Housekeeping: Good Morning.

Gold Revaluation is happening (quite literally) before our eyes

Today:

Commentary: Jackson Hole

Premium: How Crazy is $3,000 From Here?

Equity Recap:

US equities advanced on Friday after a raft of positive US economic data this past week, including better than expected retail sales and the lowest annual inflation rate since 2021 in July.

Premium Markets:

Jackson Hole Week

The stock-market reaction to speeches by Fed chiefs at Jackson Hole has, on average, been muted, but mostly positive. During the past 20 years, the S&P 500 saw an average return of 0.4% during the conference, according to Dow Jones Market Data. The index recorded an average gain of 0.1% in the month after the conference and an average return of 1.8% in the three months following the event.

Preview: Gold Above $2500, MSA’s Take

Michael Oliver’s MSA Weekly Report is out and discusses the break out in gold and upside potential

About Micheal Oliver’s MSA

Full analysis premium at bottom…

Market News:

"Sam Altman wants to save us from the AI-dominated world he is building. The trouble is, governments aren’t buying his plan, which involves an attempt to scan the eyeballs of every person on Earth and pay them with his own [digital] currency.WSJ

"A big batch of economic news over the past week kicked off a markedly critical period ahead for Federal Reserve policymakers: CNBC

"The US Federal Reserve needs to take a gradual approach to lowering borrowing costs, one of its top officials has said, as the world’s leading central bankers prepare to gather at an annual meeting in Wyoming this week. Mary Source: FT

"More than half of the US’s biggest companies see artificial intelligence as a potential risk to their businesses, according to a new survey of corporate filings... FT

"The busiest port complex in the US is churning through import volumes near the highs set during the pandemic despite worries about a cooling economy. Bloomberg

Politics/Geopolitics: World War 3

Israeli military said it conducted an airstrike in Lebanon’s Nabatieh which targeted a Hezbollah depot, while it was separately reported that Israel targeted the towns of Houla and Beit Leif in Lebanon during airstrikes on Sunday night, according to Al Jazeera. Furthermore, an Israeli airstrike targeted agricultural land northeast of the Nuseirat refugee camp in the central Gaza Strip and it was also reported that 10 people were killed in an Israeli strike on central Gaza’s Zawaida.

IDF said it detected the launch of a number of suspicious air targets from Lebanon towards areas in the Western Galilee.

Israeli PM Netanyahu’s office said the Israeli negotiating team expressed cautious optimism in advancing a Gaza hostage deal. PM Netanyahu's office also said Israel is in complex negotiations and there are things it can and cannot be flexible about, according to Reuters.

Hamas on Sunday rejected an updated US proposal for a ceasefire and hostage deal in Gaza and blamed Israeli PM Netanyahu for moving the goalposts and the US for indulging him, according to Axios.

Hamas said the new ceasefire proposal presented by the US at talks in Doha responds to Israeli PM Netanyahu’s rejection of a permanent ceasefire and complete withdrawal from Gaza, while it added that the proposal placed new conditions in the issue of a hostages exchange and retracted other issues hindering a deal, according to Reuters.

US President Biden said they will not give up and a Gaza ceasefire is still possible. It was separately reported that US Secretary of State Blinken arrived in Israel to renew the push for a Gaza ceasefire.

US Secretary of State Blinken says "This is the best and perhaps the last chance to release the hostages and reach an agreement"; "We have decisive efforts to deploy troops and deter any attacks on Israel", via Sky News Arabia.

Iranian Foreign Ministry says "we affirm our right to respond to the attack on our sovereignty and we will do so at the appropriate time", via Al Jazeera

Chinese Premier is to visit Russia from August 20th to August 22nd, according to Interfax; Premier Li will meet with Russian and Belarussian counterparts, and will hold in-depth exchanges on bilateral relations.

Pipeline at oil and chemical plant in Russia's Bashkiria set on fire, via Tass

IAEA said nuclear safety at Ukraine’s Zaporizhzhia nuclear power plant is deteriorating following a drone strike that hit the road around the plant site perimeter, while it stated there were no casualties and no impact to equipment, but there was an impact to the road between the two main gates of the plant.

Russia captured the village of Svyrydonivka in Ukraine’s Donetsk, according to TASS.

Belarusian President Lukashenko said troops were deployed along the entire border with Ukraine, according to RIA.

US, South Korean and Japanese leaders pledged to consult on regional challenges, provocations and threats

Some headlines via NewSquawk or DataTrek

Data on Deck: Jackson Hole

MONDAY, Aug. 19 9:15 am Fed Governor Christopher Waller welcoming remarks 10:00 am U.S. leading economic indicators July -0.4% 0.2% TUESDAY, Aug. 20 1:35 pm Atlanta Fed President Raphael Bostic speech 2:45 pm Fed Vice Chair for Supervision Michael Barr speech

WEDNESDAY, Aug. 21 2:00 pm Minutes of Fed's July FOMC meeting

THURSDAY, Aug. 22 S&P flash U.S. services PMI Aug. 10:00 am Existing home sales July 3.95 million 3.89 million

FRIDAY, Aug. 23 10:00 am Fed Chair Jerome Powell speech at Jackson Hole retreat 10:00 am 1

Final Market Check…

Premium: The Unclenched Fist

***DO NOT SHARE THIS***

The Unclenched Fist

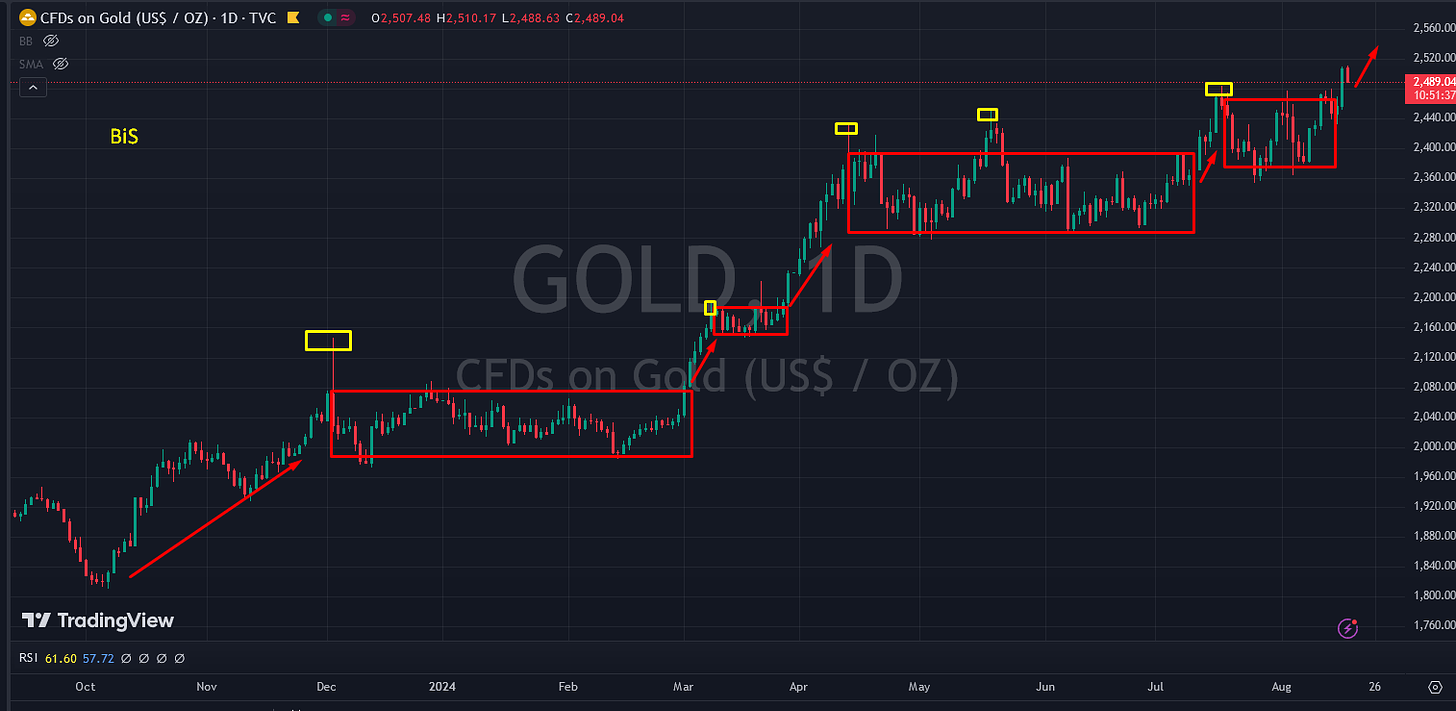

MSA re-identifies a critical breakout in the 36-month average momentum and the 100-week momentum charts, which occurred in late March.

This breakout marks the conclusion of a three-year-wide pause in gold's upward movement, initiating a new phase characterized by accelerated price action.

The multi-year parallel uptrend channel, which faced resistance around the $2450 level, has now been decisively breached.

Cap and Trade: Not How Gold Bull Markets End

Michael emphasizes that the repeated testing of the channel's upper boundary was not typical of gold's peak behavior, which historically involves sharp spikes followed by rapid declines.

The clustering of price action since April was a clear precursor to the recent breakout. This is a repeat of action we identified going back in December of 2023 and called it “Cap and Trade” when the BiS was first seen keeping Gold in a range.

Michael notes this most recent one occurs at the top of a cluster of levels going back years. More on that concept in SPECIAL: The Gold "Cap And Trade" Model

Upside and Then Some

Utilizing traditional price chart analysis, Michael projects the next significant resistance level for gold to be above $3000.

Bull trends in gold over the past fifty years have more often been at least eight-fold moves. This one began from a low at $1050. You do the math.

While such projections are inherently speculative, this target is supported by the recent momentum breakout.

Maybe More Than Before

The analyst further argues that the current monetary environment, coupled with the dynamics in other asset classes, is more volatile and disruptive than at any time in the past five decades.

Recognize that the external monetary and other asset class factors that are in play and about to become more so, are far more dynamic and upending than at any prior time in the past fifty years.

More specifically, Central banks, facing unprecedented economic challenges, are likely to engage in extensive monetary easing, which will further support gold's ascent. Michael anticipates that gold, along with miners and silver, will outperform previous bull markets, driven by the intensifying global financial instability.

The real question is: what is 8 times $1050?

end///

Related Premium Posts: