Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

“China and The US have an understanding on Gold”

Today

Discussion: Another Step Higher for Silver in 2025- UBS

Premium: Academy’s 2025 Projections

Discussion:

Another Step Higher for Silver in 2025- UBS

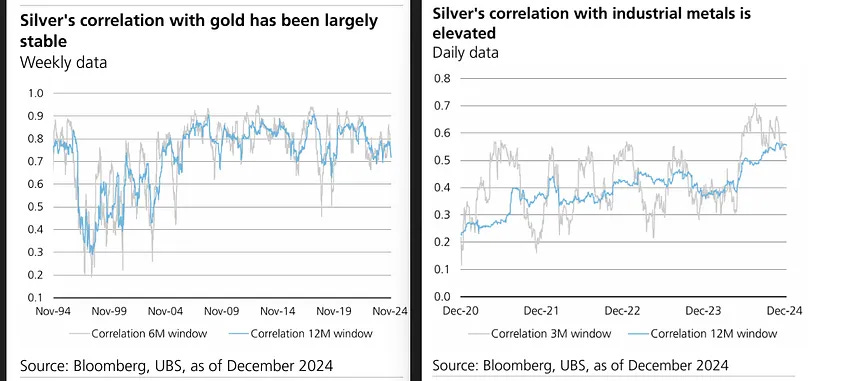

UBS’ report on silver markets for 2025 projects a bullish outlook for the metal, forecasting prices to rise to USD 38 per ounce by the end of the year. Their optimism stems from expectations of lower U.S. yields, improved global industrial activity, and a rebound in investor confidence.

There are two key drivers UBS makes: Lower Yields/USD, and an uptick in Global Industry.

How We Got Here: Higher U.S. yields, a stronger dollar, and concerns about global growth outside the U.S. reversed some earlier gains. Silver was habitually sold for all of 2024 against Fed hike fears and as a hedge for speculative Gold Buying…

They also provide levels at which they would be buyers for their book and their clients if a dip presented itself.

Full Analysis: Another Step Higher for Silver in 2025- UBS

News/Analysis:

Quick Note: China's Plan, The USD, and Gold

Equity Recap: Friday selloff comment

US equities declined on Friday, weighed down by tech shares. Large caps and small caps retreated: S&P 500 (-1.11%) vs. Russell 2000 (-1.56%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) dropped 0.45% and 0.14% respectively

Trump trade unwind, Yellen Fears..etc

Market News: China-Bashing Drivel

"In the weeks since the election, China has flaunted the ways in which it could hit back at the U.S. in the event of a new trade war with the U.S... But using such tools too aggressively risks backfiring on Beijing. The big danger is that taking shots at Western companies and restricting exports of critical minerals and other essentials will only encourage the U.S. and its allies to double down on their efforts to untangle their economies from China’s [who will they sell stuff to?]. That would spell trouble for Beijing as long as it remains wedded to an economic model [subtext, the Yuan is too strong for US] that relies so heavily on selling its goods to Western consumers [spoiler alert, they dont]." Source: WSJ

- No, money dictates decisions. Apple, China, Mercantile protectionism

Nvidia is betting on robotics as its next big driver of growth, as the world’s most valuable semiconductor company faces increasing competition in its core artificial intelligence chipmaking business. FT

"Data centers powering artificial intelligence and cloud computing are pushing energy demand and production to new limits CNBC

"By this time last year, the stock market’s rally had blown past even the most optimistic targets and Wall Street forecasters were convinced it couldn’t keep up the dizzying pace. Bloomberg

"The next interest rate cut by the European Central Bank could be longer in coming after a recent uptick in inflation, ECB Governing Council member Robert Holzmann was quoted as saying on Saturday. CNBC

Geopolitics/ Politics

Data on Deck:

MONDAY, DEC. 30 Pending home sales

TUESDAY, DEC. 31 Case-Shiller home price index (20 cities)

WEDNESDAY, JAN. 1 New Year's holiday

THURSDAY, JAN. 2 Initial jobless claims, Construction spending

FRIDAY, JAN. 31 SM manufacturing1

Final Market Check

Premium:

Bonus: Academy Securities 2025 Outlook