Podcast transcribed with additional material added below. The follow-along transcript is also attached at top.

Trust, Mercantilism, and Gold

Good morning.

Why is this happening? Why is gold relentlessly climbing?

Why is Bitcoin, other than the ETF, resilient in its march upward? Why is silver now, possibly, we want to knock wood on these things, catching fire?

It's one word, trust. The world does not trust each other anymore.

We can get into why and where that happens.

It's pretty obvious to all of us here.

But this lack of trust manifests in deglobalization.

It manifests in an inability to look forward and say,

“It's okay you can get it back to me 60 days from now.

There is no “future” in a society where trust is lacking. There is only cash and carry. There is only collateral in the here-and-now. There is only the present-tense if you wish to keep doing trade.

If you wish to keep living civilly as neighbors— even though you don't like each other— yet still recognize you depend on each other; You need collateral.

Clean Collateral.

Collateral not indebted to anyone else.

Collateral not encumbered by some clause or risk or ability to be manipulated or created or destroyed by the issuer of said collateral.

There is no other collateral on earth that fits this bill as good as precious metals.

You can argue that Bitcoin fits this bill as well, and it may fit the bill. But: They all have gold. They all have silver. They don't all have Bitcoin.

And so, as we move towards an era where trust is no longer taken for granted, where the money has to be exchanged right there and no credit lines are given, you need collateral that's clean, that everyone owns some of.

Collateral that everyone trusts and can be universally valued. That will be gold and silver.

Who is doing this?

Well, everyone is doing this.

They're all in on it.

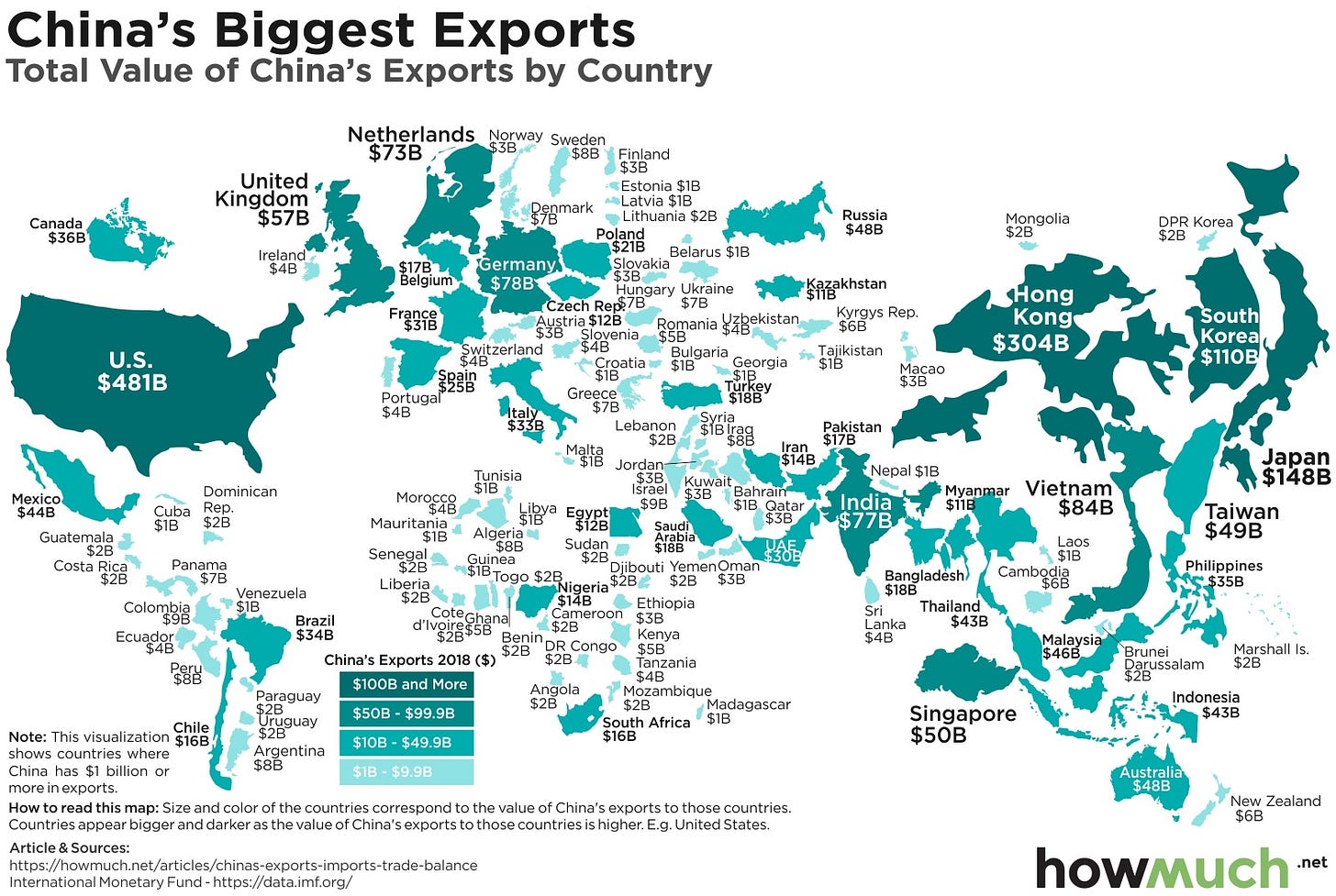

However, China is a big driver here.

China is as important, if not more important in global trade than the US considering they are the world’s manufacturing engine and they are a potential consumption engine given that they have so many people.

World Trade Dominance in 2000 and 2020…

When you put these things together if nobody trusts anybody then you have to have good collateral, and China says well “we're going to use gold”

Thus, if you want to trade with China you have to have gold.

Soon you're going to start seeing world leaders talk about things like “collateral” in the context of Basel 3. That is a distraction. Basel 3 is not a cause ofthis. Basel 3 is a result of this.

But China and The US still need each other…

Make no mistake about it. Basel 3 exists because of the changing world. They’ve been planning for this eventuality since 2009, when Basel 3 was first floated. This is Mercantilism manifest.

Mercantilism, where everybody goes to their neutral corners and all trade is intermediated in part with the only objective go-between left. Gold and Silver.

This is the Mercantile temporary fix towards dealing with a lack of trust. If it works we won't have an all-out World War three.

There's a world war right now but it's being kept to a minimum. How it ends we don't know; But right now they need unencumbered collateral to avoid killing each other.

From: “Birth of the Mercantilism Thesis - Jan 2022

Either way, things are shaping up as a closing of the global network in what is fast becoming a mercantilist system…. If the US and China do not get on the same page now; Some real military instability might happen down the road.

We think China and the US are on the same chapter of this book now, if not the same page. They have also agreed the new collateral added to the mix will be Gold.

The WEF is Worse Than Mercantilism

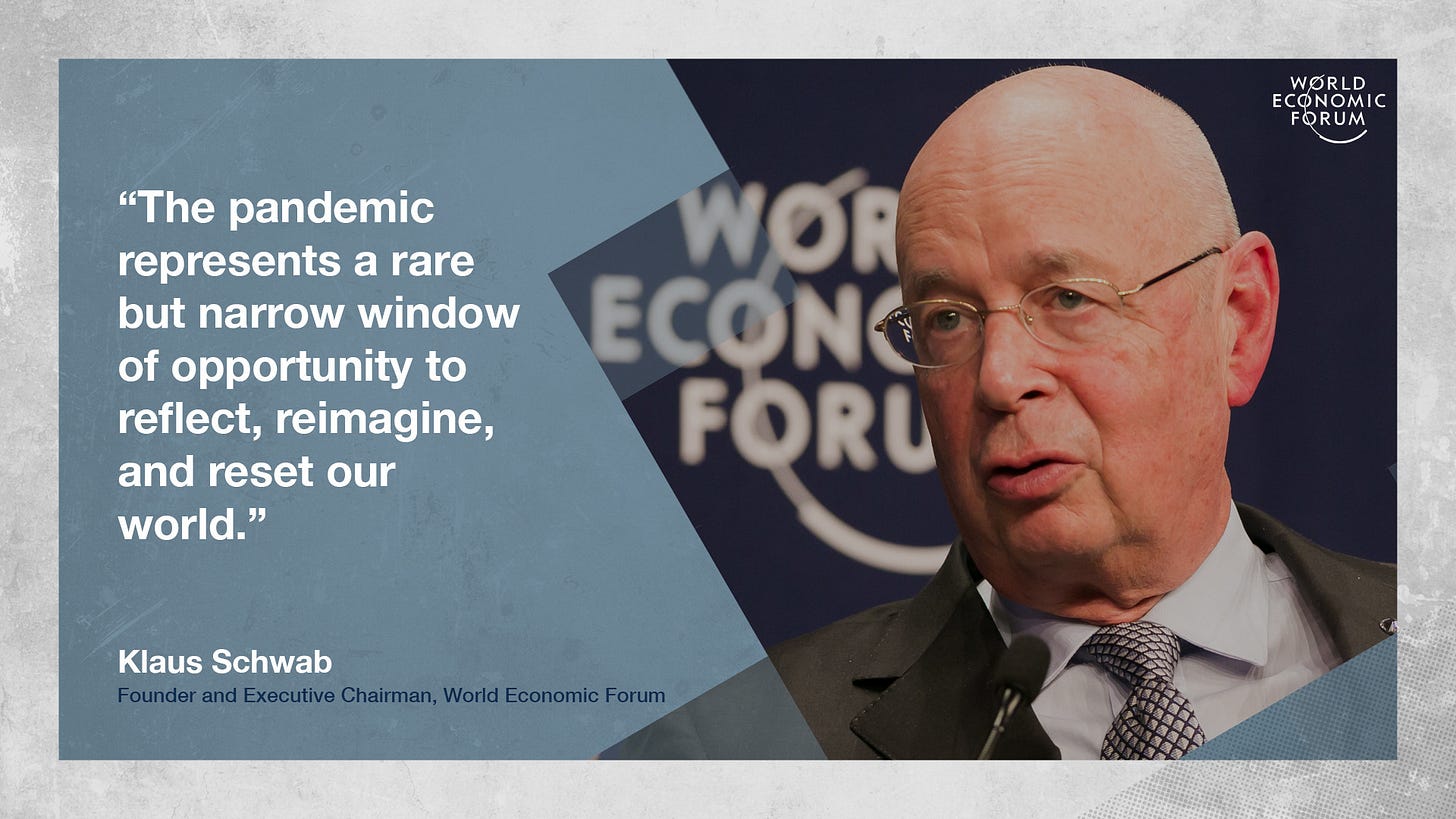

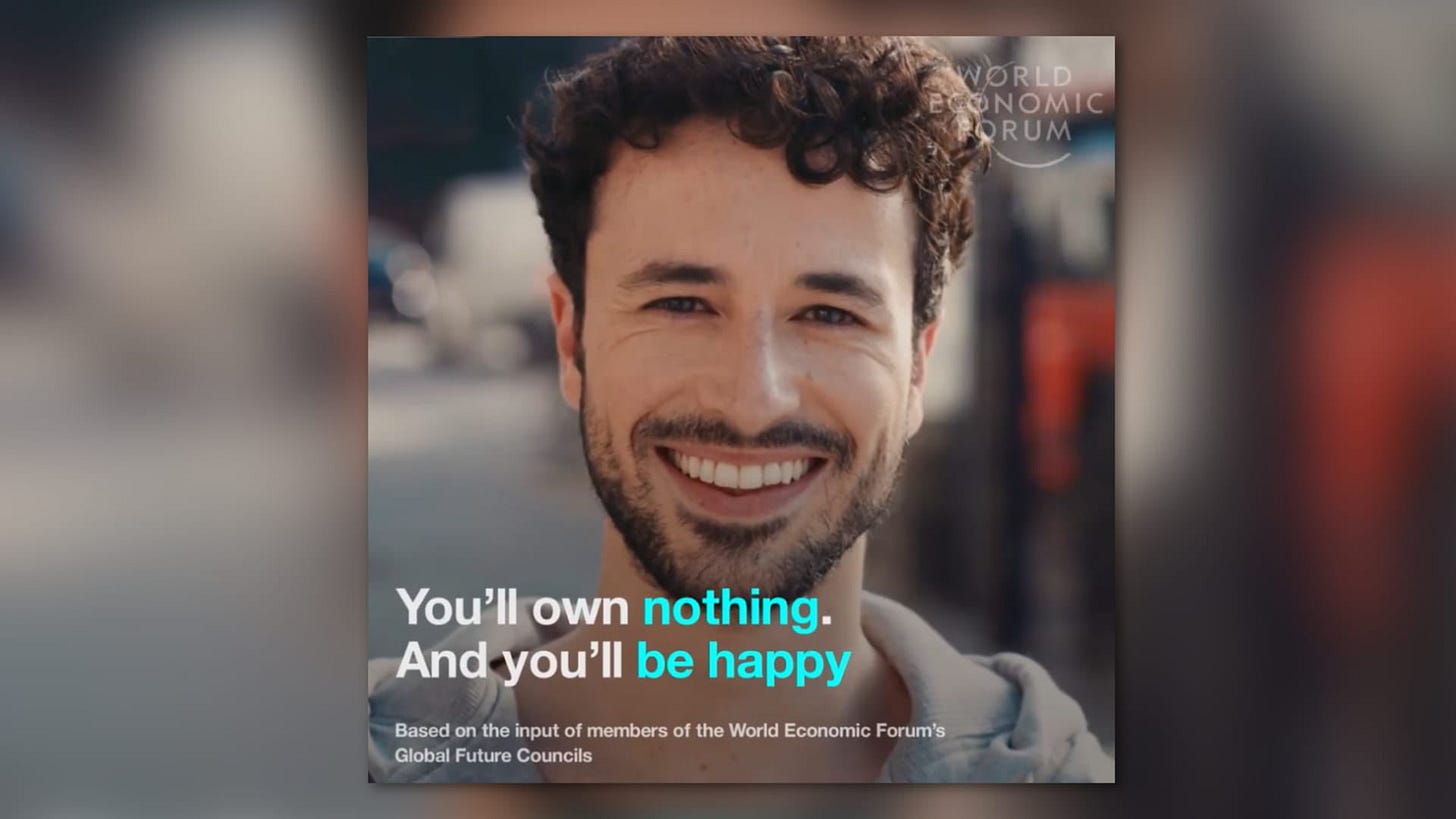

What comes after Mercantilism if it fails and the world splits even more in war? Feudalism. There are some already planning for Feudalism with their calls for reductionism, 15 minute cities, CBDC, and other means to keep pleb servants captive on the plantation to keep their own status as lords of the European Manor. They are the enemy.

The opportunist wanted to lock in a caste system and saw his chance…

They are the ones who hope for the worst. If neokeynesian ideologues are the dogmatic remains of Europe’s Liberal Democracy ideal which created tremendous prosperity over70 years, the WEF and its adherents are opportunists interested in selling you on an idea that protects their status up as feudal lords for another millennium. They hope for disaster. They are the true cynics.

They will tell you less is more, and if there is no real problem, they will make one up to get you to comply and keep them in power…

Verify Now, Trust Later

Therefore, Mercantilism has to work until trust is restored or the next step may be far worse. For mercantilism to work, trade collateral has to be unencumbered, unimpeachable, and not controlled by man.

Europe invented it and it saved them once before. Mercantilism is happening again between the US and China. The EU will be serfs for Klaus after the next World War if it fails this time. Trust will return, but not until everyone has earned it again.

Gold Has to Work, Bonds Will Not Yet.

Who has unencumbered collateral? Anyone who has gold. Gold is unencumbered collateral. So is silver, a trickier one for sure, but nonetheless it will also be called upon to serve as collateral.

What about Bonds as collateral?

“I don’t want as many US bonds because of the debt. I don’t want Chinese Bonds because they aren’t as liquid enough. I don’t want Brazilian bonds.”

The world wants something that is universally accepted. I need to buy your wheat. You need to buy my oil.

The world needs impartial money.

That means Gold and soon Silver.

Collateral is what will be needed.

Bitcoin is no joke.

But central banks aren't going to buy Bitcoin.

Not for a primary asset.

And they're not going to tell you about it if they are. Besides, they already are. But the US owns the most Bitcoin, and that makes it encumbered as money. China knows this too. You need Gold.