石油处于非常危险的境地

The risk to Oil to go higher in price is not just from Israel/Iran risk, but from likely initial compliance by junior OPEC+ members to the recent Saudi warning. This also reflects max pain to short CTAs. Event risk warns of $5 moves either way if war escalates or alternatively if OPEC+ frays more.

First the Facts:

Prices are near the lows of their range for the past 3 years

Middle East tensions have done little to prop prices up until very recently

Lower oil prices are good for the US, Europe and China; Bad for Russia and OPEC+

The News:

There are two items on top of traders’ minds right now with regard to Oil: 1) Israel-Iran, and 2) OPEC+ Solidarity

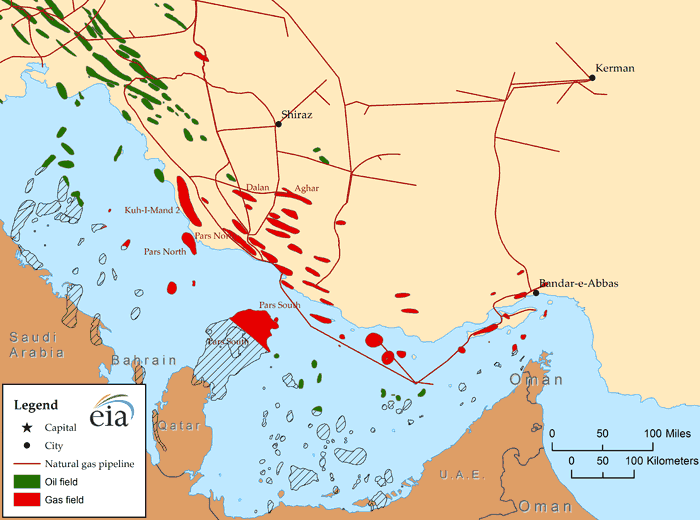

Israel Says Likely to Target Oil Facilities

Israel's military is preparing a 'significant retaliation' to the attack by Iran. They are readying "significant" response to Iran missile barrage which could involve targeting oil facilities

Saudi Minister Threatens Price War to Fellow OPEC+ Members

The Saudi oil minister called out members for overproducing. saying prices could drop to $50 if cheaters within OPEC+ don’t stick to agreed-upon production limits. The statements were interpreted by other producers as a veiled threat from the kingdom that it is willing to launch a price war to keep its market share.

The Analysis:

Prices are near the lows of their range for the past 3 years

Middle East tensions have done little to prop prices up until very recently

Israel’s Oil threat is real and very dangerous

Government intervention is suspected of keeping a lid on futures prices

Term structure indicates some unnatural deferred hedging

OPEC solidarity is starting to slightly fray publicly

The Oil market is in a dynamic situation right now.

谢谢你,祝你有美好的一天

Share this post