Housekeeping: Good Morning. No Foumders discussion this Sunday. We will be on Holiday Monday. Buona Pasqua and Chag Sameach to everyone out there.

“The reset is a process not an event”

Today

Discussion 1: UBS: There's room for gold to run higher

Discussion 2: Upside risks to demand, China, What are signs of this run ending

Analysis:

UBS: There's room for gold to run higher

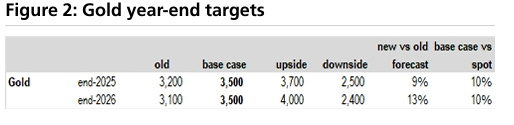

We upgrade our gold forecasts materially. We shift our price targets to the previously published upside scenario, now looking for gold to rally to $3500 this year. The case for adding gold allocations has become more compelling than ever in this environment of escalating tariff uncertainty, weaker growth, higher inflation and lingering geopolitical risks. The current backdrop wherein global trade, economic and geopolitical relationships may be changing reinforces the need to diversify into safer havens like gold. We expect gold's rally to extend into next year and for prices to stabilise at higher levels further out.

Upside risks to demand, especially from China

An important development to monitor is the rollout of insurance companies’ gold mandate. Among those that have been allowed to invest up to 1% of AUM in gold, a few have now started doing test trades. This is earlier than we expected. The 10 insurance companies that have so far been allowed to invest in gold account for about 57% of the industry,

We believe the market has begun discounting the additional purchasing coming online as well as the pilot insurers not being as patient as most think.

Brazil and BRICS Summit 2025

To add a new wrinkle not discussed anywhere else yet, but will be soon— the BRICS summit is upcoming in July, right after Basel 3’s final rollout begins… so as insane as it is, the market may be lower over the next few weeks, but it could be at or above these highs as the July 1 Basel 3 rollout begins and the BRICS 2025 Summit closes in.

That said Gold experiences short term peaks as BRICS events start regardless of if they contributed to a rally before hand. See chart at bottom

Continues at bottom… and in UBS: There's room for gold to run higher

Featured:

Markets Recap:

The S&P 500 ended higher as investors weighed progress in U.S. trade negotiations with Japan and the EU. Treasury yields ticked higher amid market calm. Gold prices slipped on profit-booking, while the dollar was little changed. Oil climbed on trade deal optimism and fresh Iran sanctions.

Energy stocks led Canada's main stock index higher, as investors took stock of U.S.-Japan trade negotiations, although sentiment remained fragile amid tariff uncertainties. Toronto Stock Exchange's S&P/TSX Composite Index ended 0.36% higher at 24,192.81.

Market News:

Google holds illegal monopolies in ad tech, US judge finds

EXCLUSIVE-Musk's SpaceX is frontrunner to build Trump's Golden Dome missile shield

Nvidia CEO stresses importance of China market in Beijing visit, Chinese state media reports

Data on Deck:

MONDAY, APRIL 14 6:00 pm Philadelphia Fed President Patrick Harker speaks 7:40 pm Atlanta Fed President Bostic speaks

TUESDAY, APRIL 15 8:30 am Import price index March 0.1% 0.4% 8:30 am Import price index minus fuel March -- 0.3% 8:30 am Empire State manufacturing survey April -10.0 -20.0

WEDNESDAY, APRIL 16 8:30 am U.S. retail sales March 1.2% 0.2% 8:30 am Retail sales minus autos March 0.4% 0.3% 9:15 am Industrial production March -0.2% 0.7% 9:15 am Capacity utilization March 77.9% 78.2% 10:00 am Business inventories Feb. 0.3% 0.3% 10:00 am Home builder confidence index April 38 39 12:00 pm Cleveland Fed President Hammack speaks

THURSDAY, APRIL 17 8:30 am Initial jobless claims April 12 -- 223,000 8:30 am Housing starts March 1.41 million 1.5 million 8:30 am Building permits March 1.46 million 1.46 million 8:30 am Philadelphia Fed manufacturing survey April 3.7 12.5

FRIDAY, APRIL 18 8:00 am San Francisco Fed President Mary Daly speaks

Summary and Final Market Check

Currency comps, China demand already in,