Housekeeping: Good Morning. Special Gold Revaluation podcast later today

“The Gold reset is a process, not an event”

Today:

Discussion: Gold is missing; Where did it go

Premium: MS on Copper Concentrate demand

Discussion: Gold is missing; Where did it go?

Since March 1st: When Macro Discretionary funds bought as well as SGE traders.

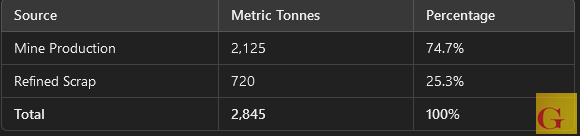

1- New Physical Gold Supply Sources

Data illustrates the proportion of gold supply from different sources.1

Total New Supply= 2845 metric tonnes

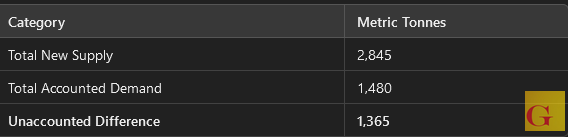

2- New Physical Gold Supply vs Accounted Demand

Data compares the total new supply with total accounted demand and highlights the unaccounted difference.

New Supply Unaccounted for= 1,365 metric tonnes

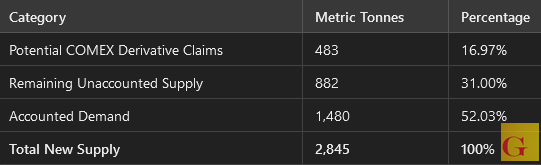

3- Physical Gold Demand Components

Data shows the contribution of each sector to the total accounted demand.

New Supply Components= 1,480 metric tonnes

4- Unaccounted Gold Supply Distribution

Data depicts how the unaccounted gold supply is distributed when considering potential derivative claims.

Unaccounted for Gold Supply is between 31% and 48% of total added

5- Final Accounting Differential

Data purpose: Compares physical supply and demand alongside derivative market claims.

There are 882 metric tonnes unaccounted for at minimum since March 1st 2024

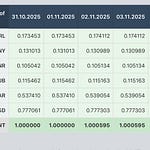

Source: Ross Norman’s Metals Daily

Where did it go?

Where is the Gold?

Non-reported Central Bank or sovereign wealth buying, PLA and other military related buying

Who is Holding it?

BRICS nations, China, Well financed speculators (Chengtong) taking delivery, G7Banks seeking to add to their own supply as principal or as agent for a client.

Metals Daily: For What Reasons?

Shanghai Speculative Trading

“For sure gold has seen strong derivatives buying on SHFE and likely within the OTC markets. Known players have thrown everything (but the kitchen sink) at other (base) metals and the maxim that “size matters” has never held more true.”

Launch a Competing BRICS’ Currency

“We are in the realm of speculation here but quite possibly the BRICS nations might back-stop a new currency with a partial gold backing – let's see. “

Destabilization of LBMA and US GRC pricing power hegemony

“[M]any nations envy the central role that London plays in the global bullion market and they make no secret of it … much like “the exorbitant privilege” the US has with the global reserve currency. So is this part of bigger story with a player wishing to take control of the global gold market … maybe. But that's going out on a limb. “

Analysis:

We think all the above are true, but not as nefarious/literal as it appears, with the possible/likely exception of some Shanghai speculators who are not immune to playing the West’s game in reverse… But if the SGE/SFE specs are actually buying the Gold, then their problem will come when they wish to take profits… (Roach motel Risk).. That should take care of itself. We’ll have much more say on this in a podcast coming out later today.

Suffice to say for now. This is the necessary by product of global economic disparity as measured by financial assets rebalancing itself against the real assets and collateral that underpin those finances.. In other words: A Gold Revaluation is happening to better reflect the new global economic realities already made real since the GFC.

For What Practical Purpose?

If BRICS- for purposes of Dedollarization substitution in their multipolar set up mBridge, BRICS-Pay etc

If CHINA- moving from a lose peg to the USD to loose peg to Gold. as evidenced by the increased correlation to CGBs and Yuan

If SPECS- if they take delivery then it is nor a bluff. If they don’t then their gains will be lost on exit

If G7 BANKS- Europe has openly spoken of revaluation, Eastern EU is openly buying and flaunting their purchases publicly and theG7 if mBRIDGE is successful will need more bullion avaialbe if they wish to trade with the BRICs internationally, as a Mercantilist world would dictate

News/Analysis:

Equity Recap:

US equities mostly fell on Monday amid rising Treasury yields and ahead of a slew of corporate earnings reports this week. Large caps bested small caps: S&P 500 (-0.18%) vs. Russell 2000 (-1.60%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) fell 0.70% and 1.18% respectively.

Market News: Not Reasons, Excuses

"Gold surged to an all-time high on Monday, fuelled by geopolitical tensions and central bank interest rate cuts. Bullion’s price climbed to $2,740.37 a troy ounce on Monday, representing a 40 per cent gain in the past year. The war in the Middle East, coupled with uncertainty over the outcome of next month’s US presidential election, have supercharged gold’s allure as a haven asset." Source: FT

"US stocks are unlikely to sustain their above-average performance of the past decade as investors turn to other assets including bonds for better returns, Goldman Sachs strategists said. Bloomberg

"Microsoft will allow organizations to create their own autonomous AI agents within Copilot Studio, the tech giant’s platform for customizing and building so-called “copilot” assistants, starting next month.CNBC

"Share buybacks on mainland China’s biggest exchanges have soared to a record high this year as Beijing pushes for companies to return cash to shareholders as part of its efforts to revive a flagging stock market. FT

"The EU’s financial markets watchdog wants expanded powers to oversee major stock exchanges and other critical parts of the bloc’s financial infrastructure, as it bids to become a European version of the US Securities and Exchange Commission.FT

"Restaurant chains and operators this year are on track to declare the most bankruptcies in decades outside of 2020, when the global pandemic upended the industry’s operations, WSJ

Politics/Geopolitics:

MIDDLE EAST

Israeli army issued an evacuation warning to residents of buildings in the neighbourhoods of Al-Lilaki and the boat ramp in the southern suburbs, according to Sky News Arabia.

Israeli Ministers of the Political-Security Council reported in recent days that a very large attack will be carried out soon on Iran, while estimates in Israel are that Iran will respond strongly to the Israeli attack, according to Al Jazeera.

UK is to lend Ukraine an additional GBP 2.26bln for weapons to fight Russia with the loans to be repaid using interest generated from USD 300bln of Russian frozen assets, according to The Guardian.

US DoJ proposed barring bulk sales of sensitive US data to China, Russia and Iran due to national security risks.

*Some headlines courtesy DataTrek and Newsquawk

Data on Deck:

MONDAY, OCT 21 8:55 U.S. leading economic indicators- Fed Speakers

TUESDAY, OCT. 22 Fed President Harker speaks

WEDNESDAY, OCT. 23 Existing home sales

THURSDAY, OCT. 24 PMI Oct New home sales

FRIDAY, OCT. 25 8:30 am Durable-goods orders

*FINAL MARKET CHECK

Premium: Morgan Stanley on Copper

We see three key themes in the Copper market at the moment: 1) China stimulus, 2) whether any price rebound will drive demand destruction and 3) how TCRC negotiations will play out

Continues below