $4,500/toz within the next 12 months.

We Say: Gold is now unshackled. Once a proxy for the dollar and interest rates, the metal is free to find a price that reflects actual global demand. Our own Price targets were revealed March 14th where we offered $3600 to 4385 as price targets

What was once viewed as a sleepy, correlated asset is now being subjected to fundamental analysis. Analysts are translating measurable demand into constrained supply and developing legitimate price projections. While some of their sentiment might appear euphoric in the short term, it’s not fantasy—it’s based on tangible demand that has emerged and been unlocked.

GoldFix Premium Post Schedule

Today around noon: Full Bank of America analysis.

Friday: A walk=through of the Bank of America report, with added insights and context.

This weekend: A deep dive into Goldman’s updated report and their 10-question valuation framework.

Continues in Premium with key report excerpts…

Analysis:

Markets Recap:

Stocks ended down, while the dollar strengthened as traders awaited auto tariffs to be announced by President Donald Trump. Treasury yields, meanwhile, inched higher as investors weighed potential exemptions to those tariffs. Oil prices jumped on reports of a dip in U.S. crude oil inventories. Gold eased but remained above the $3,000 per ounce level.

Market News:

X to report first annual ad revenue growth since Musk's takeover

Tesla to launch in Saudi Arabia as Musk and the kingdom mend relations

Trump likely to use 2019 probe to justify tariffs on auto imports

Microsoft pulls back from more data center leases in US and Europe, analysts say

Geopolitics/ Politics:

H/t Newsquawk for Geopol

Data on Deck: GDP/ PCE

MONDAY, MARCH 24 PMI

TUESDAY, MARCH 25 New home sales

WEDNESDAY, MARCH 26 Durable-goods

THURSDAY, MARCH 27 GDP

FRIDAY, MARCH 28 PCE1

Summary and Final Market Check