Housekeeping: The next 2 weeks expect Market Rundown (almost) Dailies to have less proprietary analysis due to teaching prep. But you should still have plenty to read. ***FOUNDERS CLASS RESUMES NEXT SUNDAY***

SECTIONS

Market Summary— Mkt was smoking dope

Research— Stocks, Fed, Commodities, Macro

Week’s Analysis/Podcasts— Zoltan P. and Moor Gold/Oil Podcast

Charts— Gold, Silver, Gc/Si ratio, Oil, Copper

Technicals— Gold, Oil, Nat Gas, BTC

Calendar— Consumer confidence, PMI, Jobs

Zen Moments— Karate kid

Full Analysis— Gold and Monetary Statecraft

1. Market Summaries

Last Sunday’s Weekly premium report included our research that said the following:

The Fed has given no indication that it will be backing off hawkish behavior at all until it gets much improved data on inflation or much worse data on recession. Otherwise, short an exogenous event, the market is smoking dope.

Goldfix On What Triggers A Fed Pivot - Download PDF

Five days later, Wall Street believed it and finally put down the bong1.

The sudden realization among Wall Street's best and brightest that there is no 'Powell Pivot' and never was, sparked mayhem across markets.

Nasdaq suffered the biggest drop -4% since early-June (thanks in part to an ugly day from AAPL on anti-trust headlines).

The S&P was down 3%

On the week, Nasdaq dropped almost 5% (worst week since June)

Short-term, the 'Powell-Pivot' rally will likely resolve much lower

CTAs, the dumbest ( and smartest?) money have $155BN ($36BN in S&P) of selling over the coming month in a down tape

At some point there will be optimism at a “Powell Pause”.. but we likely are a long way from that.

What Happened Friday at Jackson Hole

Powell only used eight minutes of a scheduled 30 minute speech, which had two major tough-love effects:

No nonsense or false hopes of a reversal of policy

Keep them guessing in the spirit of Volcker. No B.S.2

Powell said he's prepared to cause some pain to bring down inflation:

"While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain."

Ian Shepherdson, chief economist, Pantheon Macroeconomics:

“Chair Powell’s speech forcefully reiterated the Fed’s intention to tighten policy enough to bring inflation down to target and then keep it here, acknowledging that this likely means '…some pain to households and businesses.’ The Fed appears frustrated by market expectations -- which we have never shared -- of easing next year.

Here's why Powell was pissed off - because of the rip higher in stocks, financial conditions are now easier than when The Fed started tightening!!

However, Americans now face opposing forces depending on how politicized the Fed actually is:

Powell: pain is coming; we are going to crush demand.

Biden: midterms are coming, we are going to boost demand, discharge debt and come up with stimmies and new definitions for: recession, inflation, and money.

Finally, circling back the last week’s premium research: Unless we get fantastic data on inflation, we think any rallies you get on recessionary data releases will be met with more of the same.

H/t Zerohedge for data and some graphics.

Sectors/ Technicals

Friday’s hammering sent The Dow, S&P and almost the Nasdaq down to their 100DMAs

The Dow dropped 1000 points intraday, back below 33k

Energy was the only sector to end the week green while Tech was wrecked

Oil Services look good still in light of oil policy changes

Commodities:

The Dollar ripped higher on Powell's hawkishness Friday, back into the green for the week

The Gold Silver ratio is now close to recent highs where we saw a massive short squeeze in Silver happen last month. If it doesn’t stop there again, there is nothing stopping it from going to 100 plus as banks continue buying Gold and selling Silver to balance margins.

Oil prices ended the week higher amid OPEC headlines on supply cuts which dominated any recessionary demand threats

The rise in crude (and wholesale gasoline) suggest lower pump prices could be set to stall very soon.

Gold ended the week lower, back around $1750, after being hammered lower on Powell's hawkishness

Bonds:

Treasuries were very mixed on the week with the long-end dramatically outperforming (2Y +16bps, 30Y u-1bp)

Recession and inflationary fighting are getting even more pronounced in flattening/inversion now.

September rate-hike odds shifted hawkishly from pre-Powell levels to around a 66% chance of 75bps, 33% of 50bps

Short-Term Interest-Rates (STIRs) never bought the 'pivot' and both rate-hike expectations and rate-cut expectations have been pushing hawkishly for two weeks

Crypto:

Cryptos were slammed after Powell's hawkish comments with Bitcoin tanking back below $21,000 to its lowest in six weeks...

2. Research:

This week:

Equity Outflows Resume- Goldman

Commodities including Gold- UBS

Recap and prospects-JPM

CTA Gold and Silver Report- TD

MORE AT BOTTOM...3. Analysis/Podcasts:

This week’s Precious Metals, Energy, and Economics pieces by GoldFix

Most Popular Last Week:

Zoltan's Latest: "Bretton Woods III is destined to happen. It’s already happening"- 45,000 views, downloads

GOLDFIX EXCLUSIVE: Energy, Gold, and Bitcoin Technical Podcast Excerpt (Beta)

GoldFix Content Last Week: original pieces and more

Powell Struggles to Not Be Arthur Burns 2.0. He Could be Worse.

Zoltan's Latest: "Bretton Woods III is destined to happen. It’s already happening"- on Zerohedge

Silver Physical Demand Buying the Dip Again, JPM on Gold- on Zerohedge

Mkt Rundown | INFLATION BACKS OFF, YOUR INCOME BACKS OFF MORE

Silver Physical Demand is Buying the Dip Again | JPM on Gold

Energy: OPEC Threats Spike Oil, Nat Gas Blows Its Lid- on Zerohedge

The Russian Fat Lady Getting Ready To Sing For The LBMA- on Zerohedge

Nat Gas Price Explosion Puts U.S. Diesel in the Crosshairs This Winter

Weekly: Gold and Silver Being Played Again- Correlation Spoofing

On Gold Price Suppression:

4. Charts:

Gold:

Silver:

Gold-Silver Ratio:

Oil:

Copper:

Charts by GoldFix using TradingView.com

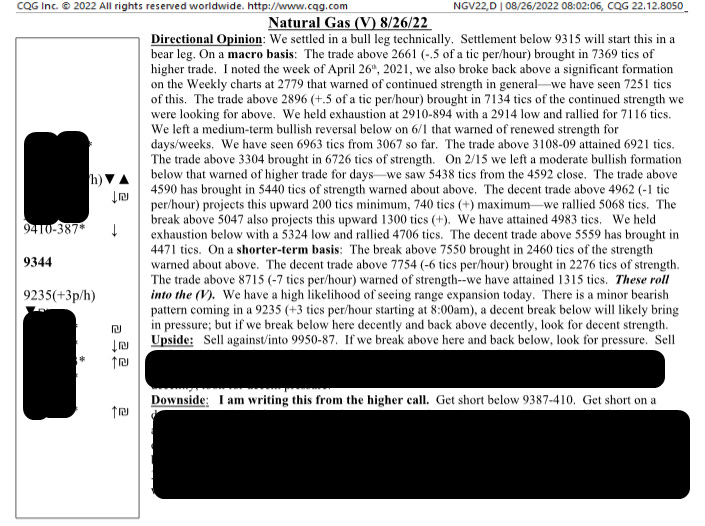

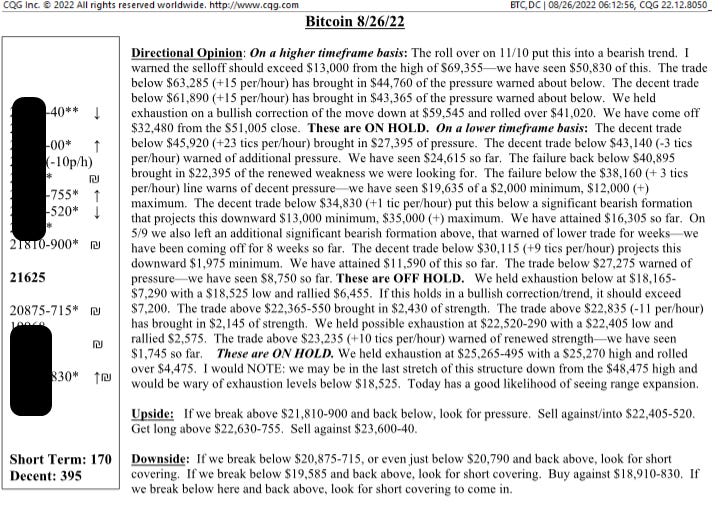

5. Technicals

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold:

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions.

Energy:

Bitcoin:

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

6. Calendar

MONDAY, AUG. 29

None scheduled - Fed Gone Fishing

TUESDAY, AUG. 30

9 am S&P Case-Shiller U.S. home price index (year-over-year) June -- 19.8%

10 am Consumer confidence index Aug. 97.0 95.7

10 am Job openings July -- 10.7 million

10 am Quits July -- 4.2 million

11 am New York Fed President John Williams speaks

WEDNESDAY, AUG. 31

8 am Cleveland Fed President Loretta Mester speaks

8:15 am ADP employment report Aug. 310,000 N/A

9:45 am Chicago manufacturing PMI Aug. 52.8 52.1

6:30 pm Altanta Fed President Raphael Bostic speaks

THURSDAY, SEPT. 1

8:30 am Initial jobless claims Aug. 27 -- 243,000

8:30 am Continuing jobless claims Aug. 20 -- 1.42 million

8:30 am Productivity revision (SAAR) Q2 -5.0% -4.6%

8:30 am Unit labor costs revision (SAAR) Q2 10.8% 10.8%

9:45 am S&P U.S. manufacturing PMI (final) Aug. -- 52.2

10 am ISM manufacturing index Aug. 52.0% 52.8

10 am Construction spending July 0.0% -1.1%

3:30 pm Atlanta Fed President Raphael Bostic speaks

Varies Light motor vehicle sales (SAAR) Aug. -- 13.5 million

FRIDAY, SEPT. 2

8:30 am Nonfarm payrolls Aug. 325,000 528,000

8:30 am Unemployment rate Aug. 3.5% 3.5%

8:30 am Average hourly earnings Aug. 0.4% 0.5%

8:30 am Labor-force participation rate, 25-54 years Aug. -- 82.4%

10 am Factory orders July 0.3% 2.0%

10 am Core capital equipment orders revision July -- 0.4%

Main Source: MarketWatch

7. Zen Moment:

Imitation, then innovation…