Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today:

Analysis:

Oil’s Current SituationPremium Discussion:

Oil Deep-Dive Geopol, Flow,

Premium Analysis: Oil’s Current Situation

The risk to Oil is higher not just from Israel/Iran risk, but from likely initial compliance by junior OPEC+ members to the Saudi warning. This also reflects max pain to short CTAs. Event risk warns of $5 moves either way if war escalates or alternatively if OPEC+ frays more.

First the Facts:

Prices are near the lows of their range for the past 3 years

Middle East tensions have done little to prop prices up until very recently

Lower oil prices are good for the US, Europe and China; Bad for Russia and OPEC+

The News:

There are two items on top of traders’ minds right now with regard to Oil: 1) Israel-Iran, and 2) OPEC+ Solidarity

Israel Says Likely to Target Oil Facilities

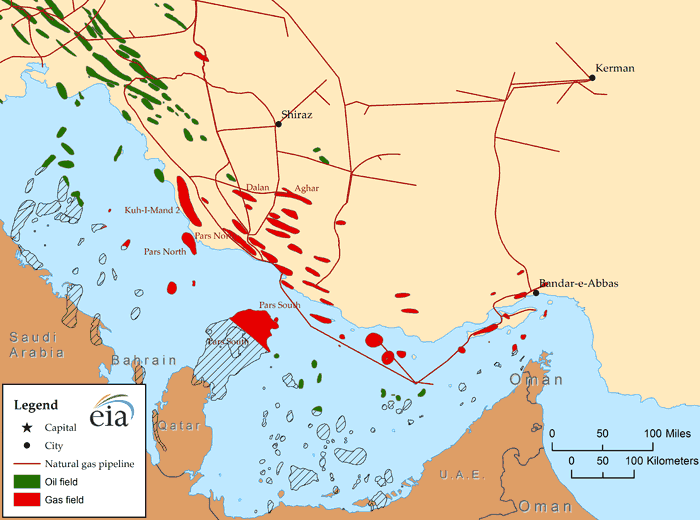

Israel's military is preparing a 'significant retaliation' to the attack by Iran. They are readying "significant" response to Iran missile barrage which could involve targeting oil facilities

Saudi Minister Threatens Price War to Fellow OPEC+ Members

The Saudi oil minister called out members for overproducing. saying prices could drop to $50 if cheaters within OPEC+ don’t stick to agreed-upon production limits. The statements were interpreted by other producers as a veiled threat from the kingdom that it is willing to launch a price war to keep its market share.

The Analysis:

Prices are near the lows of their range for the past 3 years

Middle East tensions have done little to prop prices up until very recently

Israel’s Oil threat is real and very dangerous

Government intervention is suspected of keeping a lid on futures prices

Term structure indicates some unnatural deferred hedging

OPEC solidarity is starting to slightly fray publicly

For Miners: Lower oil prices is good for energy costs. But this has been apparent for some time. That means mining shares are not attracting flows for a different reason. if that reason makes no sense, you buy them and get a nice dividend while waiting for a cap gain. Can also be an operational sweet spot for miners.. make sure you know their hedge book before betting on upside

**In depth OIL analysis continues at bottom**

News Analysis:

Equity Recap:

US equities retreated on Tuesday amid concerns about rising geopolitical tensions in the Middle East. US crude oil prices rose over 2%. Large caps bested small caps: S&P 500 (-0.93%) vs. Russell 2000 (-1.48%). MSCI Emerging Markets (EEM) added 0.72% and MSCI EAFE (EFA) fell 0.74%.

Market News:

"Israeli Prime Minister Benjamin Netanyahu vowed to retaliate against Iran : FT

"A strike hitting ports along the East and Gulf coasts could stoke prices for food, autos and a host of other consumer goods but is expected to cause only modest broader impacts CNBC

"Apple, fresh off the release of the iPhone 16, is preparing to announce a new low-end phone early next year alongside upgraded iPads. Bloomberg

"China’s outbound investment is surging from already-record levels, government data shows FT

Politics/Geopolitics:

See above

Data on Deck: Unemployment

MONDAY, SEPT. 30 Chicago Business Barometer (PMI)

TUESDAY, OCT. S&P final U.S. manufacturing PMI

WEDNESDAY, OCT. 2 ADP employment

THURSDAY, OCT. 3 S&P final U.S. services PMI

FRIDAY, OCT. 4 U.S. employment report1

FINAL MARKET CHECK

Premium: Deep Dive Oil Geopolitics

Includes current technical charts

![Goldman: "The secret buyer has elevated prices and reset the [Gold] relationship"](https://substackcdn.com/image/fetch/$s_!GhWf!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-video.s3.amazonaws.com%2Fvideo_upload%2Fpost%2F149612583%2Fb9fee0ab-60c0-412f-a09b-aef8742cc00a%2Ftranscoded-00001.png)