Housekeeping: Housekeeping: Good afternoon. Hartnett’s Weekly report is presented 3 ways: 1) Video walk-through with commentary 2) Hartnett’s main points broken out below, 3) and original format at bottom. Enjoy.

"Treasury price action this week suddenly ‘cut, then cut, then inflation'."

- M. Hartnett

TL/DR

Markets pricing AI benefits, not AI costs

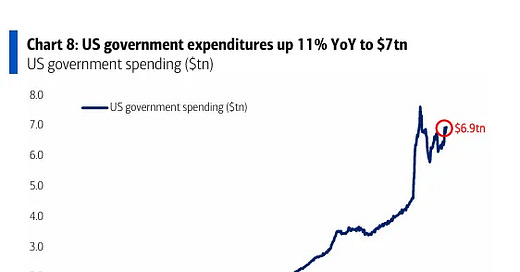

Trump 2.0 » Inflation 2.0 » Dealing with Inflation 2.0

Bonds, Int’l Stocks, and Gold benefit

Key Timestamps:

12:53- Hartnett’s 2025 playbook intro (a way to read this stuff…)

14:41- Point 1: AI causes inflation 2.0 before it causes growth (Long US stocks, Short Bonds)

16:09- Point 2- Markets overpricing AI/ Trump 2.0, underpricing inflation 2.0 (Long commodities, Long gold, Short USD)

19:08- Point 3- Inflationary reality sets in, and what happens (Long Gold, Long int’l markets, Short US Stocks, Long bonds)

26:40- Hartnett on Government sponsored HELOCs to absorb US Deficit

28:40- Tapping the Home Owner Piggy Bank to Buy US Bonds

30:50- Conclusion: Hartnett’s 3 points re-summarized

Much more on this in HOW THE US WILL FINANCE ITS DEFICIT