Weekly: Germany's In (Very) Bad Shape, Gold is Oversold, and a U.S. Hard Landing Cometh

Hartnett Notes Gold Flows

Housekeeping: This week there are several things to pick from. We note Michael Hartnett has Gold flows on his radar now. We add some commentary on that. Hartnett also expects much more pain and a hard landing. DB sees the German economy, for being so adamantly inflation-sensitive is in its worst predicament since the past 2 World Wars. Morgan Stanley is bullish Ford at GM's expense. And of course we update the CTA situation in metals. Finally, there are some novel charts for stock watchers.

SECTIONS

Market Summary— up, but barely

Research— Gold, Hartnett, World War Germany, and more

Week’s Analysis/Podcasts— lots of Gold and Silver analysis

Charts— Gilligan’s island top reversal

Technicals— Gold, Stocks, Oil, NG, BTC

Calendar— CPI, PPI, Retail Sales, UMich

Zen Moment— apple pie and birthday cake

Full Analysis— premium

1. Market Summary

Nonfarm payrolls beat for the 6th straight month Friday. Stocks managed to close the week green despite a horrendous Friday. Unemployment came in lower than anticipated and Non Farm Payrolls came in higher than expected signalling the economy isn’t in such bad shape1.

And as we know what is good for the economy is bad for inflation and thus the interest rate situation. That 'good' news spiked rate hike expectations today. Stocks therefore sold off hard. The good news is they were in fact up on the week. The bad news is they are only up off the lows of the previous week.

Sectors and Technicals:

Exxon had its greatest weekly return ever, Tesla not so much

Nasdaq's first positive week in the last four weeks

Energy was the week's big winner, Defensives ended lower

Commodities:

Oil was up for the 5th straight day rallying over 17% on the week

Dollar this week ending marginally stronger vs fiat peers

Silver futures were down but above $20. EFP watch- This rally has been almost entirely shorts covering.

Bonds:

Credit market stress is starting to accelerate. Companies with poor cash flow are going under without a pivot soon.

Curve was pretty uniformly higher in yield on the week. 10Y yields are pushing back up towards 4.00% once again.

Crypto:

Bitcoin tumbled breaking back below $20k to end the week almost unchanged from last Friday.

H/t Zerohedge for data and some graphics.

2. Research:

BOA’s Hartnett—Gold is on his contrarian radar

WE ADD INTERPRETATION AT BOTTOM AS WELL. CONTINUES AT BOTTOM...Morgan Stanley— Buy Ford, Sell GM

CONTINUES AT BOTTOM...CTA Position Tracker— Short Gold, Long Silver

CONTINUES AT BOTTOM...BOA’s Hartnett again— The Case for a Hard Landing

CONTINUES AT BOTTOM...DeutscheBank—Worst Economy Since Last World War

CONTINUES AT BOTTOM...3. Week’s Analysis/Podcasts

Nordstream Sabotage: Russia Didn't Do it, But Said They Know Who Did- Zerohedge (78,000 views)

GOLDFIX EXCLUSIVE: Energy, Gold, S&P 500 Technical Podcast Excerpt (Beta) 10/7/22- Moor

Gold: "Above $1687.70 Warns of Strength for Weeks/Months" but Davos is Coming- Zerohedge ( 32,000 views)

Markets believe Fed’s 4.5% solution gets inflation to 2%, markets are wrong - Reports

4. Charts:

We look at charts in several ways in forming opinions and getting ideas. Here are two that may be helpful. These inspire contradicting comments as captioned

Stocks

This is a very powerful technical indicator called an Island Reversal. For some reason, the gap area is a hot spot for missed trade behavior.

Current situation says: there definitely are trapped longs who wish to sell on and near the “island”. Assume there were trapped shorts who wanted to buy below before. But now they bought and are immediately in the wrong again. You know there are sellers all the way up and into the gap above. There are further more sellers stranded on the island itself. Usually these formations go lower before going higher.

Finally, when they are violated on the upside, it is generally a news event that does it and completely overwhelms the trapped longs who “need” to sell.

Many technical traders will therefore seek to sell this market as it rallies towards the gap with a stop-loss above. Or if they are bullish they buy the market as it strengthens once inside the gap and put their stop loss underneath the gap. It makes for fireworks in both directions usually. Good Luck.

Dollar

Gold

Silver

Oil

This weeks pieces by GoldFix using TradingView.com

5. Technicals:

Gold:

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions.

S&P 500

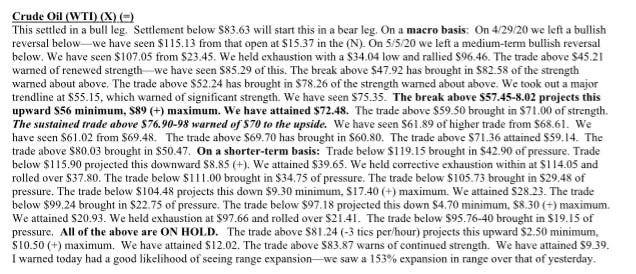

Oil

Nat Gas

Bitcoin

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

6. Calendar:

MONDAY, OCT. 10 None scheduled. Columbus Day holiday

TUESDAY, OCT. 11

6 am NFIB small-business index Sept. -- 91.8

11 am NY Fed 5-year inflation expectations Oct. -- 2.0%

WEDNESDAY, OCT. 12

8:30 am Producer price index, final demand Sept. -- -0.1%

2 pm FOMC minutes

THURSDAY, OCT. 13

8:30 am Consumer price index Sept. -- 0.1%

8:30 am Core CPI Sept. -- 0.6%

8:30 am Core CPI (three-month SAAR) Sept. -- 6.5% 8:30 am CPI (year-on-year) Sept. -- 8.3%

8:30 am Core CPI (year-on-year) Sept. -- 6.3%

8:30 am Initial jobless claims Oct. 8 -- N/A

8:30 am Continuing jobless claims Oct. 1 -- N/A

FRIDAY, OCT. 14

8:30 am Retail sales Sept. -- 0.3%

8:30 am Retail sales ex-motor vehicles Sept. -- -0.3%

8:30 am Import price index Sept. -- -1.0%

10 am UMich consumer sentiment index (early) Oct. -- 58.6

10 am UMich 5-year inflation expectations Oct. -- 2.7%

10 am Business inventories Aug. -- 0.9%

Main Source: MarketWatch

7. Zen Moment:

8. Full Analysis:

BOA, DB, TD, and MS