Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today:

Discussion: Silver, Copper, Uranium, Palladium

Analysis: Goldman, ANZ

Discussion: Silver, Copper, Uranium, Palladium

Metals vs. Tech…

Silver Bullish… “Next 2-3 months, we see a retest of the 2011-2012 highs”

Jr Silver Miners – Bullish Since 2023… $18 next stop

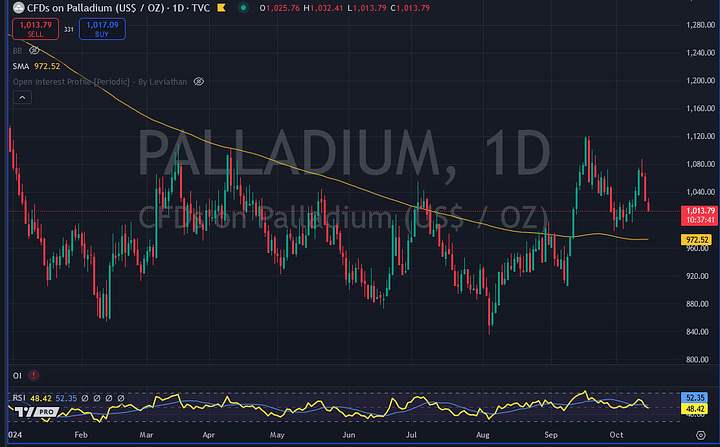

Palladium- Trading a Broken Market…

News/Analysis:

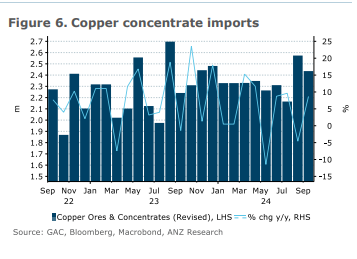

ANZ on China Copper

China released its preliminary trade data for metals yesterday, which shows total imports for unwrought copper rose 14% MoM to 478.6kt in September on improving seasonal demand and a better consumption outlook for the industrial metal. Cumulatively, imports rose 2.6% YoY to 4.1mt over the first nine months of the year. Meanwhile, imports of copper concentrate rose 8.7% YoY to 2.4mt last month, as strong domestic refined output continued to support import demand for raw material.

Continues at Bottom

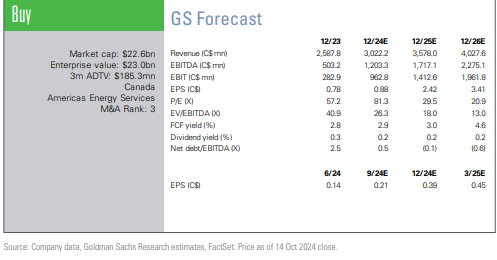

Goldman on Cameco

Last week, we attended the Cameco Corporation (CCJ/CCO.TO, Buy) Cigar Lake and McClean Lake site visit and a management dinner in Saskatchewan, Canada Following the trip, we reiterate our constructive view on Cameco, where we continue to highlight the company’s premium assets across the fuel cycle with exposure to attractive fundamentals in the medium and longer-term, competitive positioning on the global cost curve with lower relative geopolitical risk vs peers, particularly in Mining,

We are Buy-rated on CCJ/CCO.TO, and our 12-month P/E-based price targets are unchanged at US$55/C$74.

Continues at Bottom

Equity Recap:

The S&P 500 and Dow Jones Industrial Average closed at record highs on Monday ahead of a slew of corporate earnings reports. Large caps and small caps advanced: S&P 500 (+0.77%) vs. Russell 2000 (+0.64%). MSCI Emerging Markets (EEM) lost 0.41% and MSCI EAFE (EFA) added 0.29%.

Market News:

"Google will back the construction of seven small nuclear-power reactors in the U.S., a first-of-its-kind deal that aims to help feed the tech company’s growing appetite for electricity to power AI and jump-start a U.S. nuclear revival... The arrangement is the first that would underpin the commercial construction in the U.S. of small modular nuclear reactors. Many say the technology is the future of the domestic nuclear-power industry, potentially enabling faster and less costly construction by building smaller reactors instead of behemoth bespoke plants." Source: WSJ

"A strong US economy and mixed inflation data support a more gradual pace of interest rate cuts following a big reduction by the country’s central bank last month, FT

"Electric cars have gone from pricey purchases to some of the biggest bargains on the used-car lot, as resale values for the vehicles have tumbled. WSJ

"Tesla used humans to remotely control some capabilities of its Optimus robot prototypes at a recent event designed to generate investor enthusiasm for forthcoming products Bloomberg

"Elliott Investment Management has formally called for a special meeting at Southwest Airlines, the activist’s first U.S. proxy fight since 2017 CNBC

"Microsoft on Monday said that its vice president of GenAI research, Sebastien Bubeck, is leaving the company to join ChatGPT-maker OpenAI." Source: Reuters

Politics/Geopolitics:

Israeli PM Netanyahu told the US that Israel will strike Iranian military, not nuclear or oil, targets, according to officials cited by The Washington Post.

Israeli PM Netanyahu held a secret meeting with Defence Minister Gallant and Chief of Stall Halevi to discuss a possible attack on Iran, according to Al Jazeera citing Israeli press.

North Korea blew up part of inter-Korean roads, according to South Korea's military. It was separately reported that South Korea's military fired warning shots south of the demarcation line after North Korea destroyed inter-Korean roads

Data on Deck:

MONDAY, OCT. 14 Columbus Day holiday. Bond market closed.3:00 pm

TUESDAY, OCT. 15 Empire State manufacturing survey

WEDNESDAY, OCT. 16 Import price index

THURSDAY, OCT. 17 U.S. retail sales

FRIDAY, OCT. 18 Housing starts

FINAL MARKET CHECK