Housekeeping: Good Morning.

Gold Revaluation is happening (quite literally) before our eyes

Today:

Commentary: CTA Seasonality

Premium: Silver and Gold in Goldman’s CTA analysis

Equity Recap:

US equities retreated on Wednesday as investors continued to consider corporate earnings results and the Fed's next rate moves.

Premium Markets: CTA Chop Season

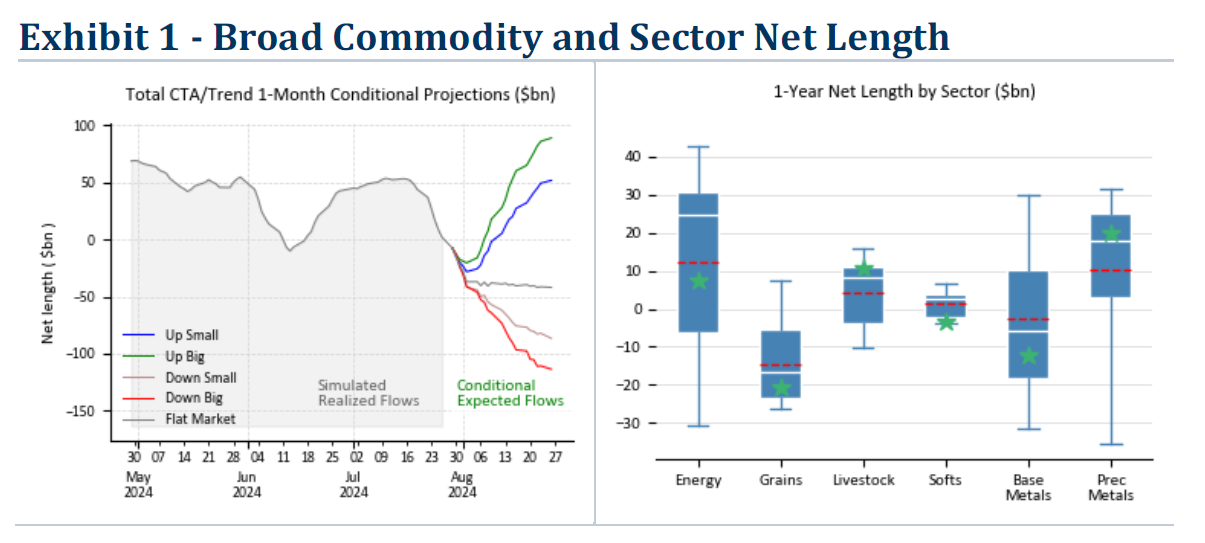

BOA: Outside of Gold, CTA commodity shorts increasing

Except for a relatively large Gold long, CTA positioning in commodities is quite short. Next week trend followers could be increasing shorts in Oil, Aluminum, [Silver] Copper, and Soybean Oil.

Goldman CTA Flows: The Pathway to Hell

Less Energy, Less Precious longs, More Base shorts

Market News:

"US consumers are reining in spending on travel and leisure, hitting businesses including Disney theme parks, Airbnb home rentals and Hilton hotels as questions grow about the health of the economy. Source: FT

"Shipping giant Maersk, considered a barometer for global trade, is not seeing signs of a U.S. recession as freight demand remains robust, the company’s chief executive said Wednesday...Source: CNBC

"Quant funds that chase the hottest trades on Wall Street are getting thrashed as momentum bets backfire all at once." Source: Bloomberg

"The landmark antitrust ruling against Google on Monday is shaking up one of the longest-standing partnerships in tech. At the heart of the case are billions of dollars’ worth of exclusive agreements Google has inked over the years to become the default search engine on browsers Source: FT

Politics/Geopolitics:

Listen to News from Ukraine….

Hezbollah reportedly looks increasingly like it may strike Israel independent of whatever Iran may intend to do, according to two sources familiar with the intelligence cited by CNN.

Israel told the US if Hezbollah harms Israeli civilians as part of its retaliation for the assassination of its top military commander, the Israel Defense Force's response would be disproportionate, according to two officials cited by Axios.

Russia's Medvedev said Russia must press on to Odesa, Kharkiv, Dnipro, Mykolaiv, Kyiv, and further, while he added that Russia will stop only when it finds it acceptable and beneficial.

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, Aug. 510:00 am ISM services July 48.8%TUESDAY, Aug. 68:30 am U.S. trade deficit JuneWEDNESDAY, Aug. 73:00 pm Consumer creditTHURSDAY, Aug. 8 10:00 am Wholesale inventories June -- 0.6%

FRIDAY, Aug. 9 None scheduled1

Premium: CTA Chop Season Detailed

Seasonality

Chop season

No new money, musical chairs.

Catching a trend hopes, usually not

Interpretting GS report this week

***DO NOT SHARE THIS***