Housekeeping: Due to the holiday in observance for President Jimmy Carter’s Funeral, there was no CFTC CoT data on Sunday.

The Comex Silver EFP Problem With Bob Coleman

Overview:

This past week or so much discussion has been had about the growing risk to Silver market functionality due to inventory depletion in London coupled with a growing concern over Tariff exemption in NY Comex deliverables.

Bottom line: there may not be enough Silver on hand to satisfy current demand. GoldFix covered this in its Weekly feature: The Big Silver Stockout of 2025. Here’s our quick summary of the potential “stockout” from that story:

In commodity trading, a "stockout" occurs when ready inventory is fully depleted, disrupting supply. Causes include supply chain delays, demand surges, or natural events. Stockouts drive price market disruptions. Key examples span energy, agriculture, and metals, making inventory monitoring crucial.

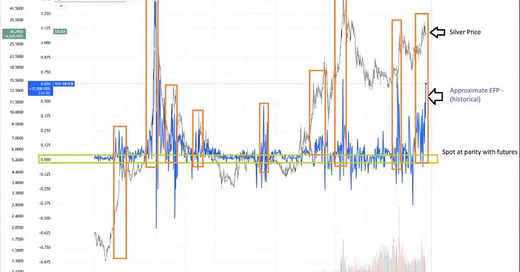

The risk of a stockout can be measured by a little understood tool of supply/demand imbalance in precious metals called the Exchange for Physical (EFP)

Discussion Intro:

This discussion between VBL and Bob Coleman breaks the EFP concept and its implications for Silver and Gold down

Bob Coleman joins GoldFix Founders group for a discussion on the recent Silver EFP behavior and its capacity as an early “tell” of bigger supply/demand imbalances in the market structure that have as of yet not manifested in flat price. Bob starts speaking 17:40. Topic outline and slides follow. Enjoy.

Contact info for Bob Coleman:

Website: Idaho Vaults

X/Twitter: @ProfitsplusID

Topics Discussed

Speaker Timestamps

Vince: 0:00- 17:40

Bob 17:40- 1:23:52

Introduction to Futures and Spot Markets

Explanation of commodity futures curves.

Distinction between spot price and futures price.

Historical context of gold and silver pricing mechanisms.

Global Spot Market Dynamics

The significance of the London Bullion Market Association (LBMA) for gold.

COMEX’s role in the U.S. futures market.

Geopolitical and logistical considerations in pricing.

Cost of Carry

Factors influencing the cost of carry:

Interest rates.

Insurance, storage, and transportation costs.

Explanation of "carry trade" in commodity markets.

Behavior of futures curves under normal and stressed market conditions.

Short Squeezes in Commodity Markets

Definition and examples of short squeezes.

Effects on spot prices and futures curves.

Transition from contango to backwardation during crises.

Case studies: Natural gas, grains, and silver.

Exchange for Physical (EFP) Mechanism

The role of EFP in commodity trading.

Relationship between London and New York markets.

Indicators of physical demand tightness through EFP movements.

Impact of COVID-19 on Refining and Logistics

Refinery shutdowns and their effect on COMEX and LBMA gold and silver bars.

Challenges in delivering 400-ounce gold bars to the U.S.

Venue squeezes caused by regulatory differences.

Tariff and Geopolitical Risks

Influence of tariffs on silver and gold markets.

Case studies: Chinese-origin and Russian-origin metals.

Market reactions to potential tariff impositions.

Market Indicators of Stress

Persistent EFP premium indicating systemic issues.

Differences between registered and eligible metal stocks.

Analysis of depository statistics for gold and silver.

Role of ETFs (e.g., SLV and PSLV)

Trends in SLV shares outstanding and physical metal redemptions.

Relationship between ETF activity and COMEX stress.

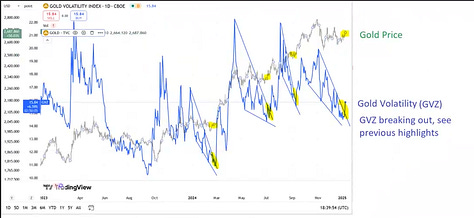

Backwardation and Volatility

Historical instances of backwardation in precious metals.

Relationship between volatility and price movement.

Analysis of volatility wedges and their implications for future pricing.

Institutional Factors

Basel III regulations and their impact on market liquidity.

Reduced leverage among banks and authorized participants.

Comparison Between COMEX and Shanghai Gold Exchange (SGE)

Differences in transparency and settlement currencies.

Barriers to SGE’s dominance in global trading.

Investor Sentiment and Contrarian Opportunities

Retail sentiment during market stress.

Contrarian strategies in the face of widespread pessimism.

Practical Advice for Investors

Importance of understanding storage agreements.

Reading market signals like EFP and volatility movements.

Strategies for navigating tight or volatile markets.

Closing Remarks

Relevant Slides:

Contact info for Bob Coleman:

Website: Idaho Vaults

X/Twitter: @ProfitsplusID

Nothing below this line…

Share this post