Weekly: Bear Repair, The Bumpy Road Back in Charts

GS, BOA, JPM, and Higher Inflation Tolerance is Coming

Housekeeping: Today we have an 80 page chart book detailing the "Bumpy Road Back", Hartnett describes the pain points, our take on (we're betting) the coming inflation target raise to 2.5 or 3% and more. We've also added new tabs icymi to better sort the different content. Enjoy

SECTIONS

Market Summary— Old Economy vs. New

Research—GS, BOA, JPM, GF, TD

Week’s Analysis/Podcasts—

Charts— Bear Repair. Bumpy Road Back

Technicals— Gold, S&P, Oil, Nat Gas, Bitcoin

Calendar— GDP, PCE

Zen Moment— Croc-dogs

Full Analysis— premium

1. Market Summary

US equities ripped higher Friday up over 2.5% after starting down 1% Thursday night. The US stock market had its best week since June (with Nasdaq Duration outperforming)

Perhaps even more notably, VIX was bid this afternoon as stocks soared. This was a continuation of what was seen last week that despite the market being extremely hedged and long puts out the wazoo — savvy pivot/pause types bought calls expecting a rally. Which they got in the form of a Fed leaked story from the WSJ’s Nick Timiraos, after which stocks ripped up the road. It’s “almost” like they knew.

H/t Zerohedge for data and some graphics.

Sectors:

So called “duration” stocks did very well. Tech that benefits from monetary ease due to consumer spending

Energy did almost better, which is a sign of “old economy” strength as well as the end of US oil producing embargo maybe being at an end, even while prices stabilize in the $80s.

Financials also net cleaned up, as they benefit from easy money, and uninversion (see below) in yield curves…not to mention a net positive earnings season.

Special Note: One Way We Look at the Broader Markets Lately…

Pick the monetary theme that will win, then find the company you like most in the industry you prefer. For example: Assuming you think “New” is overvalued relative to “Old” due to an opinion of prolonged inflation risks. You still must be aware of the emerging industries that combine old and new economy; like CHIPS, Cybersecurity and tech that helps older industries; Disinflation type companies run by savvy mgt, and old industries that have poor mgt despite the potential changing of the guard.

Commodities:

Yen gains sent the dollar reeling to its worst day in almost 3 weeks and worst weekly drop since August...erasing all of its post-payrolls gains ( that’s good for Gold)

Oil prices were flat on the week despite Biden's promises with WTI ending around $85

Gold saw its best day since the start of October today (finding support at Sept lows when the BoE panicked1), pushing the precious metal higher on the week

Bonds:

On the week, the curve steepened (uninverted) over 30bps

Mkt is telling you inflation is getting under control, while accepting longer term inflation is being accepted as higher.

The all important FRA-OIS indicator of interbank funding stress (and money-market risk) is now above 45bps

We think the Yellen panic was the fiscal pivot. The Fed may just pause

Crypto:

Bitcoin puked back below $19000 Friday, then ripped back above it on the dollar drop, dovish FedSpeak.

2. Research:

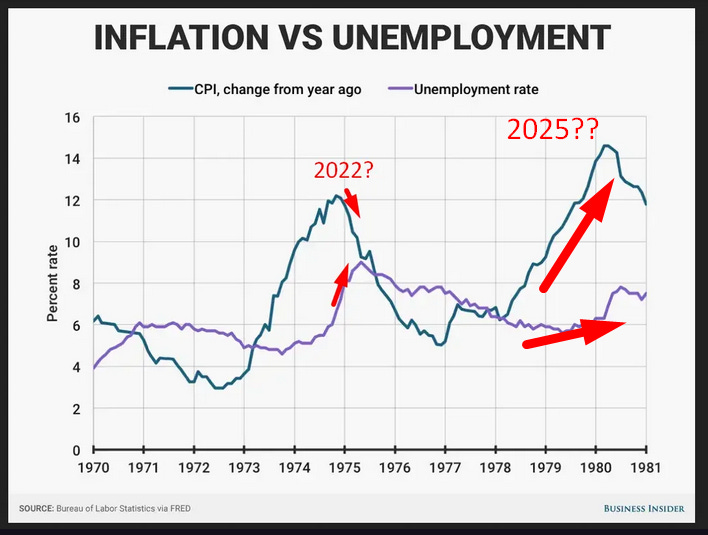

GoldFix: Higher Inflation Tolerance is Coming

HARTNETT Pain trade2

GOLDMAN Bear Repair The Bumpy Road In Charts

JPM Us Inflation Downshift Is On Its Way

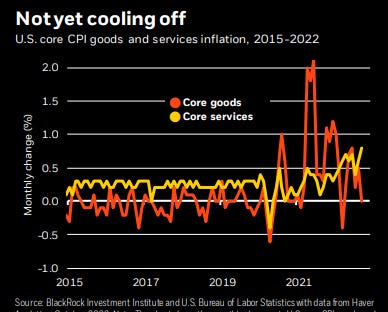

BLACKROCK Weekly Commentary October 17

Stocks: XOM, AA, and PFG

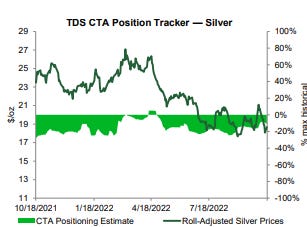

TD CTA Position Tracker

CFTC Weekly Report

3. Week’s Analysis/Podcasts

UNLOCKED: S&P 500, Gold Technical Podcast Excerpts for Oct 21.

Special Silver Comment, and Tesla Earnings are "Science Fiction"

A Digital Drive to Reform the $11 Trillion Global Gold Market

UNLOCKED: MoorAnalytics Gold, S&P 500, and Bitcoin Technical Podcast Excerpt

4. Charts:

Excerpts from GS 80 page chart report

5. Technicals:

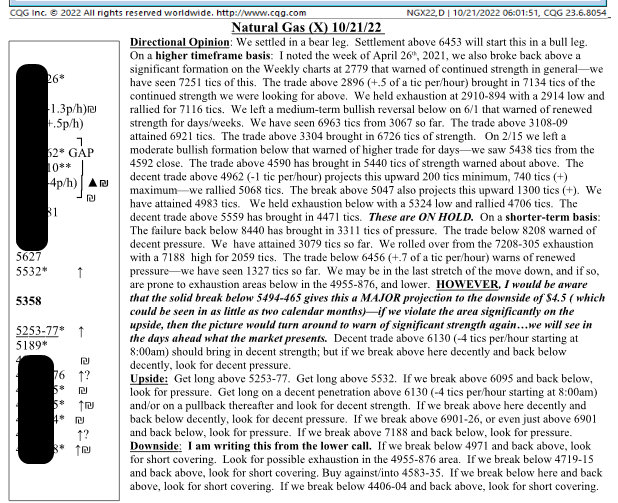

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold:

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions.

S&P 500:

Oil/Nat Gas:

Bitcoin:

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

6. Calendar

MONDAY, OCT. 24

8:30 am Chicago Fed national activity index Sept. -- 0.00

9:45 am S&P U.S. manufacturing PMI Oct. 51.8 52.0

9:45 am S&P U.S. services PMI Oct. 49.7 49.5

TUESDAY, OCT. 25

9 am S&P Case-Shiller U.S. home price index (SAAR) Aug. -- -2.9%

9 am FHFA U.S. home price index (SAAR) Aug. -- -6.9%

10 am Consumer confidence index Oct. 105.3 108.0

WEDNESDAY, OCT. 26

8:30 am Trade in goods (advance) Sept. -- -$87.3 billion

10 am New home sales (SAAR) Sept. 588,000 685,000

THURSDAY, OCT. 27

8:30 am Real gross domestic product, first estimate (SAAR) Q3 2.4% -0.6%

8:30 am Real final sales to domestic purchasers, first estimate (SAAR) Q3 -- 0.2%

8:30 am Initial jobless claims Oct. 22 -- 214,000

8:30 am Continuing jobless claims Oct. 15 -- 1.39 million

8:30 am Durable goods orders Sept. 0.0% -0.2%

8:30 am Core capital equipment orders Sept. -- 1.4%

FRIDAY, OCT. 28

8:30 am Employment cost index (SAAR) Q3 4.8% 5.4%

8:30 am PCE price index Sept. -- 0.3% 8:30 am Core PCE price index Sept. 0.4% 0.6%

8:30 am PCE price index (12-month change) Sept. -- 6.3%

8:30 am Core PCE price index (12-month change) Sept. 5.2% 4.9%

8:30 am PCE price index (3-month SAAR) Sept. -- 4.7%

8:30 am Core PCE price index (3-month SAAR) Sept. -- 5.0%

8:30 am Real disposable income (SAAR) Sept. -- 0.9%

8:30 am Real consumer spending Sept. -- 1.2%

10 am UMich consumer sentiment index (late) Oct. 59.8 59.8

10 am UMich consumer 5-year inflation expectations (late) Oct. -- 2.9%

10 am Pending home sales index Sept. -- -2.0%

Main Source: MarketWatch

7. Zen Moment: