Housekeeping: Welcome New Subscribers. We have a great many new premium subscribers and are grateful. This report is different than the weekday posts. Weeklies are designed to be a recap with new research insights in the old Barrons style. Enjoy and thank you.

SECTIONS

Market Summary— 0DTE

Research— All about 0DTE options, Hartnett, and Dollar Death

Week’s Analysis/Podcasts— Feedback Loop, Powell Gets Pranked

Charts— Metals, Energy, FX, Bonds, Crypto

Calendar— FOMC Rate decision, press conference

Technicals— GC, CL, BTC, S&P

Zen Moment— How Chess Pieces are Born

Full Analysis— BOA, GS, TD,

1. Market Summary

The market shrugged off a week of disappointment in macro with stagflation very much back on the table. There were increasing banking system threats with FRC literally collapsing. The flight to safety within stocks continues to rule the day. Mega-cap tech gains lead the Nasdaq notably higher , while Small Caps lagged.

Of 500, only 10 stocks are responsible for 86% of gains return..

On the month, Nasdaq's last few days got it back to unchanged. The Dow was the month's biggest gainer. Transports and Small Caps were the biggest losers.

Year-to-date, the Nasdaq continues to roar while the S&P 500 treads water at levels seen before

VIX was lower on the week, down considerably from the early week tag of 20. However, 1-Day VIX (tracking 0DTE) ended notably higher with every day looking the same: an opening gap down and persistent vol bid all day.

This Market does not believe the Fed Put is gone Yet…

The Vix has been broken as a risk indicator for years. Now it is more broken. 0DTE Options reveal many things to us (volatility, sources of manipulation, undervalued risk) about stock market structure (broken and skewed) and participant behavior. One thing they reveal is the complete lack of put buying in general and the ever-growing move to shorter term “investing”. More to come we are sure.

Behaviorally: Speculative bulls are buying 0DTE calls preceding and during rallies. However investment bulls ( hedgers) are not buying puts at all in either product. Among other things it signals a change in stochastic volatility.

Dear Stock Pals, Welcome to the Comex

0DTEs, the least expensive notional options on earth, are increasingly a stronger signal for market movement than longer dated options. Kind of like Penny stocks moving indexes. Exchange liquidity has become ephemeral, and “lit” exchange volumes are largely derivative of the real OTC style “dark pool” activity now. Exactly like Silver in the 1990s when the OTC did 5x the floor volume. But everyone watched the COMEX price for cues. And we all got manipulated. (Much more on 0DTE options at bottom)

***In English: The market does not think the Fed Put is dead at all***

Sectors/Technicals

Ever increasing bifurcation within sectors. Stock pickers paradise?

Commodities:

Gold and Silver chopped around, Wheat continued to get hammered

Gold ended April higher (though by less than 1%) for its 5th positive month of the last six,

Crude got killed early and bounced on Friday. The play here is unless we get above 80 or below 70, everybody is happy.

Oil managed very modest gains on the month having erased all of the post-OPEC+ production-cut spike that started the month off.

The dollar ended April marginally lower (its 6th month drop of the last seven months)

Bonds:

Bond yields ended the week lower. Entire curve down around 11-13bps by the end

Entire curve down around 11-13bps by the end

On the month: yields were practically unchanged

Crypto:

Crypto had a decent week, and a better month

Solana, Bitcoin, & Ethereum all had a solid month while Ripple was down notably

2. Research Excerpts:

Dollar Death.. Calm down

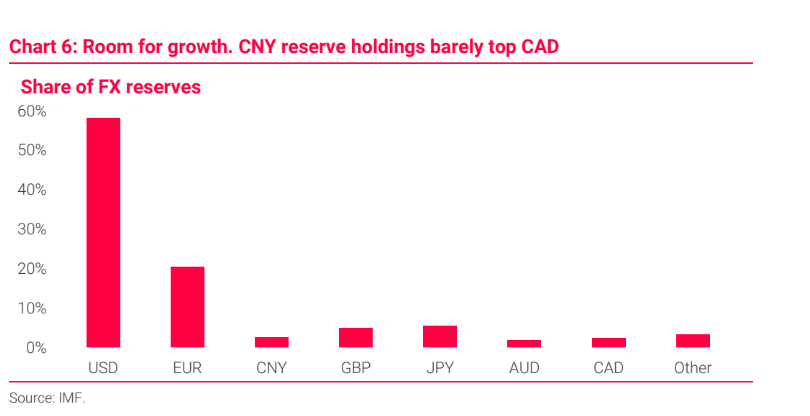

Financial media headlines are going through their annual death-of-the-dollar cycle. Amid all the misplaced hyperbole about the end of America’s exorbitant privilege, nuances in the evolution of global FX can get lost. It is important to differentiate between increased international usage of RMB and de-dollarization.

Summary: China does not have enough reserve type assets, its CIPS platform is derivative of SWIFT, and while they want the world to use more RMB, they still do not want to liberalize its offshore use. Translated, the RMB is a hot house flower still, and China is extremely uncomfortable giving the world any type of free market influence over its value.

And to become a reserve currency, you must have plentiful reserve assets for people to hold. For now, we believe the goal of China is as it has always been: to get more people to use it as a settlement medium, while keeping it safe from the real world.

Hartnett: Bearish still

0DTE Report— fabulous must-read ***

GS FOMC Preview

MS: Geopolitics, Multipolarity investing - good short read***

MS: The path away from China may be towards Mexico

GS: Consumer spending update.. Not that bad.- insightful***

CS: Tobacco as a defensive stock is back- Something to think about now***

Copper Mining Update for Freeport

FULL ANALYSIS AT BOTTOM…