Housekeeping: Good Morning.

Bretton Woods Three is a Process, Not an Event

“The World has been and always will be Mercantilist” - Macro Discretionary Fund

Today:

Premium: Bank says Silver at $30 not a problem

China is Selling Gold

How to read the Silver Institute Report

Markets Yesterday:

US equities continued to sell off on Wednesday as investors considered potential rate decisions by the Federal Reserve.

Premium: “Riding the volatile SILVER bullet catch-up trade to $30-32/oz”

We upgrade our base case NY silver price forecasts for 2024 (12%) and 2025 (19%) to $29/oz and $31/oz, respectively.

To the extent the Fed proceeds with insurance cuts and growth stays strong in 2H’24, we could see XAUXAG push lower to ~70x.

Silver: 31.86 vs 28.47

Gold: 2420 vs 2380

Much more at bottom…

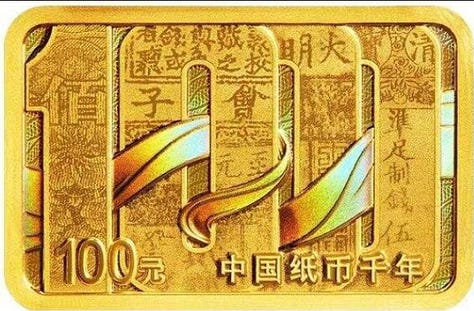

Markets: China is Selling Gold

China will issue a set of commemorative coins on April 22 to mark the 1000th anniversary of the world's first papercurrency issued in the country. The set features two gold coins and one silver coin, with face values of 2,000 yuan ($276), 100 yuan, and 10 yuan respectively. source PD China

A Tombstone for Paper Money…

Silver: 31.86 vs 28.47

Gold: 2420 vs 2380

Silver Institute Report:

Look for revisions in demand and supply

Past demand is higher than previously estimated

Future demand is higher- thats a pushout from the present

Present demand is lowered- see future demand

Future mine supply is higher- that’s hopes and prayers

Market News:

"Chip stocks fell on Wednesday after key semiconductor manufacturing equipment maker ASML said that sales suffered a steeper drop than investors had expected. Source: CNBC

"TikTok is heading to its moment of truth in Washington, with Congress on a fast track to approve a bill aimed at forcing the social-media platform’s Chinese parent ByteDance to divest its controversial ownership stake." Source: Bloomberg

"Airline executives expect a record summer travel season. Demand is growing despite persistent inflation and safety concerns. Air travel demand has been resilient despite persistent inflation and a spate of high-profile safety issues that have sparked congressional hearings." Source: CNBC

"Cathie Wood’s Ark Investment Management is launching its first three active exchange traded funds in Europe, courting a new continent of investors after a run of poor performance and outflows in the US..Source: FT

"Micron Technology, the largest US maker of computer-memory chips, is poised to get more than $6 billion in grants from the Commerce Department to help pay for domestic factory projects, part of an effort to bring semiconductor production back to American soil." Source: Bloomberg

Geopolitics:

G7 statement noted significant geo-political risks from Russia's war against Ukraine and the Middle East situation could affect trade, supply chains and commodity prices

"Multiple reports claiming Netanyahu is postponing counter strike on Iran till after Passover next week", according to Sky News' Waghorn "Al Araby al Jadeed claiming he’s promised a more limited retaliation in return for freedom to strike Rafah hard."

US has reportedly agreed to back an Israeli operation in Rafah in return for Israel not conducting a major strike on Iran, via JNS citing Egyptian officials.

"Al-Arabiya correspondent: Large movements of Israeli armoured vehicles near the outskirts of the city of Rafah", according to Al Arabiya.

UK Ministry of Defence insider speaking to Politico says they now expect “strikes back and forth” between Israel and Iran, via Politico

Prior MSM Stories HERE

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, APRIL 15 8:30 am U.S. retail sales MarchTUESDAY, APRIL 168:30 am Housing starts 1:15 pm Fed Chair Powell speaksWEDNESDAY, APRIL 172:00 pm Fed Beige BookTHURSDAY, APRIL 18 8:30 am Initial jobless claims

FRIDAY, APRIL 19 10:30 am Chicago Fed President Austan Goolsbee speaks1

Premium:

Citi Target raise analysis'

Contextual analysis

***DO NOT SHARE THIS***