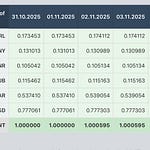

This was recorded as the USD was dropping Monday Morning during the inauguration process.

Podcast Topics

Dollar Dump, Tariffs, and Trump’s Economic Plan: A Detailed Breakdown

Key Takeaways

• Trump’s Economic Reality: While the plan is ambitious, political constraints and market dynamics suggest compromises are inevitable.

• Weak Dollar is Central: If tariffs cannot be implemented, a weaker dollar becomes the primary tool for achieving Trump’s growth agenda.

• Market Implications: Investors are already adjusting to this reality, with dollar weakness leading the charge.

Outlook for Gold, Silver, and the Dollar

• Gold and Silver:

• Prices will likely remain influenced by dollar movements. If the dollar weakens further, both metals could see more upside.

• The Dollar:

• The market is already pricing in the challenges Trump faces in implementing his full agenda.

• A weak dollar strategy appears increasingly likely as a fallback to support exports and mitigate political resistance.

Market Recap: Dollar Leads the Moves

• Market Action:

• The dollar dropped sharply, down as much as 160 points earlier and possibly more by the close.

• Stocks and gold gained, but gold was not as strong as in the morning. Silver started weak but firmed later.

• Key Questions:

1. Why did the dollar dump?

2. Why didn’t gold and silver rally more, despite the weaker dollar?

Let’s break these down.