Housekeeping: Good Morning. Transcript tabbed

*** Chinese New Year/GS/ UBS Comments***

Contents

Yesterday’s Activity

Today’s Prices

Today’s Data

Markets/Metals Commentary

Attached- Chinese New Year, Korea, Goldman, UBS

Markets Covered:

Metals, Energy, Crypto, Bonds, Stocks

Yesterday’s Activity:

Stock Meltup

US equities rallied on Friday as the S&P 500 closed at an all-time high.

Technology (+2.35%) and financials (+1.64%) outperformed the broader market indices, while consumer staples (-0.33%) and utilities (-0.12%) lagged.

The Nasdaq gained 1.70%, while the "FAAMG" stocks rose

h/t DataTrek

Overnight Activity:

Gold is under modest pressure, China did not help things - new year buying, no chasing

Silver: Base metals are smacked amid downbeat trade in China overnight- excuse to sell silver twice.. not joking

Oil is modestly higher- consider the move noise

Nat Gas is down large -spot versus futures

Crypto is lower- Warren thinks she matters

Week’s Data:

Earnings, LEI, PMI, PCE, and GDP

MONDAY, JAN. 22 10:00 am LEI

TUESDAY, JAN. 23 None scheduled

WEDNESDAY, JAN. 24 9:45 am PMI

THURSDAY, JAN. 25 8:30 am Q4 GDP

FRIDAY, JAN. 26 8:30 PCE

Total Calendar1

News:

NOTABLE HEADLINES

Japanese PM Kishida says wage growth outpacing prices is a requirement for a virtuous cycle- Shunto

Economic data was weak everywhere: China especially

GEOPOLITICS

ME News implies stalemate and continuance: Israel conducted a strike, US, Egypt and Qatar are pushing Israel and Hamas to talk, israel is having none of it, Saudi’s Foreign Minister said they are very focused on de-escalation in Gaza, US personnel suffered minor injuries in iraq

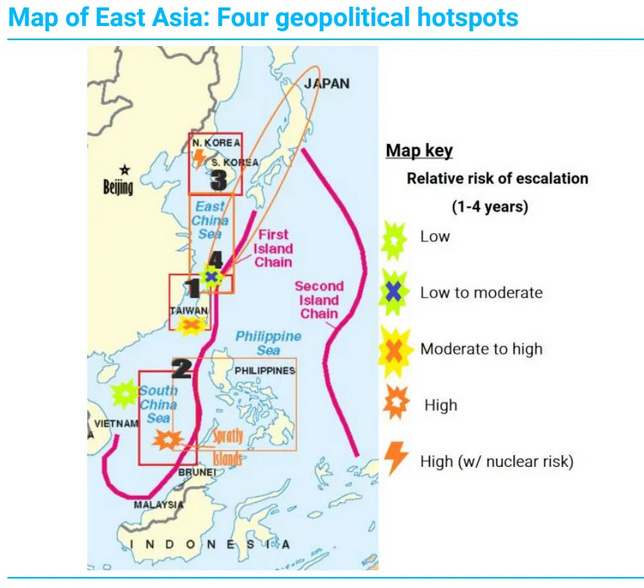

Russian President Putin reportedly showed his intention to visit North Korea soon

some headlines via NewSquawk

Markets/Metals Commentary:

Gold- Sellers above, Buyers below. Who is most flexible? CTAs, China

Silver: Worst of both worlds right now

Crypto: too many long specs

Oil: CTAs,

End