Housekeeping:

***Founders Discussion today: CoT, CTAs, Impending tamp down of Gold and Silver miners is coming ( See special note today)

New Educational Tab with University materials very soon

SPECIAL GOLD AND SILVER NOTE:

Regarding Gold and Silver, specifically stocks/ shares: We read this tweet from Josh Crumb.

Normally we take all non-falsifiable claims with a shaker of salt. But we know Josh’s work in Metals and Crypto. Further, his comment fits into something we’ve been studying since 2016; namely How would either China or the West confiscate Gold wealth if it had to? Josh’s tweet may have just told us how. Worse, it fits in the behavioral matrix studied from previous interventions in Gold, Silver, Oil, and anything else that serves as an obstacle to Davos goals.

PDF AT BOTTOM...SECTIONS

Market Summary— The Pivot Cometh?

Research— Metals, Loose Ends, JPM, BoA, and GS

Week’s Analysis/Podcasts— Biden’s Green Complex Boondoggle

Charts— Gold, Silver, Dollar and Crude During the UK Bailout

Technicals— Gold, S&P, Oil, Nat Gas, BTC

Calendar— Emergency Fed Meeting, Unemployment

Zen Moment— Birds

Full Analysis—

1. Market Summary

The S&P 500 Index is ending this quarter deep in the red (back below 3600), fully erasing the 14% gain from July/August. All the majors are technically back in bear market territory, with Nasdaq now below its June 16 lows.

Stocks tumbled unable to find enough 'bad news' in macro to prompt more hype/hope of a pivot in September.

As Bloomberg notes, this will mark the first time since 1938 that the benchmark is closing a quarter with a negative return after earlier rising more than 10% and posting the biggest drawdown from a quarterly high in recent decades.

Sectors and Technicals

Gold miners did very will this week #5

Semis were horrible- economic barometer #1

Energy held its own despite choppy oil- #4

Apple was slaughtered on analyst downgrades #2 (report at bottom)

This week saw all the majors trade lower

Utilities were hammered #6

Biotech did well #3

Commodities:

Silver significantly outperformed gold on the month. See chart

Crude and Copper were down hard in September

After dropping 13% and 9% respectively in July and August, Americans pump prices for gas were unchanged in September and are now up 10 days in a row.

The Dollar rose for the 4th straight month (and 8th of the last 9) to its strongest since April 2002.

Bloomberg's Spot Commodity Index down for the 3rd month of the last 4 and back at its lowest since Jan 2022

Bonds:

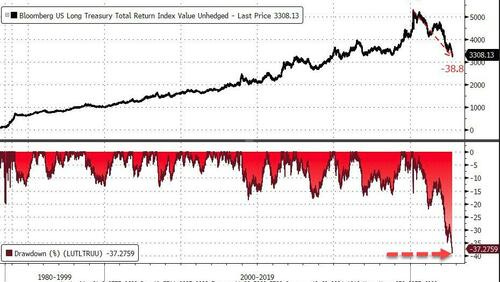

The global bond market is currently undergoing its worst drawdown ever

US Treasury market short-end was up over 70bps in yield

Rate-hike expectations surged during the quarter, and at the same time for a change, expectations for subsequent recession-saving rate-cuts did not.

"Thin UST liquidity & limited demand may make the US market vulnerable to a market functioning breakdown, similar to UK.... Fed could follow BoE in event of extreme UST market functioning breakdown"- M. Cabana NY Fed

Crypto:

Cryptos ended the quarter barely higher with Ripple and Ethereum outperforming (bitcoin was the laggard)

Sleepy week net-net with some wild intraday volatility for Bitcoin

H/t Zerohedge for data and some graphics.

2. Research:

There is a lot of good macro, almost zero metals analysis (we are getting very suspicious), and plenty of UK commentary. Our own work aims to very briefly sum up the moving parts next week and add a little color on Gold and Silver.

Special Gold and Silver Comment

GoldFix: Loose Ends and Open Wounds. Escalating event list

JPMs Marko Kolanovic apologizes for being wrong. Just kidding. He blames the Fed for his bad calls

GS: The Week Ends with a Thud

BOA: Bearish until Halloween then look out- The Flow Show Spx 666

Apple Downgrade: says it all

GS: Chart of the day Bonds

CONTINUES AT BOTTOM...3. Week’s Analysis/Podcasts

This week’s Precious Metals, Energy, and Economics pieces by GoldFix

The Demoralization of the West- WEF Style- Zerohedge

Green Complex Gets $370 Billion (85%) of Biden's Inflation Reduction Act Money- JPM Analysis- Zerohedge

Goldman Identifies The Trigger for The UK Crisis and Why This Will (Not) Happen Here

How Mercantilism Brought Europe’s Fragmented Economy Together

4. Charts:

UK Gilt Bailout and Effect on Markets

Dollar

Gold

Silver

Oil

Charts by GoldFix using TradingView.com

5. Technicals:

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions.

S&P 500

Oil

Nat Gas

Bitcoin

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

6. Calendar:

MONDAY, OCT. 3

9:45 am S&P U.S. manufacturing PMI (final) Sept. 51.8 51.8

10 am ISM manufacturing index Sept. 52.0% 52.8%

10 am Construction spending Aug. -0.2% -0.4%

Varies Motor vehicle sales (SAAR) Sept. -- 13.2 million

TUESDAY, OCT. 4 10 am Job openings Aug. -- 11.2 million

10 am Quits Aug. -- 4.2 million

10 am Factory orders Aug. 0.3% -1.0%

10 am Core capital goods orders revision Aug. -- 1.3%

WEDNESDAY, OCT. 5

8:15 am ADP employment report Sept. 216,000 132,000

8:30 am International trade balance Aug. -$68.2 billion -$70.6 billion

9:45 am S&P services PMI (final) Sept. 49.3 49.2

10 am ISM services index Sept. 56.0% 56.9%

THURSDAY, OCT. 6

8:30 am Initial jobless claims Oct. 1 200,000 193,000

8:30 am Continuing jobless claims Sept. 24 -- 1.35 million

FRIDAY, OCT. 7

8:30 am Nonfarm payrolls Sept. 275,000 315,000

8:30 am Unemployment rate Sept. 3.7% 3.7%

8:30 am Average hourly earnings Sept. 0.3% 0.3%

8:30 am Labor force participation rate, ages 25-54 Sept. -- 82.8%

10 am Wholesale inventories revision Aug. 1.1% 1.3%

3 pm Consumer credit Aug. $25 billion $24 billion

Main Source: MarketWatch

7. Zen Moment:

R2D2 ?