Housekeeping: Good Morning.

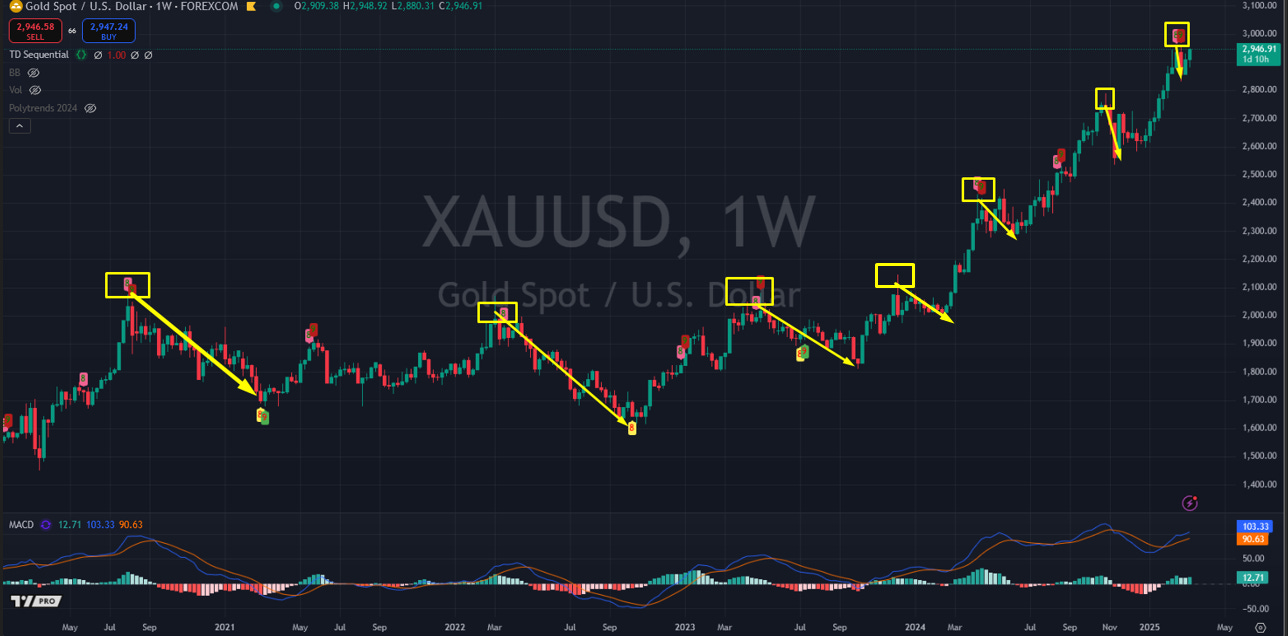

“The Gold reset is a process, not an event”

Today

Discussion: UBS and Cap /Trade Markets

Premium: UBS Buys The Dip in Silver, Copper, Oil

Discussion:

UBS Buys The Dip in Silver, Copper, Oil

The steady rise in commodity prices from the start of the year has come to an abrupt halt. Growth uncertainty and commodity-specific factors, mainly on the grains side, have caused a price consolidation at a broad asset class level. We think tariff-induced risks, which seem to have less market impact, remain a short-term concern.

However, we remain positive on the asset class. We like crude oil for volatility selling strategies. Gold’s return outlook, although limited in our base case, and its ability to perform in adverse times are still appealing to us. Silver should outperform gold alongside copper in our base case of a modest recovery in manufacturing activity.

The report’s Precious metals section discusses

Supply-chain issues

Trump Tariffs

UK Vault Problems

Silver dynamics are more complicated

Central bank purchases

Full Analysis at bottom…

News/Analysis:

Markets Recap:

Stock reactions were muted with an S&P pop post the data to 5668 with a weaker bias the remainder of the day to settle about 5592 up only 22 points

Market News:

News: “Inflation cooled last month. Consumer prices were up 2.8% in February from a year earlier, the Labor Department reported Wednesday, versus a January gain of 3%... Prices excluding food and energy categories—the so-called core measure that economists watch in an effort to better capture inflation’s underlying trend—rose 3.1%. That was the lowest year-over-year reading since 2021.”

Today US agencies, ranging from the Treasury Department to the Justice Department, are required to submit their cost-cutting proposals to the White House and the government's human resources department.

President Trump in a Wednesday press conference while hosting Irish prime minister Micheál Martin at the White House appeared to backpedal on his plan to turn Gaza into the "Riviera of the Middle East" by expelling all Palestinian inhabitants.- ZH

“Canada will impose 25% tariffs on more than $20 billion worth of U.S. goods in retaliation for the Trump administration’s steel and aluminum duties that took effect overnight. CNBC

“China’s Ministry of Commerce has summoned executives at Walmart over reports the US retailer asked its suppliers to cut prices in response to tariffs imposed by President Donald Trump, according to state media. FT

“TSMC has pitched U.S. chip designers Nvidia, Advanced Micro Devices and Broadcom about taking stakes in a joint venture that would operate Intel’s factories... CNBC

Geopolitics/ Politics:

MIDDLEEAST

Hamas official said they welcomed US President Trump's apparent retreat from calls for the displacement of Gazans.

RUSSIA-UKRAINE

US White House said National Security Adviser Waltz spoke with his Russian counterpart.

Russian President Putin said troops should defeat the enemy in the Kursk region and completely liberate the region, while it was also reported that Russia's Chief of the General Staff said Kyiv's plans in Kursk region failed and Ukrainian forces in the Kursk region are surrounded, according to IFX. It was later reported that the Kremlin said the operation in the Kursk region is at the final stage, according to TASS.

Ukraine's top army commander said Russia is trying to oust Kyiv troops out of the Kursk region and move fighting into Ukrainian border territories, while he added Kyiv will hold defence in the Kursk region as long as necessary.

Polish President Duda urged for the US to move nuclear warheads to Polish territory, according to FT.

H/t Newsquawk for Geopol

Data on Deck: CPI, PPI

MONDAY, MARCH 10 None scheduled

TUESDAY, MARCH 11 NFIB optimism index

WEDNESDAY, MARCH 12 CPI Feb.0.3% exp 0.5%prev.

THURSDAY, MARCH 13 PPI 0.3%exp 0.4%prev

FRIDAY, MARCH 14 Consumer sentiment1

Summary and Final Market Check

Cap and Accumulate…