Housekeeping: Good Morning.

Bretton Woods Three is a Process, Not an Event

Today:

Premium: Mining Catalyst’s apparent

Commentary: China Sanctions are bad, Biden’s Tax Hike is worse

Markets Yesterday:

US equities were mixed on Wednesday ahead of the Q1 reading of US gross domestic product.

Premium: Mining Catalyst?

We all know miners are undervalued. The key to getting love for chronically undervalued assets is to find the catalyst. Catalysts can come in event-form. More frequently they come in narrative form. The old, “Their time has come” concept applies here. China is influencing not just bullion prices now, but mining prices as well; and Mining may be a narrative who’s time has come.

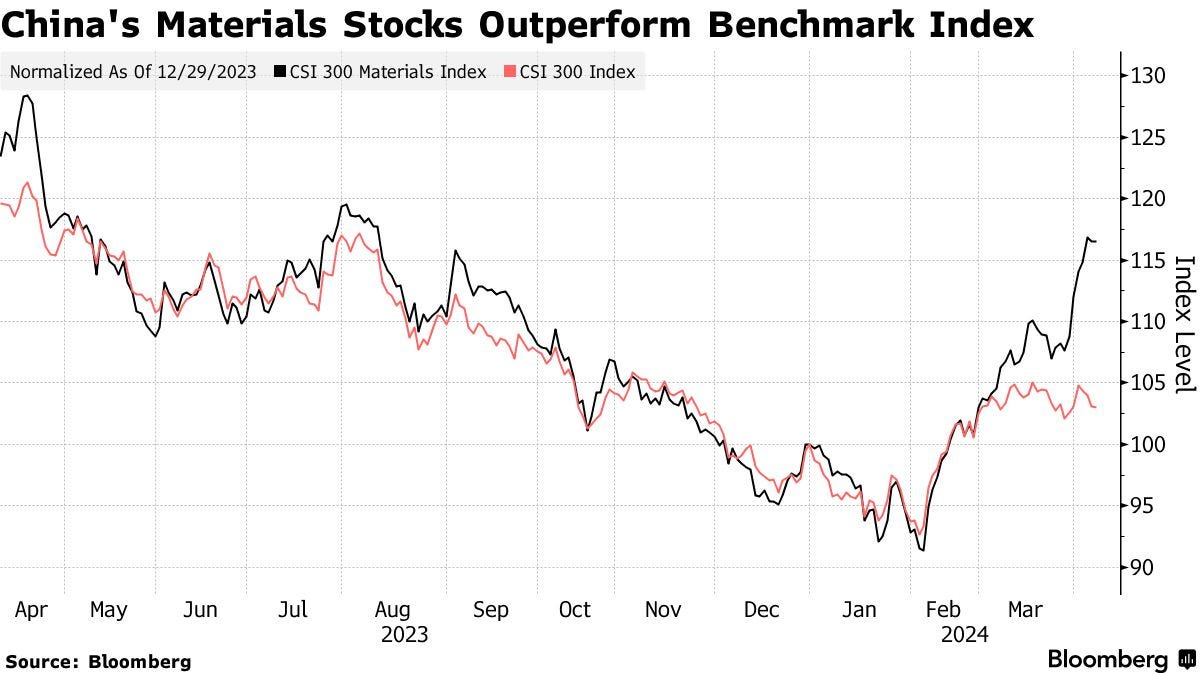

China is now influencing miner prices as well as bullion itself

Western analysts are taking note

One of them has made a comment today on topic

The world may start to wake up to mining sector valuations

More in premium including the bank that may be at the cutting edge in investor perception on mining shares.

Commentary: China Sanctions

Antony Blinken has landed in China amid a worsening rift between the world’s two most powerful countries that threatens to overshadow otherwise improving relations.

The US secretary of state arrives with a warning that the US and its European allies are no longer prepared to tolerate China’s sale of weapon components and dual-use products to Russia, which are helping Vladimir Putin rebuild and modernise his arms factories, enabling him to intensify his onslaught on Ukraine. Guardian

Blinken’s Trip to China is about hurting Russia

The US is threatening sanctions against china if they don’t abide (banking/finance)

China likely knew this was coming in some form

China has been preparing for this for years with gold purchases and stockpiling of key materials

The US among other things believes this will weaken their ties to Russia

The US should have bluffed this 2 years ago with gold at $1600. China only sees it as weakness now.

The likely effect is to accelerate their work towards multipolarity and divorcing themselves from Western influence

As an acceleration event, one cannot help but think this is all theater, or already scripted. Certainly this is no way to slow the loss of a close friend.

The US election and the demonizing of China is now front and center with Gold as a tool of accusations of trade manipulation- FT, BBG, on Gold/China speculators/manipulation/ frothy etc

China suffers as well: foreign capital will accelerate exit

Perhaps we feel they will cry uncle and come back into the fold given their own economic woes

United States actually had the objective of reducing Chinese assistance to Russia they would not be taking these steps.

Market News: Biden Tax Hike

Tax hike: Democrats will likely prove successful in raising individual income tax rates and in strengthening audits of wealthy Americans as they work on overhauling the U.S. tax code in coming months.

That’s a key takeaway from a survey of 15 current and former White House and congressional aides specializing in tax policy completed by Bloomberg this month.

A tax on unrealized capital gains, as envisioned by Senate Finance Committee Chair Ron Wyden, was deemed impossible to get through Congress, the survey showed.

Geopolitics:

White House National Security Adviser said the US is still in talks with Israelis regarding Rafah and expects in-person Rafah talks to take place relatively soon.

US official said the US quietly slipped long-range ATACMS missiles to Ukraine in the March aid package, which were fired by Ukraine against a Russian target last week.

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, APRIL 22None scheduledTUESDAY, APRIL 239:45 am S&P flash U.S. services PMIWEDNESDAY, APRIL 248:30 am Durable-goods orders MarchTHURSDAY, APRIL 25 8:30 am GDP Q1

FRIDAY, APRIL 26 PCE1

Premium:

***DO NOT SHARE THIS***