Housekeeping: The video discusses managed money’s lack of exposure to Gold, their options positions, and what to do when the market moves again. All is done in context of how to read these reports quickly and efficiently for market analysis. PDF and follow along transcription attached.

For the Gold Commentary:

9:42 to 12:45

19:00 minutes onward

Gold CTA Bank Report Breakdown

MBA level Masterclass on How to Read the BNP CoT Report

Video Contents

Intro

Chart Overview

Complete Gold and Silver Analysis

***THIS IS ALL IN THE VIDEO***

Gold and Silver Managed Money Report

What it tells us for the metals

How to read these things

Walk Through the key charts and how to read them

Read and comment on an actual report

What stands out

POSITIONING SCORE

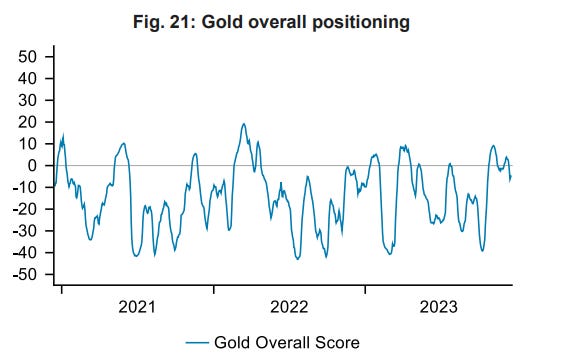

The positioning scores in Figure 1 are percentiles based on the prior five years of data, rescaled to give a value between −50 and +50. Values above 40 and below −40 represent extreme positions (90th and 10th percentiles). For example, interpret a score of −27 by adding 50 to get 23, indicating that 23% of observations over the past five years have been below the current observation.

OVERALL SCORE COMPONENTS

GOLD OVERALL & COMPONENTS

SILVER OVERALL & COMPONENTS

MM: Commitment of traders as a proxy for US-based hedge-fund activity

Trend: Technical measure of the strength of momentum- ADX or something similar

Curve: The degree of backwardation in the futures market- Base, Silver, Oil

Skew: 110–90% call-put skew to indicate options market sentiment - option activity for sentiment

Pressure: Measure of broad market price pressure by evaluating prices and open interest jointly- pressure up or down, divergence concept, stochastic concept